Eco World Development Group Bhd (Dec 9, RM1.37)

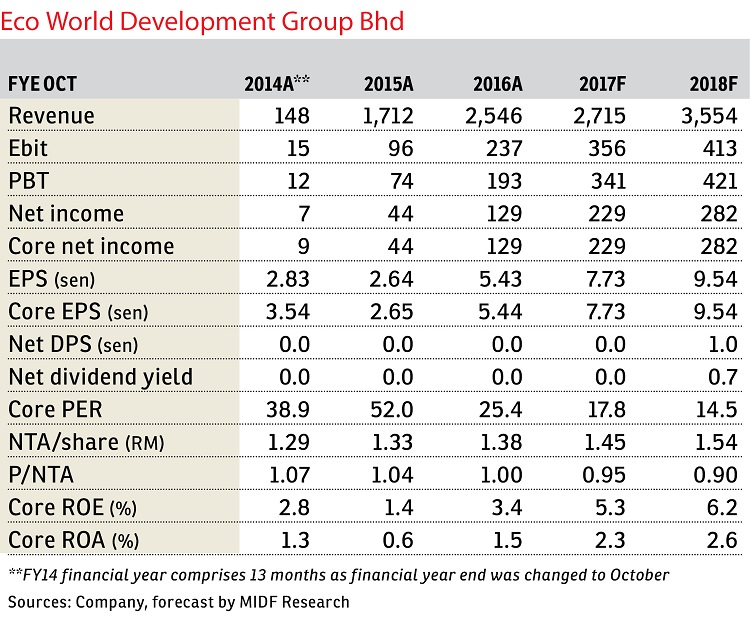

Maintain buy recommendation with an unchanged target price of RM1.68: Eco World Development Group Bhd’s (EcoWorld) financial year 2016 (FY16) core net income of RM129 million was within expectations as it achieved 104% and 102% of our and consensus forecast respectively.

No dividend is declared and this is within expectations as the company is still in high growth stage.

Revenue grew by 49% year-on-year to RM2.55 billion, driven by ongoing recognition of projects in the Klang Valley (Eco Majestic, Eco Sanctuary and Eco Sky), Iskandar Malaysia (Eco Botanic, Eco Spring, Eco Summer, Eco Business Park 1, Eco Tropics and Eco Business Park III) and Penang (Eco Meadow and Eco Terraces).

EcoWorld achieved its sales target of RM4 billion, securing sales of RM4.01 billion for FY16. We gather that RM3.4 billion of the sales was from local projects. The remaining RM610 million was generated from its pro-forma 27% share of FY16 sales from Eco World International (EWI).

For FY17, the group aims to secure RM4 billion gross sales from all Malaysian development projects managed by EcoWorld (including joint ventures). Note that in FY17, EcoWorld will be entitled to a proportionate share of international sales achieved by EWI based on the group’s proposed 27% shareholding in EWI.

We continue to like EcoWorld for its excellent sales achievement, superior earnings growth prospects and strong branding. Catalysts will be the successful achievement of sales target and earnings delivery. — MIDF Research, Dec 9

This article first appeared in The Edge Financial Daily, on Dec 13, 2016. Subscribe to The Edge Financial Daily here.

TOP PICKS BY EDGEPROP

Ion Belian Garden, Batang Kali

Batang Kali, Selangor

Taman Angkasa

Jalan Klang Lama (Old Klang Road), Kuala Lumpur

Danau Permai Condominium

Taman Desa, Kuala Lumpur

Desa Business Park

Jalan Klang Lama (Old Klang Road), Kuala Lumpur

Bandar Botanic

Bandar Botanic/Bandar Bukit Tinggi, Selangor

Setia Damai

Setia Alam/Alam Nusantara, Selangor

Setia Indah

Setia Alam/Alam Nusantara, Selangor

Bayu Sutera @ Celyn, Bandar Sri Sendayan

Seremban, Negeri Sembilan

Menara Bintang Goldhill

Bukit Bintang, Kuala Lumpur

Kawasan Perindustrian Batu Caves

Batu Caves, Selangor

Kawasan Perindustrian Meru Timur

Klang, Selangor