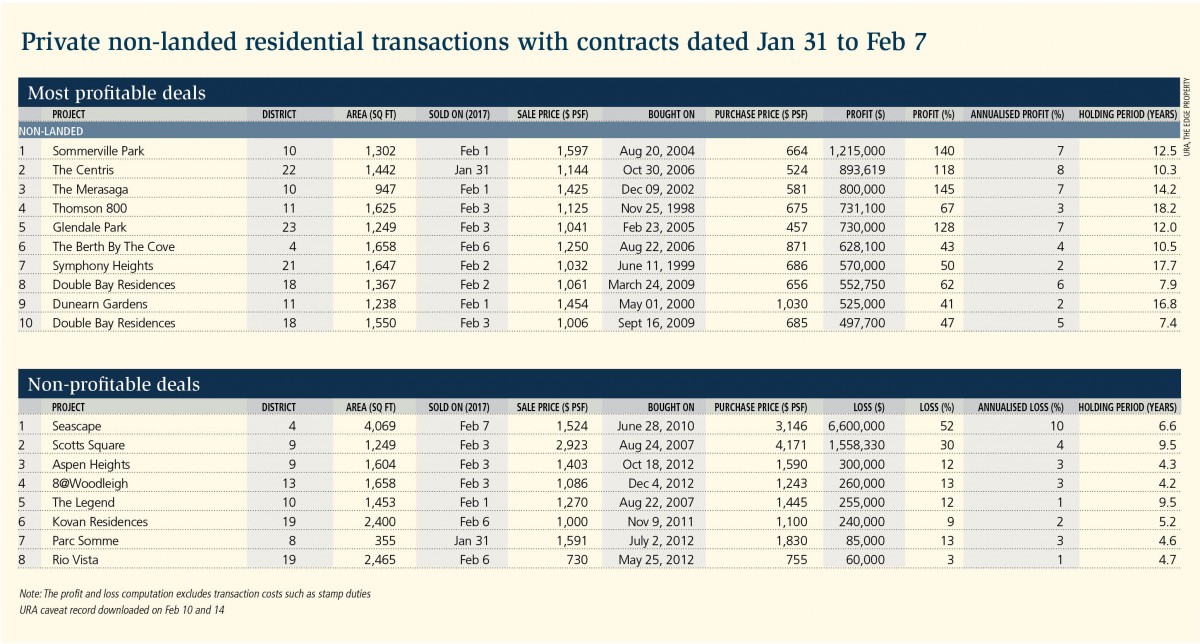

ON Feb 7, a 4,069 sq ft unit at Seascape in Sentosa Cove was sold at a $6.6 million loss. The loss works out to 52%, or 10% annualised over a holding period of 6.6 years.

The previous owner, a Russian national, bought the unit from the developer at $12.8 million, or $3,146 psf in June 2010. The unit was put up for mortgagee sale at an auction conducted by JLL in January 2017 at an opening price of $6.8 million but did not find a buyer. It was subsequently sold at $6.2 million, or $1,524 psf, by private treaty. According to JLL head of auctions Mok Sze Sze, the buyer is an investor.

The transaction marks the biggest loss for condominiums at Sentosa Cove so far. Based on the matching of URA caveat data, the second- and third-biggest losses at Sentosa Cove were also traced to Seascape. In May 2015, a 4,133 sq ft unit at Seascape was sold at a $5.2 million loss. The unit was bought at $11 million, or $2,661 psf, in December 2011 and sold at $5.8 million, or $1,403 psf. The loss works out to 47%, or 17% annualised over a three-year holding period. The seller was also liable for a 4%, or $232,000, Seller’s Stamp Duty.

The third-biggest loss of $4.65 million occurred in relation to a 4,241 sq ft unit at Seascape that was bought at $11 million, or $2,594 psf, in December 2011 and sold at $6.35 million in October 2016. The loss works out to 42%, or 11% annualised over a holding period of nearly five years. Seascape, which has a 99-year leasehold tenure, was completed in 2011 and comprises 151 units.

In total, 15 condo units at Sentosa Cove were sold at a loss last year. The sellers sustained losses ranging from $80,010 to $4.65 million, working out to an average loss of $1.35 million, or 23%.

For private non-landed homes sold in the week of Jan 31 to Feb 7, the next biggest loss, after the Seascape unit, of $1.56 million occurred in the sale of a 1,249 sq ft unit at Scotts Square in prime District 9. The seller bought it at $5.2 million, or $4,171 psf, from the developer in August 2007 and sold it at $3.65 million, or $2,923 psf, on Feb 3. The loss works out to 30%, or 4% annualised over a holding period of 9.5 years.

This transaction marks the biggest loss at Scotts Square so far. All seven units at Scotts Square transacted last year, whose previous caveats could be traced, were sold at a loss. The sellers sustained losses ranging from $647,088 to $1.2 million, working out to an average loss of $910,579, or 24%.

The monthly rents for units of between 1,200 and 1,300 sq ft at Scotts Square averaged $7,682 in 2H2016, which implies a 3% gross rental yield for the recently transacted unit. Scotts Square is a mixed-use development completed in 2011. It comprises 338 freehold apartment units and is located within walking distance of Orchard MRT station.

This article first appeared in The Edge Property Singapore, a pullout of The Edge Singapore, on Feb 20, 2017.

For more stories, download TheEdgeproperty.com pullout here for free.

TOP PICKS BY EDGEPROP

Seksyen 4, Petaling Jaya

Petaling Jaya, Selangor

Tujuh Residences @ Kwasa Damansara City Centre

Shah Alam, Selangor

Alora Residences @ Avenue 25 Subang Jaya

Subang Jaya, Selangor

Amaya Residences @ Damansara Avenue

Damansara, Kuala Lumpur

Amaya Residences @ Damansara Avenue

Damansara, Kuala Lumpur

Amaya Residences @ Damansara Avenue

Damansara, Kuala Lumpur

Amaya Residences @ Damansara Avenue

Damansara, Kuala Lumpur