THE property market in Johor will remain challenging this year and developers will focus on clearing stock and selling products priced below RM700,000.

“More freebies will be given to close sales,” says KGV International Property Consultants (Johor) Sdn Bhd executive director Samuel Tan when presenting The Edge-KGV International Property Consultants Johor Bahru Housing Property Monitor for 4Q2016. “There will be fewer new launches, and launches will be in small batches. Niche areas such as Senibong Cove and Horizon Hills as well as preferred areas like Bukit Indah, Setia Eco Garden and Seri Alam will remain attractive even though sales moderated in 4Q2016.”

He foresees changes in the industry as developers strive to perform better and, in some cases, to survive. He expects them to adopt new marketing approaches to overcome the current soft market conditions.

“All in all, I am cautiously optimistic about landed residential properties, niche products in preferred locations and stratified properties priced below RM550 psf with absolute pricing at RM500,000,” he says.

The Kuala Lumpur-Singapore high-speed rail (HSR) project remains the focus of Johor although its alignment has yet to be confirmed. Tan believes a new wave of land price increases is likely to hit when the alignment is confirmed or when land acquisitions commence.

“Based on past experiences of catalytic projects, land prices in the vicinity will rise 20% to 100%, depending on the distance of the sites from the HSR station,” he explains. “When the station is completed, prices will increase further.”

Tan also expects prices of other types of properties to go up in tandem with the rising land prices. For a start, he believes the demand for homes will soar as workers move to the state to take up jobs in the HSR project. He also expects hotels and shops in the state do well.

