PETALING JAYA (April 5): The Employees Provident Fund (EPF) has entered into an agreement to subscribe a 49% interest in Yarra Park City Pty Ltd (YPC) for A$154 million (RM517 million), expanding its property investment portfolio in Australia, OSK said in a statement today.

The remaining 51% interest in YPC is held by PJ Development Holdings Bhd (PJD), a subsidiary of OSK Holdings Bhd, via its wholly-owned Australian subsidiary P.J. (A) Pty Limited (PJA) and Equity & Property Investment Corporation Pty Limited (EPIC). EPIC is 27.5% owned by PJA.

YPC is the developer of the 5-acre mixed-use development project Melbourne Square in Southbank, Melbourne.

“The Melbourne property development befits EPF’s long-term objectives and will be a good addition to our overseas portfolio.

“This is EPF’s second development venture overseas after Battersea in London. The increasing demand for residential property in Melbourne, Australia will enable EPF to generate returns for its members,” said EPF chief executive officer (CEO) Datuk Shahril Ridza Ridzuan at the signing ceremony.

According to OSK, Melbourne Square will mark the developer’s maiden foray into Melbourne, which will be “an important destination within the world’s most liveable city”.

“This is an important project for Southbank’s future and it provides the delivery of critical community infrastructure that the city requires. We are delighted to partner EPF on this exciting project, and we hope to deliver a project which all Malaysians can be proud of,” said OSK CEO and group managing director Tan Sri Ong Leong Huat.

With an estimated gross development value (GDV) of A$2.8 billion, Melbourne Square will transform a former carpark bounded by the Westgate Freeway and Kavanagh, Balston and Power Streets in Southbank into a mixed-use community and retail centre.

“The project aims to give Southbank a ‘green heart’ with a public park and network of leafy spaces as well as critical community infrastructure such as a childcare facility and a supermarket along with other retail options,” said the developer.

The development will comprise four towers of residential apartments, an office tower, a hotel/serviced apartments tower and multiple street-level retail lots across the different components. The project will be developed in five stages over eight to 10 years.

OSK said the first stage of the development will feature two residential towers comprising over 1,000 apartment units and has GDV of over A$900 million. Stage One will also provide a showcase of green spaces and essential amenities including an urban park, a child care centre, a supermarket, restaurants, cafes and other residential amenities.

The developer also added that YPC has appointed a list of consultants for Melbourne Square including multiple award-winning Cox Architects to design the master plan and Stage One of the project, Carr Design for interior design services, Sinclair Brook for project management and CBRE as the sales agent for Stage One, which was launched a few days ago.

TOP PICKS BY EDGEPROP

Aster Grove Residences Park

Shah Alam, Selangor

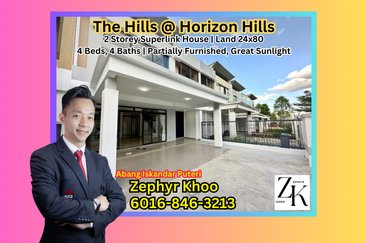

The Hills @ Horizon Hills 2 Storey Superlink House

Horizon Hills, Johor

ECO BUSINESS PARK 5

Bandar Puncak Alam, Selangor

Semi D Corner Subang Bestari U5

Subang Bestari, Selangor

Charming Essex, Setia Eco Templer

Rawang, Selangor

Ion Belian Garden, Batang Kali

Batang Kali, Selangor