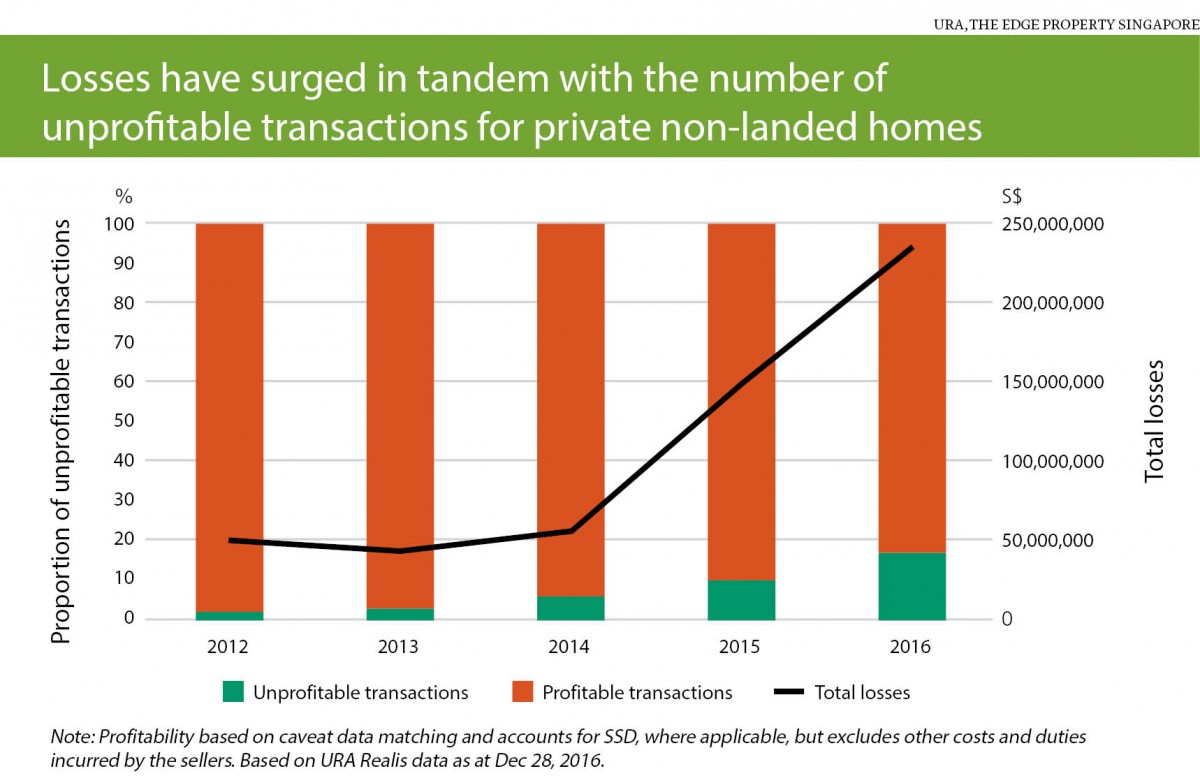

AS the proportion of unprofitable property transactions surged from 9% (508 out of 5,433 matched transactions) in 2015 to 17% (1,002 out of 5,924 matched transactions) in 2016, the losses incurred by sellers climbed 62% from S$161 million to S$260 million over the same period.

The study by The Edge Property Singapore matched the latest sub-sale and resale caveats with their previous caveats based on data from URA Realis as at Dec 28, 2016. The computation of gains and losses accounts for seller’s stamp duty (SSD), where applicable, but excludes other costs and duties incurred by the sellers. The study covers strata properties in the non-landed residential, industrial, office and retail segments.

In the condominium and apartment segment, the proportion of unprofitable transactions was 10% (447 out of 4,687 matched transactions) in 2015. In 2016, the proportion rose to 17% (873 out of 5,264 matched transactions). While the majority of sellers enjoyed profits, the average profit per transaction fell from S$310,815, or 37%, in 2015 to S$224,721, or 28%, in 2016. The losses incurred by sellers of private non-landed homes climbed 57% from a total of S$151 million in 2015 to S$236 million in 2016 (see chart).

The biggest loss of S$4.65 million in the private non-landed home segment in 2016 accrued to a 4,241 sq ft unit at Seascape in Sentosa Cove. The unit was bought at S$11 million, or S$2,594 psf, in December 2011 and sold at S$6.35 million, or S$1,497 psf, in October 2016. This translates into a loss of 42%, or 11% per annum over a holding period of about five years. Transacted resale prices at Seascape have fallen from a peak of between S$2,551 and S$2,867 psf in 2012 to between S$1,403 and S$1,497 psf in 2015 and 2016. Completed in 2011, Seascape is a 99-year leasehold condo comprising 151 units.