Rental rates remained flat

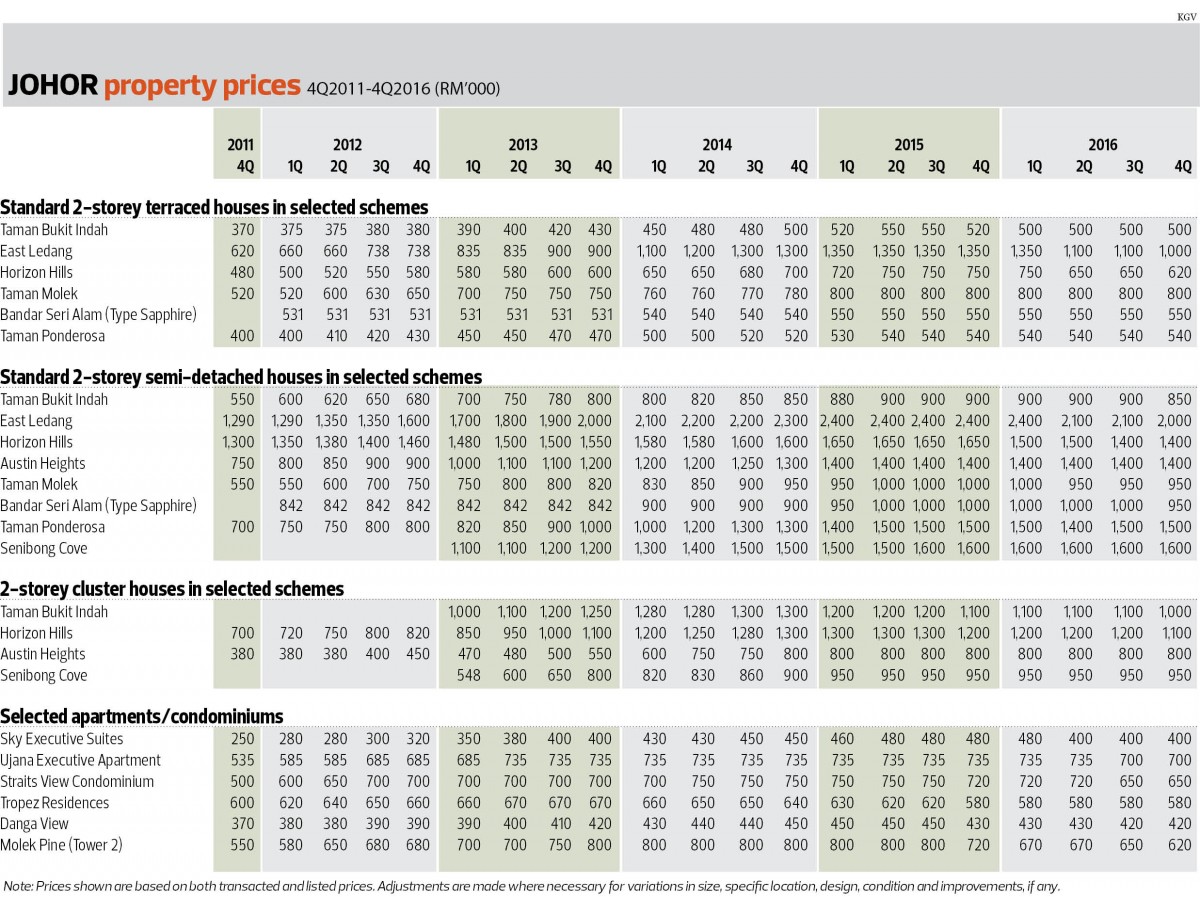

The performance of Johor’s property market was mixed across all segments in the last quarter of 2016. According the KGV data, the prices of most landed and non-landed homes were flat while others saw a slight drop.

In Horizon Hills, the prices of standard 2-storey terraced houses (land area: 1,400 sq ft) and 2-storey cluster houses (2,240 sq ft) slipped 4.6% to RM620,000 and 8.3% to RM1.1 million respectively.

The prices of standard 2-storey semi-detached houses in Taman Bukit Indah (land area: 3,400 sq ft) also declined, down 5.5% to RM850,000, while those in Bandar Seri Alam (2,380 sq ft) saw a 5% decline to RM950,000.

Meanwhile, the prices of 2-storey cluster homes in Taman Bukit Indah fell 9% to RM1 million while those of the units in Molek Pine Condominium (Tower 2) declined 4.6% to RM620,000.

