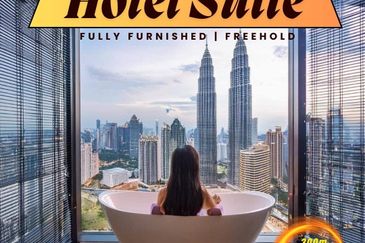

KSL Holdings Bhd (Sept 11, RM1.50)

Maintain outperform with a lower target price (TP) of RM1.72: For the first half ended June 30, 2015 (1HFY15), KSL Holdings Bhd only managed to register RM267.7 million worth of sales which is below our expectations, accounting for only 35% of our full-year estimate of RM761 million. However, this industry-wide trend is not surprising as only 14% of developers under our coverage are on track to meet full-year targets. Its sluggish sales were mainly still due to the tight lending environment, fewer new launches during the quarter (only RM61.8 million worth of new launches in first half of 2015) as management remains very cautious on the current market condition. Moving ahead, management is looking to launch affordable properties priced below RM500,000 such as its Avery Park @ Taman Rinting with a total gross development value (GDV) of RM139 million. We gather that the response for the project is still relatively encouraging given that it secured 30% booking just a few days after its launch in early September.

In view of slower launches coupled with the challenging property environment in Johor, we slashed our FY15 to FY16 sales by 24% each to RM579.8 million (-41%, year-on-year [y-o-y]) and RM586.3 million (+1%, y-o-y), respectively.

Consequently, our FY16E (estimate) core net profit was lowered by 8% to RM276.5 million, while our FY15E core net profit remains unchanged given that it is well supported by its unbilled sales of RM807.8 million that would provide the group with more than a year of earnings visibility. We would like to remind investors that about 30% of income is still driven by its resilient recurring income from its investment properties (KSL City Mall and Resort), which offers some degree of dividend payout comfort to investors. Despite the reduction in our earnings forecasts, management is comfortable with the minimum dividend policy payout assumption of 40%; we estimate FY15 to FY16E yields of 7.6% to 7.7%.

During the briefing, management indicated that they have already budgeted RM500 million for FY16 spanning over three years for the capex of its upcoming mall namely KSL City Mall 2 in Klang, which management is looking to commence construction works next year upon getting all the approvals from the state authorities. Looking at KSL’s balance sheet, it remains fairly healthy with a net gearing of only 0.01 times as of 2QFY15, and they can raise another RM950 million by leveraging up to 0.5 times net gearing, should the need arise for massive landbanking or to finance the construction cost of KSL City Mall 2.

During the briefing, management indicated that they have already budgeted RM500 million for FY16 spanning over three years for the capex of its upcoming mall namely KSL City Mall 2 in Klang, which management is looking to commence construction works next year upon getting all the approvals from the state authorities. Looking at KSL’s balance sheet, it remains fairly healthy with a net gearing of only 0.01 times as of 2QFY15, and they can raise another RM950 million by leveraging up to 0.5 times net gearing, should the need arise for massive landbanking or to finance the construction cost of KSL City Mall 2.

Post-briefing, we lowered our TP for KSL pegged to 6 times FY16E price earnings ratio (PER), a 10% discount to its small-mid-cap peers’average of 6.6 times (previously, RM2.15 based on 70% discount to its revised net asset value [RNAV] of RM7.07), as we have turned cautious on the property market, especially in Johor. We opt to change our valuation methodology to forward PER as investors become more concerned about earnings delivery compared to realisation of developers’ RNAVs. We are applying a 10% discount to its peers’ average given its high exposure in Johor. However, we think 10% is sufficient as the company has a very light balance sheet, targets affordable housing and has strong dividend payout abilities thanks to its recurring income streams.

KSL remains an “outperform” albeit the lowered TP as its dividend yield for FY16E remains attractive at 7.7% vs its peers’ average of 5.9%. At our current TP, it implies a 77% discount to its RNAV of RM7.07. — Kenanga Research, Sept 11

This article first appeared in the digitaledge DAILY on Sept 14, 2015. Subscribe here.

TOP PICKS BY EDGEPROP

Jardin Residences @ Bandar Seri Coalfields

Sungai Buloh, Selangor

Bandar Baru Sri Damansara

Bandar Sri Damansara, Selangor

[CORNER LOT] TROPICANA ALAM @ Puncak Alam

Bandar Puncak Alam, Selangor

Jewel by Oxley KLCC

Kuala Lumpur, Kuala Lumpur

TROPICANA ALAM @ PUNCAK ALAM

Bandar Puncak Alam, Selangor

[4R3B Corner Lot] Lemuni @ Daunan Worlwide @ Puncak Alam

Bandar Puncak Alam, Selangor

[4R3B Non Facing House] Daunan Worlwide @ Puncak Alam

Bandar Puncak Alam, Selangor