WCT Holdings Bhd (April 12, RM2)

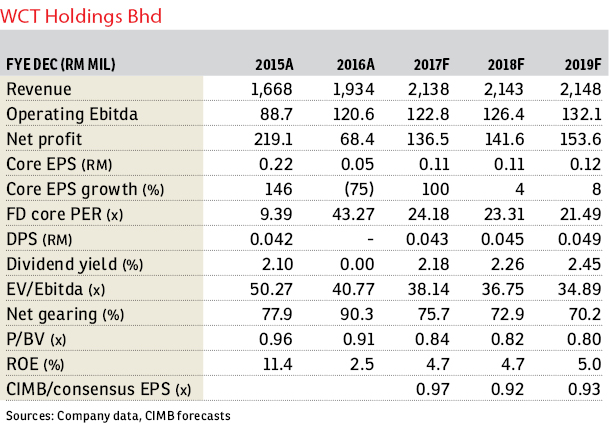

Maintain hold with a higher target price (TP) of RM2.10: We remain upbeat about WCT Holdings Bhd’s infra outlook, but this is offset by property sales risks. The group’s next phase of its de-gearing initiative is the real estate investment trust (REIT) deal in mid-2017. The property market remains tough with no new launches planned; the RM500 million internal sales target could be at risk if year-to-date (YTD) sales of RM133 million lose momentum.

Job visibility looks good, with more light rail transit 3 (LRT3) and mass rapid transit 2 (MRT2) packages up for tender. A share placement overhang and uncertainty about the REIT deal could cap the upside to its share price.

We maintain our “hold” call, but with a higher TP of RM2.10. We had contacted management for updates on the group’s outlook. Key points include: i) the de-gearing initiative continues to be the priority, and other land bank disposal moves are also on the cards; ii) the RM500 million property sales target remains intact amid a still-challenging market, with no new launches planned in the second half of 2017 (2H2017); iii) WCT is upbeat on job flows and targets to secure a larger-value LRT3 package; and iv) the second tranche of the share placement is likely in 2H2017.

With a 0.9 times net gearing level that is at the higher range of comparable contractors/property developers, our medium-term focus continues to be the group’s REIT plans. The unchanged guidance was that the RM1.1 billion REIT deal could be realised either by the formation of a new REIT vehicle or an outright asset injection into an existing REIT.

Under the new REIT vehicle scenario, WCT will likely retain a 30% to 40% stake. We expect more developments by mid-2017. WCT recently clinched an RM186 million contract to undertake package TD1, which is the construction of Johan Setia Depot (Phase 1) for the LRT3 project — its first contract win for 2017.

WCT has also tendered for other larger-value LRT3 packages worth RM400 million to RM500 million. It is also bidding for more MRT2 jobs, though likely smaller than the RM893 million package V204 secured in late 2016. Management remains upbeat about its job flow prospects in 2H2017.

We forecast RM1.5 billion job wins in financial year 2017. The group observed that it is still a tough market for property sales with no new launches planned for the year.

Property sales YTD, however, are off to a good start with RM133 million sales secured under its repricing and rebate sales strategy. The challenge now is to sustain and boost property sales to meet its internal target of RM500 million. This could compromise margins for property products with higher land cost outside its townships in Klang, in our view.

Based on our optimistic scenario and assuming no delays in the REIT deal, WCT should be able to raise RM1.2 billion to RM1.3 billion from the REIT (estimated RM660 million in net proceeds), RM300 million to RM400 million from the land sale, and RM221 million from the share placement by end-2017.

We assume WCT retains an about 40% stake in the REIT. We expect WCT’s strong job flow outlook to be mitigated by property sales risks and uncertainty surrounding its REIT plans. We raise our forward revalued net asset value (RNAV)-based TP as we update the value of selected land banks (still based on a 30% discount to RNAV). — CIMB Research, April 11

This article first appeared in The Edge Financial Daily, on April 13, 2017.

For more stories, download TheEdgeProperty.com pullout here for free.

TOP PICKS BY EDGEPROP

Forest City Golf Resort, Gelang Petah

Johor Bahru, Johor

Bandar Tasik Senangin

Lenggeng, Negeri Sembilan