Malaysian Resources Corp Bhd (Dec 4, RM1.27)

Maintain buy with an unchanged target price (TP) of RM1.63: Malaysian Resources Corp Bhd (MRCB) has entered into a heads of agreement with MRCB-Quill Real Estate Investment Trust (MQREIT) for the disposal of Menara Shell to the latter for RM640 million.

The said property in Kuala Lumpur Sentral consists of a 33-storey office tower, five-storey podium and four-storey basement car park. The purchase consideration will be satisfied via cash and issuance of new MQREIT shares. However, the ratio of cash to new shares has yet to be determined.

This news does not come as a surprise as the management has highlighted numerous times about its intention to inject Menara Shell into MQREIT. Another potential asset injection on the cards is Ascott Residences (RM250 million).

In our analysis, we have assumed that the purchase consideration of RM640 million for Menara Shell will be satisfied via 64% cash (RM412 million) and 36% in new shares (RM228 million). This ratio is consistent with that used for the disposal of Platinum Sentral to MQREIT. If we further assume that the shares will be issued at a price of RM1.09 per share, then a total of 209 million new MQREIT shares will be issued to MRCB.

We estimate that the disposal of Menara Shell will reduce MRCB’s net gearing from the current 113% to 86% on a pro forma basis. However, this is unlikely to be the case that eventuates, given that MRCB is in need of funding to undertake several large-scale developments, such as Kwasa Damansara (MX-1), Cyberjaya City Centre and the National Sports Complex redevelopment.

MRCB currently holds a 31.2% stake in MQREIT. Should the purchase consideration be satisfied in accordance with the cash-to-share ratio (64% versus 36%) that we have postulated, this will see MRCB receiving an additional 209 million shares in MQREIT. The former’s stake in the latter would then be raised to 47.7%.

Execution (particularly of its construction jobs) is a key risk to keep an eye on. There is no change to our estimates for now, pending clarity on the timeline regarding the disposal and a breakdown of the consideration. Potential impact on its net gearing is as previously explained.

While still in the early days, we reckon that MRCB’s new management is on the right path (albeit at a slow pace) to turn the company around. We expect more positive news flows in the coming months.

While still in the early days, we reckon that MRCB’s new management is on the right path (albeit at a slow pace) to turn the company around. We expect more positive news flows in the coming months.

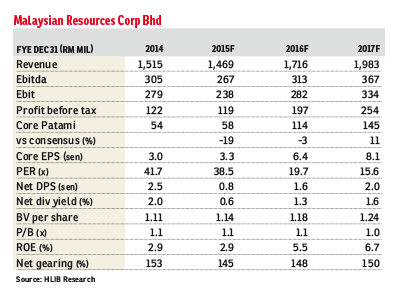

Our sum-of-parts-based TP of RM1.63 implies an expensive financial year ending Dec 31, 2015 (FY15) price-earnings ratio of 50 times, but this will be reduced to 25.5 times for FY16 once earnings growth sets in. — Hong Leong Investment Bank Research, Dec 4

This article first appeared in The Edge Financial Daily, on Dec 7, 2015. Subscribe to The Edge Financial Daily here.

TOP PICKS BY EDGEPROP

Kaleidoscope Residence

Wangsa Maju, Kuala Lumpur

Kemensah Villa Condominium

Taman Melawati, Kuala Lumpur

Seasons Luxury Apartments @ Amara Larkin

Johor Bahru, Johor

Bandar Puncak Alam

Bandar Puncak Alam, Selangor