A seller at The Ritz-Carlton Residences incurred the second-highest loss in 2016 when he sold a 2,831 sq ft unit at S$7.1 million, or S$2,508 psf, in March 2016. He bought the unit at S$10.8 million, or S$3,815 psf, in June 2013. The seller would likely have incurred an 8% SSD, or S$568,000, owing to a holding period of less than three years. Including SSD, the losses total S$4.27 million (40%), or 17% annualised. Transacted resale prices at The Ritz-Carlton Residences have fallen from a peak of between S$3,768 and S$3,896 psf in 2012 and 2013 to between S$2,508 and S$3,003 psf in 2016. The Ritz-Carlton Residences is a freehold development comprising 58 units on Cairnhill Road in prime District 9. It was completed in 2011.

The third-biggest loss of S$3.64 million accrued to a 2,777 sq ft unit at Turquoise in Sentosa Cove. The unit was bought at S$7.16 million, or S$2,580 psf, in November 2007 from the developer and sold at S$3.8 million, or S$1,368 psf, in June 2016. This translates into a 47% loss, or 7% per annum over a holding period of nearly nine years. So far, the highest psf resale price at Turquoise is S$2,446, for a unit sold in 2012. Prices have since fallen to between S$1,368 and S$1,521 psf in 2016. Turquoise is a leasehold development that contains 91 units and was completed in 2010.

The two highest profits for private non-landed homes in 2016 accrued to two 2,885 sq ft units at Ardmore Park. Both units were bought from the developer in 1996 and sold after a 20-year holding period. The larger profit of S$3.53 million accrued to a sixth-floor unit that was bought at S$4.97 million, or S$1,723 psf, and sold at S$8.5 million, or S$2,947 psf, in May 2016. This translates into a 71% profit, or 3% annualised. The smaller profit of S$3.31 million accrued to a 14th-floor unit that was bought at S$4.89 million, or S$1,695 psf, and sold at S$8.2 million, or S$2,843 psf, in September 2016. This translates into a 68% profit, or 3% annualised. The 330-unit Ardmore Park is a freehold condo in prime District 10 that was completed in 2001.

More industrial properties sold at a loss

In the strata industrial segment, the proportion of unprofitable transactions was 8% (45 out of 572 matched transactions) in 2015. In 2016, the proportion surged to 20% (101 out of 495 matched transactions). The losses incurred by sellers of strata industrial property more than doubled from S$5.1 million in 2015 to S$13.1 million in 2016. Meanwhile, the average profit per transaction fell from S$265,356, or 48%, in 2015 to S$202,108, or 38%, in 2016. For unprofitable transactions, the average loss increased from S$113,442, or 14%, to S$132,029, or 11% over the same period.

The biggest loss of S$510,000 for a strata industrial unit sold last year accrued to a 3,003 sq ft unit at Entrepreneur Business Centre in Kaki Bukit. The unit was bought at S$1.6 million, or S$533 psf, in May 2012 and sold at S$1.1 million, or S$363 psf, in September 2016. This translates into a loss of 32%, or 8% annualised. Transacted resale prices for similar-sized units at Entrepreneur Business Centre have fallen from a peak of between S$350 and S$361 psf in 2012 to between S$259 and S$263 psf in 2016. Entrepreneur Business Centre was completed in 2004 and has a 60-year leasehold tenure.

At Joo Seng Warehouse, a freehold development on Upper Aljunied Link, a 2,056 sq ft warehouse unit was sold at the second-biggest loss of S$388,300 for a strata industrial unit in 2016. The seller bought the unit at S$1.65 million, or S$803 psf, in a sub-sale in May 1996 and sold it at S$1.26 million, or S$614 psf, in January 2016, incurring a 24% loss, or 1% per annum over a 20-year holding period. Transacted resale prices for similar-sized units at Joo Seng Warehouse have fallen from a peak of between S$580 and S$720 psf in 2012 to between S$574 and S$614 psf in 2016.

The third-biggest loss for a strata industrial unit sold last year accrued to a 1,539 sq ft unit at North Spring Bizhub in Yishun. The unit was bought at S$1.18 million, or S$767 psf, in February 2014 and sold at S$838,000, or S$544 psf, in August 2016. Owing to the holding period of less than three years, the seller incurred a 5% SSD of S$41,900. Including SSD, the losses total S$383,900 (33%), or 14% annualised. Transacted resale prices for similar-sized units at North Spring Bizhub have fallen from a peak of between S$422 and S$585 psf in 2011 to between S$408 and S$544 psf in 2016. North Spring Bizhub was completed in 2013 and has a 60-year leasehold tenure.

The highest profit of S$1.91 million in the strata industrial segment last year accrued to a 4,951 sq ft unit at LHK Building, a freehold development on Sims Drive. The seller bought the unit at S$1.12 million, or S$225 psf, in May 2007 and sold it at S$3.02 million, or S$610 psf, in March 2016. This translates into a 171% profit, or 12% per annum over a nine-year holding period.

At Senoko Food Connection, a 30-year leasehold development completed in 2006, a 20,335 sq ft unit fetched the second-highest profit of S$1.78 million for a strata industrial unit in 2016. The unit was bought at S$1.78 million, or S$87 psf, in June 2007 and sold at S$3.56 million, or S$175 psf, in January 2016. This translates into a 100% profit, or 8% per annum over about nine years.