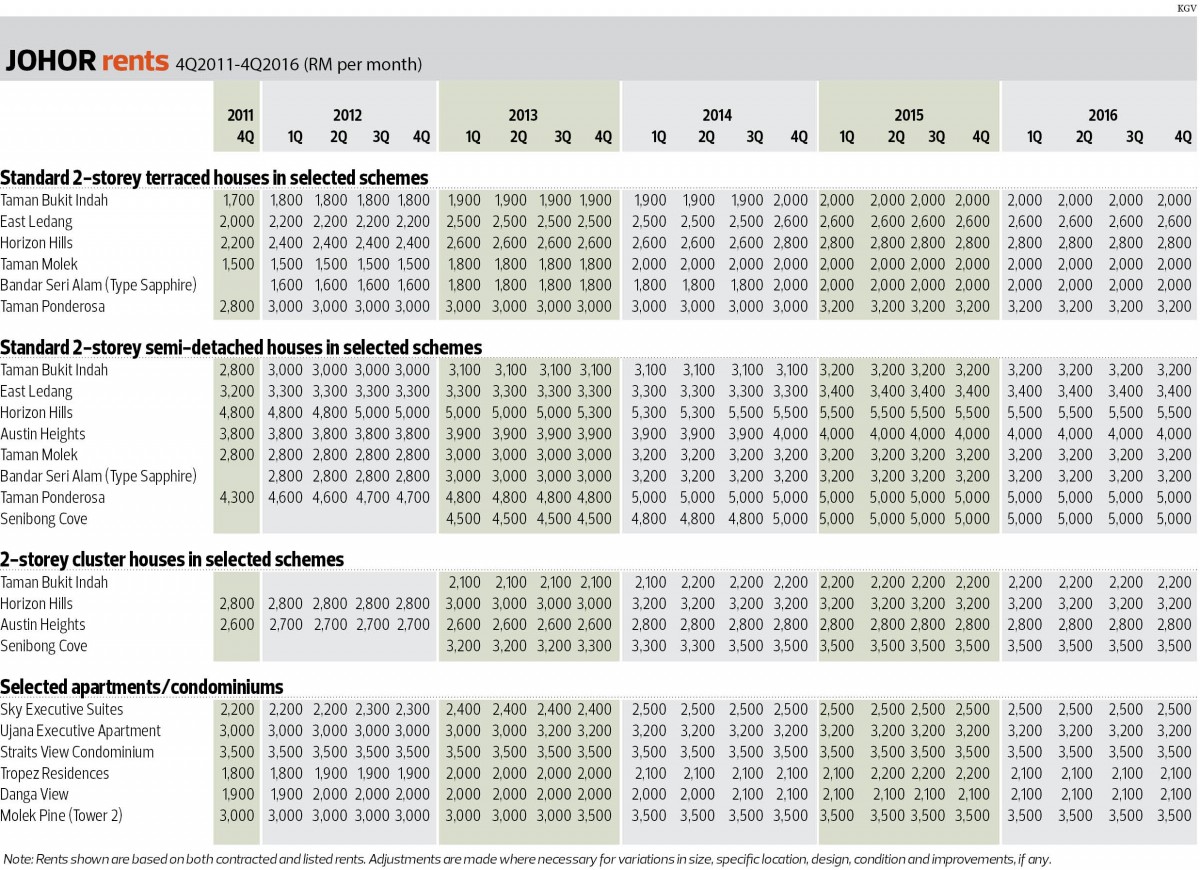

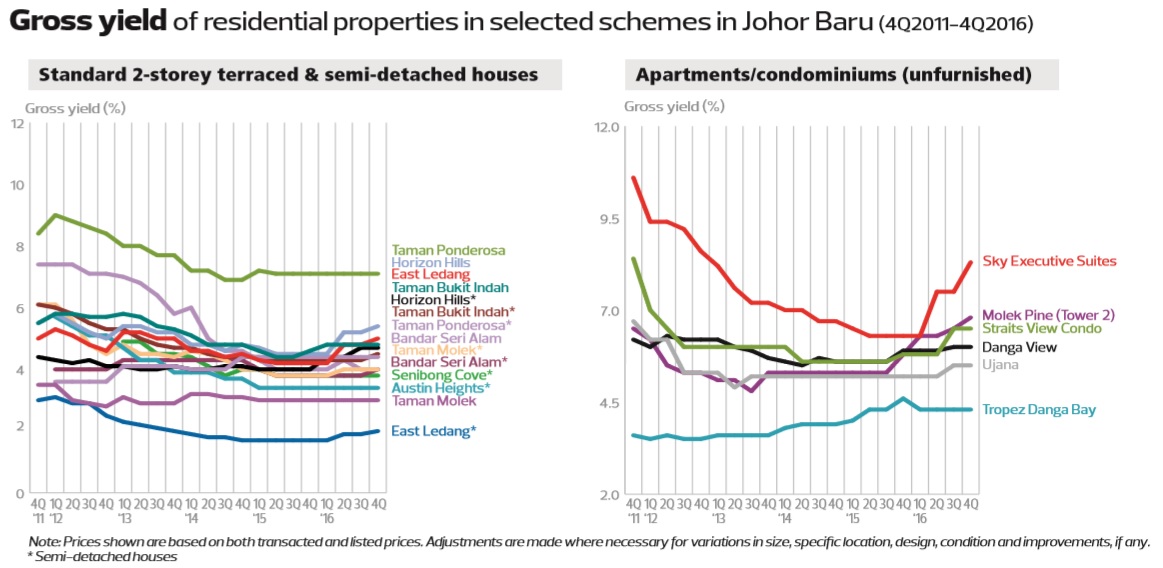

According to KGV, the gross monthly rents of houses in Johor Bahru were also flat in the quarter under review. Nevertheless, a number of houses sampled saw a slight increase in gross yield. Rents for standard 2-storey terraced houses in both East Ledang (land area: 1,820 sq ft) and Horizon Hills (1,400 sq ft) rose 0.2% to 5% and 5.4% respectively.

Other landed homes such as standard 2-storey semidees and 2-storey cluster homes also saw a similar trend. Rents for standard 2-storey semidees in both Taman Bukit Indah (land area: 1,400 sq ft) and Bandar Seri Alam (2,380 sq ft) rose 0.2% to 4.5% and 4% respectively.

