- In a filing with Bursa Malaysia on Wednesday, IGB said proceeds from the issuance of the MTNs will be used for its investment, capital expenditure, working capital requirements and/or to refinance and/or to repay its existing borrowings.

KUALA LUMPUR (Oct 30): Property developer IGB Bhd (KL:IGBB) plans to raise up to RM5 billion by establishing a medium term note (MTN) programme to finance the general corporate purposes of the group.

In a filing with Bursa Malaysia on Wednesday, IGB said proceeds from the issuance of the MTNs will be used for its investment, capital expenditure, working capital requirements and/or to refinance and/or to repay its existing borrowings.

It has lodged with the Securities Commission Malaysia the required information and relevant documents in relation to the establishment of the MTN programme.

Public Investment Bank Bhd is the principal adviser, lead arranger and lead manager for the MTN programme.

IGB shares closed down two sen or 0.75% to RM2.65 on Wednesday, giving it a market capitalisation of RM3.6 billion. The stock has risen 20.45% so far this year.

Looking to buy a home? Sign up for EdgeProp START and get exclusive rewards and vouchers for ANY home purchase in Malaysia (primary or subsale)!

TOP PICKS BY EDGEPROP

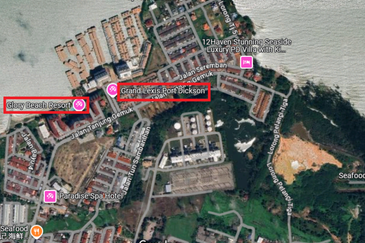

💥𝐏𝐫𝐢𝐦𝐞 𝐒𝐞𝐚-𝐅𝐚𝐜𝐢𝐧𝐠 𝐂𝐨𝐦𝐦𝐞𝐫𝐜𝐢𝐚𝐥 𝐋𝐚𝐧𝐝 𝐟𝐨𝐫 𝐒𝐚𝐥𝐞 – 𝐏𝐨𝐫𝐭 𝐃𝐢𝐜𝐤𝐬𝐨𝐧

Port Dickson, Negeri Sembilan