Twenty-one strata offices sold at average loss of 12%

In the strata office segment, the proportion of unprofitable transactions was 4% (three out of 82 matched transactions) in 2015. In 2016, the proportion increased to 21% (21 out of 101 matched transactions). Strata office units transacted in 2016, whose prior caveats could be traced, fetched an average profit of S$488,459, or 45%. For unprofitable transactions, the average loss increased from S$58,533, or 10%, in 2015 to S$271,621, or 12%, in 2016.

The biggest loss of S$1.21 million for a strata office unit sold last year accrued to a 2,336 sq ft unit at Suntec City. The 99-year leasehold unit was bought at S$6.03 million, or S$2,580 psf, in March 2011 and sold at S$4.82 million, or S$2,062 psf, in September 2016. This translates into a 20% loss, or 4% annualised.

At Parkway Parade, a 99-year leasehold development, the seller of a 1,765 sq ft strata office unit incurred the second-biggest loss of S$1.06 million in 2016. The unit was bought at S$2.8 million, or S$1,586 psf, in May 2015 and sold at S$1.74 million, or S$986 psf, in September 2016. This translates into a 38% loss over a holding period of just over a year.

The third-biggest loss of S$657,400 for a strata office unit sold last year accrued to a 1,216 sq ft unit at Oxley Tower. It was bought from the developer at S$4.5 million, or S$3,700 psf, in October 2014 and sold at S$3.84 million, or S$3,159 psf, in a sub-sale in April 2016. This translates into a 15% loss, or 10% annualised. Oxley Tower is a freehold development on Robinson Road that is expected to receive its temporary occupation permit at end-2018.

The highest profit of S$6.38 million in the strata office segment last year accrued to an 11,819 sq ft unit at Prudential Tower, a 99-year leasehold development on Cecil Street. The unit was bought at S$26.71 million, or S$2,260 psf, in May 2014 and sold at S$33.09 million, or S$2,800 psf, in March 2016. This translates into a 24% profit, or 12% annualised over a two-year holding period.

At The Octagon, a freehold development on Cecil Street, four units with a total area of 6,189 sq ft fetched the second-highest profit of S$4.3 million in the strata office segment last year. The units were bought at S$9.9 million, or S$1,600 psf, in June 2008 and sold at S$14.2 million, or S$2,294 psf, in November 2016. This translates into a 43% profit, or 4% annualised over eight years.

Six strata retail units sold at average loss of 5% in 2016

In the strata retail segment, the proportion of unprofitable transactions was 14% (13 out of 92 matched transactions) in 2015. In 2016, the proportion declined to 10% (six out of 64 matched transactions). Strata retail units transacted in 2016, whose prior caveats could be traced, fetched an average profit of S$399,348, or 62%. Forty-four per cent (28 out of 64) of the units sold at a profit in 2016 were bought between 2011 and 2013, before prices peaked at end-2014.

The biggest loss of S$550,000 for a strata retail unit sold last year accrued to a 1,539 sq ft property at Bukit Timah Plaza, a 99-year leasehold development. The unit was bought at S$3.35 million, or S$2,176 psf, in September 2013 and sold at S$2.8 million, or S$1,819 psf, in April 2016. This translates into a loss of 16%, or 7% per annum over a holding period of about three years.

At The Lenox, a freehold development on Changi Road, a 560 sq ft unit was sold at the second-biggest loss of S$162,793 for a strata retail unit in 2016. The seller had bought the unit at S$1.56 million, or S$2,792 psf, from the developer in February 2013 and sold it at S$1.4 million, or S$2,501 psf, in May 2016. This translates into a 10% loss, or 3% per annum over a three-year holding period.

The third-biggest loss of S$38,000 for a strata retail unit sold last year accrued to a 431 sq ft unit at Far East Plaza, a freehold development completed in 1982. The unit was bought at S$2.04 million, or S$4,733 psf, in March 2007 and sold at S$2 million, or S$4,645 psf, in March 2016, after a nine-year holding period. This translates into a 2% loss.

The two most profitable transactions in the strata retail segment last year accrued to two units at Lucky Plaza, a freehold development completed in 1979. The larger profit of S$2.67 million accrued to a first-floor 355 sq ft unit that was bought at S$1.95 million, or S$5,490 psf, in August 2012 and sold at S$4.62 million, or S$13,000 psf, in November 2016. This translates into a 137% profit, or 22% per annum over four years. The second-largest profit of S$1.65 million in 2016 accrued to a 549 sq ft unit on the third floor that was bought at S$1.15 million, or S$2,095 psf, in February 2010 and sold at S$2.8 million, or S$5,101 psf, in April 2016. This translates into a 143% profit, or 15% per annum over a six-year holding period.

Lin Zhiqin is a senior analyst at The Edge Property Singapore.

This article first appeared in The Edge Property Singapore, a pullout of The Edge Singapore, on Jan 9, 2017.

TOP PICKS BY EDGEPROP

Fairfield Residences, Tropicana Heights

Kajang, Selangor

Parkfield Residences, Tropicana Heights

Kajang, Selangor

Villa Residence @ Goodview Heights

Semenyih, Selangor

Savanna Executive Suites @ Southville City

Bangi, Selangor