Gadang Holdings Bhd (April 20, RM1.24)

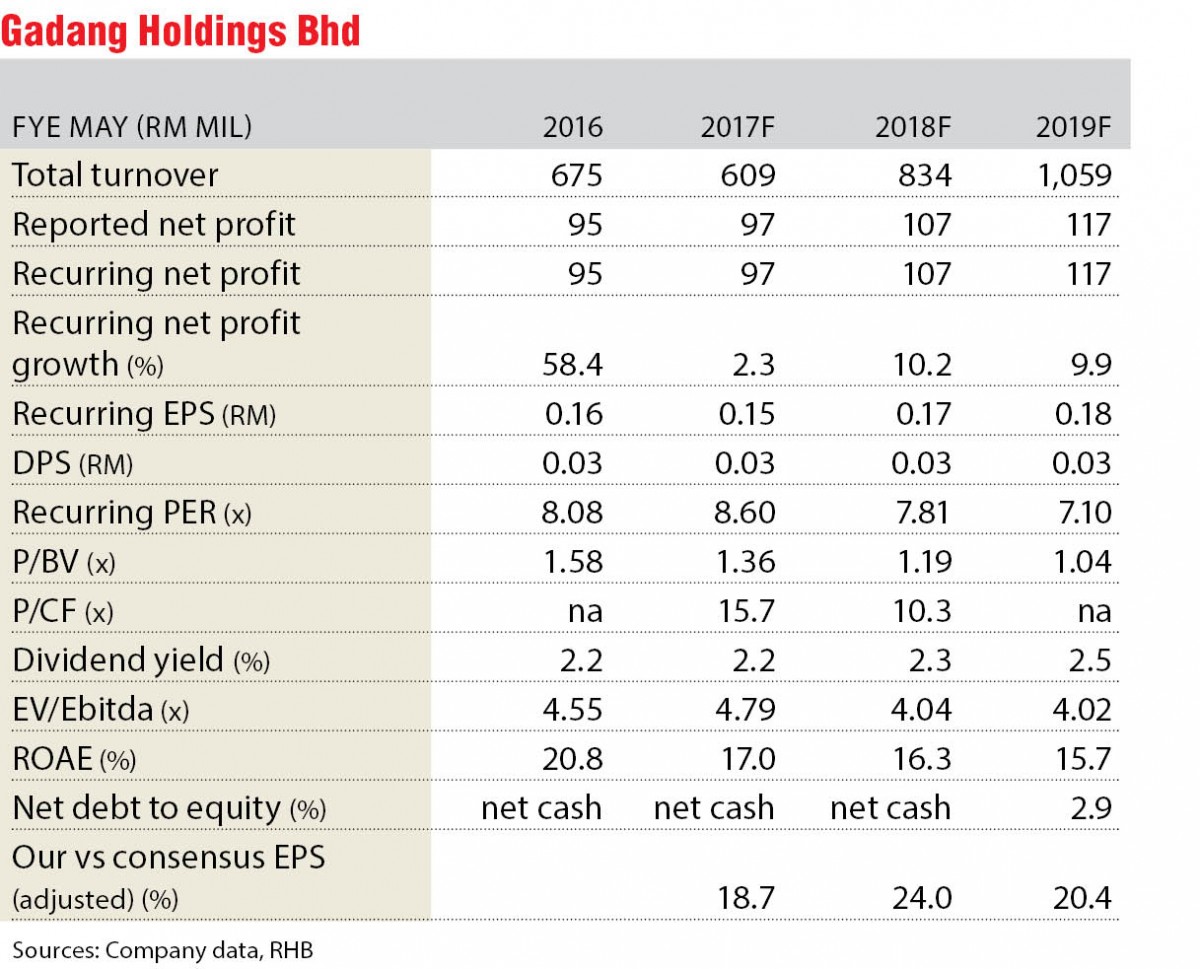

Maintain buy with an unchanged target price (TP) of RM1.55: After a long wait, Gadang Holdings Bhd recently won a mass rapid transit Line 2 viaduct project worth RM952.1 million. We believe the company stands a good chance of winning more projects in the near future, considering the various infrastructure projects scheduled to be awarded in the coming months. Meanwhile, its outstanding construction order book (lifted to RM1.6 billion) and unbilled property sales of RM165 million provide earnings visibility over the medium term. Its utilities unit continues to churn in stable earnings from its four water supply concessions in Indonesia, which more than offset a minor loss at its plantation unit.

We deem its nine months of financial year 2016 (9MFY16) results largely in line with our expectations and make no changes to our earnings estimates. For FY17, we are confident Gadang could at least match its robust earnings recorded in FY16. Key risks include the inability to replenish its construction order book, a significant slowdown in the local property sector and a hike in input costs.

After the sharp rebound in the second quarter of FY17, Gadang reported a minor 7.6% quarter-on-quarter drop in net profit, though up 2.7% year-on-year. 9MFY17 earnings made up 72.6% to 82.3% of our and consensus’ full-year forecasts respectively. The decent earnings were attributable to a variation order claim received together with the completion of certain construction projects and progressive recognition for its property projects.

We are assured on Gadang’s near-term earnings visibility, coupled with the longer-term growth prospects from all business units. Meanwhile, the stock trading at single-digit forward price-earnings (PE) presents a good buying opportunity. Our sum-of-parts based TP of RM1.55 implies 10.3 times 2017 forecast PE versus the small-cap construction sector’s PE of 10 times to 12 times. — RHB Research, April 20

This article first appeared in The Edge Financial Daily, on April 21, 2017.

For more stories, download TheEdgeproperty.com pullout here for free.

TOP PICKS BY EDGEPROP

Kawasan Perindustrian Mount Austin

Johor Bahru, Johor

Smart Industrial Park @ SILC

Gelang Patah, Johor

Medan Idaman Business Centre

Setapak, Kuala Lumpur