Crescendo Corp Bhd (March 31, RM1.71)

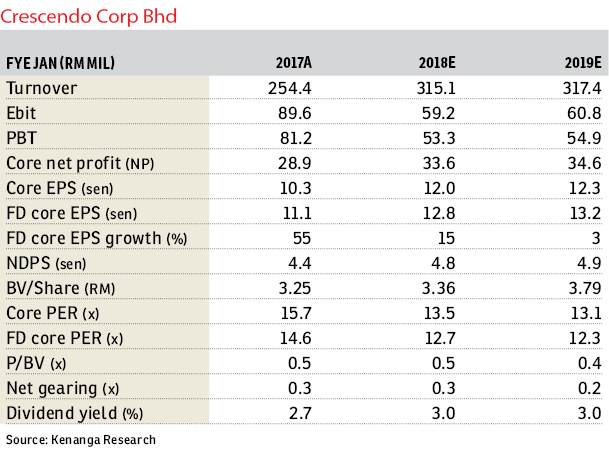

Maintain market perform with an unchanged target price (TP) of RM1.70: Crescendo Corp Bhd’s financial year 2017 (FY2017) core net profit (CNP) of RM28.9 million came within expectations, making up 103% of our full-year estimate. No sales figure was given by management, but we expect them to exceed our full-year sales estimate of RM235 million. A three sen dividend was declared, bringing full-year dividend to five sen as expected.

FY2017 CNP registered an impressive growth of 62% underpinned by a 31% improvement in revenue, driven by its property division, which saw a 72% improvement in development revenue. This was thanks to higher billings of its ongoing projects, namely Bandar Cemerlang as they registered higher sales as compared with last year. That said, its management services division also saw its revenue and operating income increase by 50% and 37% respectively.

Quarter-on-quarter, the fourth quarter of FY2017’s CNP declined by 8% albeit a 17% improvement in revenue, mainly due to higher operating costs incurred by its manufacturing division coupled with lower sales of concrete products.

We are of the view that the near-to mid-term outlook for Crescendo remains unexciting due to its exposure to industrial property and projects’ concentration in Johor, while the group remains cautious about launches going forward.

Post results, there are no changes to our FY2018 estimates (FY2018E) earnings as we are anticipating margins to be lower despite a growth in revenue due to a higher mix of residential products sold which commands lower margins as compared with industrial products.

That said, we also roll out our FY2019E earnings of RM34.6 million. Its unbilled sales currently stand at RM158 million, which provides earnings visibility for at least a year.

Despite its outstanding performance, we are still keeping our “market perform” call on Crescendo with an unchanged TP of RM1.70 based on our 73% discount to FD revalued net asset value of RM6.32.

While the property market remains challenging, especially in Johor, Crescendo has demonstrated its ability to position itself as an affordable property player which has garnered strong interest from serious buyers of reasonably priced landed properties in Johor despite a soft market environment.

However, its forward price-earnings ratio is almost on a par with some of the big-cap developers, which means that its earnings level need to be raised further before further rerating can take place. — Kenanga Research, March 31

This article first appeared in The Edge Financial Daily, on April 3, 2017.

For more stories, download TheEdgeProperty.com pullout here for free.

TOP PICKS BY EDGEPROP

Subang Perdana Goodyear Court 10

Subang Jaya, Selangor

Bandar Baru Wangsa Maju (Seksyen 6)

Wangsa Maju, Kuala Lumpur

Pangsapuri Mawar Sari

Taman Setiawangsa, Kuala Lumpur

Happy Garden (Taman Gembira)

Kuchai Lama, Kuala Lumpur

Pearl Villa Townhouse

Bandar Saujana Putra, Selangor

OUG Parklane

Jalan Klang Lama (Old Klang Road), Kuala Lumpur

Taman Tun Dr Ismail (TTDI)

Taman Tun Dr Ismail, Kuala Lumpur