For 2-storey cluster homes in Taman Bukit Indah (land area: 2,240 sq ft) and Horizon Hills (2,240 sq ft), rents rose 0.2% and 0.3% to 2.6% and 3.5% respectively.

As for non-landed properties, the gross rental yield of Sky Executive Suites rose 0.8% to 8.3% while that of Molek Pines (Tower 2) increased 0.3% to 6.8%.

Cautiously optimistic

Tan expects the opening of the new interchange linking the Kempas-Senai Highway and Senai Airport City to boost development in the areas near the airport, especially those belonging to Senai Airport City and Singapore-based Lee Rubber Co Pte Ltd.

“First, accessibility will boost demand for homes in the area. Currently, the route to Senai Airport City is long and cumbersome. [With the new interchange], demand for land, factories, houses and shops in Senai Airport City and the surrounding areas will pick up,” he says.

“On the other side of the interchange is Taman Impian Emas. It will now have easier access.”

The Edge reported recently that Lee Rubber has been disposing of its land in Malaysia. Since April 2015, it has sold four properties, valued at more than RM300 million, of which two are in Johor.

The news report also notes that, based on a 2008 booklet issued by the Iskandar Regional Development Authority, Lee Rubber has formed a joint venture with Johor Corp and the Employees Provident Fund to develop the 456-acre Johor Technology Park. It also says the company has a further 6,100 acres — a 2,900-acre township being developed at Taman Impian Emas on a joint-venture basis with the Kuok Group and another company, and 3,200 acres in Senai and Skudai.

Chinese developers are continuing to increase their presence in Johor.

Tan notes that Hong Kong-listed Country Garden Holdings Co Ltd is changing its business focus — it is venturing into the domestic pro-perty segment.

Damansara Realty Bhd and Country Garden signed an agreement last October to set up a joint-venture company — DAC Properties Sdn Bhd — to develop an integrated township called Central Park on 53 acres of freehold land in Johor Bahru.

The joint venture is 30%-owned by Damansara Realty’s indirect wholly-owned subsidiary Damansara Realty (Johor) Sdn Bhd with the remaining 70% held by Country Garden Management Sdn Bhd, which is wholly owned by Country Garden.

DAC Properties will develop Central Park over six to eight years with the first phase to be launched in 1Q2017. The project, located in the Tebrau district and just 5km from the city centre, is targeted at young homebuyers.

Tan says any new development of stratified units will certainly worsen the oversupply situation, but he would not dismiss the possibility of more such developments.

“It all depends on whether the products are designed and priced to meet market demand. If they are, then the units will sell well,” he says.

“Central Park is strategically located in Tampoi, with easy access via Jalan Tampoi and the Pasir Gudang Highway. The surroundings areas are also mature. If the products are priced around RM500,000 each, I believe they will find ready buyers.”

Tan also believes that more such joint ventures will be set up in the coming years as foreign developers begin to understand the needs of the local market and design their projects accordingly.

Country Garden is also the developer of Forest City, which has a gross development value of more than RM400 billion, and Danga Bay in Johor as well as Country Garden Diamond in Kuala Lumpur.

This article first appeared in City & Country, a pullout of The Edge Malaysia Weekly, on Feb 20, 2017.

For more stories, download TheEdgeproperty.com pullout here for free.

TOP PICKS BY EDGEPROP

Kenny Hills (Bukit Tunku)

Kenny Hills (Bukit Tunku), Kuala Lumpur

Tujuh Residences @ Kwasa Damansara City Centre

Shah Alam, Selangor

Amaya Residences @ Damansara Avenue

Damansara, Kuala Lumpur

Amaya Residences @ Damansara Avenue

Damansara, Kuala Lumpur

Amaya Residences @ Damansara Avenue

Damansara, Kuala Lumpur

Amaya Residences @ Damansara Avenue

Damansara, Kuala Lumpur

Damansara Seresta

Bandar Sri Damansara, Kuala Lumpur