THE impact of the Johor government’s move to freeze new applications for non-landed developments continued to be felt in 1Q2016, says KGV International Property Consultants (Johor) Sdn Bhd executive director Samuel Tan.

In the quarter under review, there was only one non-landed launch, which was for the first phase of Forest City, comprising high-rise apartment (753 to 1,862 sq ft) and hotel suites (373 to 385 sq ft), KGV International data shows.

That compares with seven launches of new non-landed projects or phases in 4Q2015, among the most notable of which was Eco Palladium at Tebrau by Eco World Development Group Bhd.

Slowdown in launches

Slowdown in launches

“Developers may not launch projects that already have approvals due to the current oversupply situation for high-rise properties,” Tan says in presenting The Edge-KGV International Property Consultants Johor Bahru Housing Property Monitor 1Q2016. “Many developers are still advertising the sales of unsold high-rise units. This situation will continue in the next few quarters. Some also would have just got their bumiputera lots released.”

He believes Forest City will put Iskandar Malaysia back on the radar screen of real estate investors and raise the standard of property development in the region in terms of concept, size and market.

“However, I do not think there will be any adverse impact on the other developments in Iskandar Malaysia as Forest City caters for a different market for now. Things may change when products and prices there are adjusted to meet the requirements of the locals,” Tan says.

Launches of landed developments in the Johor property market continued to drop in 1Q2016 as well, on the back of lacklustre economic conditions as well as the festival season. New launches included Bukit Impian Residence in Taman Impian Emas, Tebrau, by Gunung Impian Development Sdn Bhd and 2-storey terraced houses at Mutiara Rini Skudai by Mutiara Rini Sdn Bhd.

Bukit Impian Residence, which was launched in March, offers 100 2-storey terraced houses with built-ups of 2,567 to 2,638 sq ft, and priced from RM648,000 to RM1.13 million. The launch at Mutiara Rini Skudai, meanwhile, comprised 223 units of 2-storey terraced homes, with built-ups of 1,694 to 2,327 sq ft, and selling prices of RM408,000 to RM680,000.

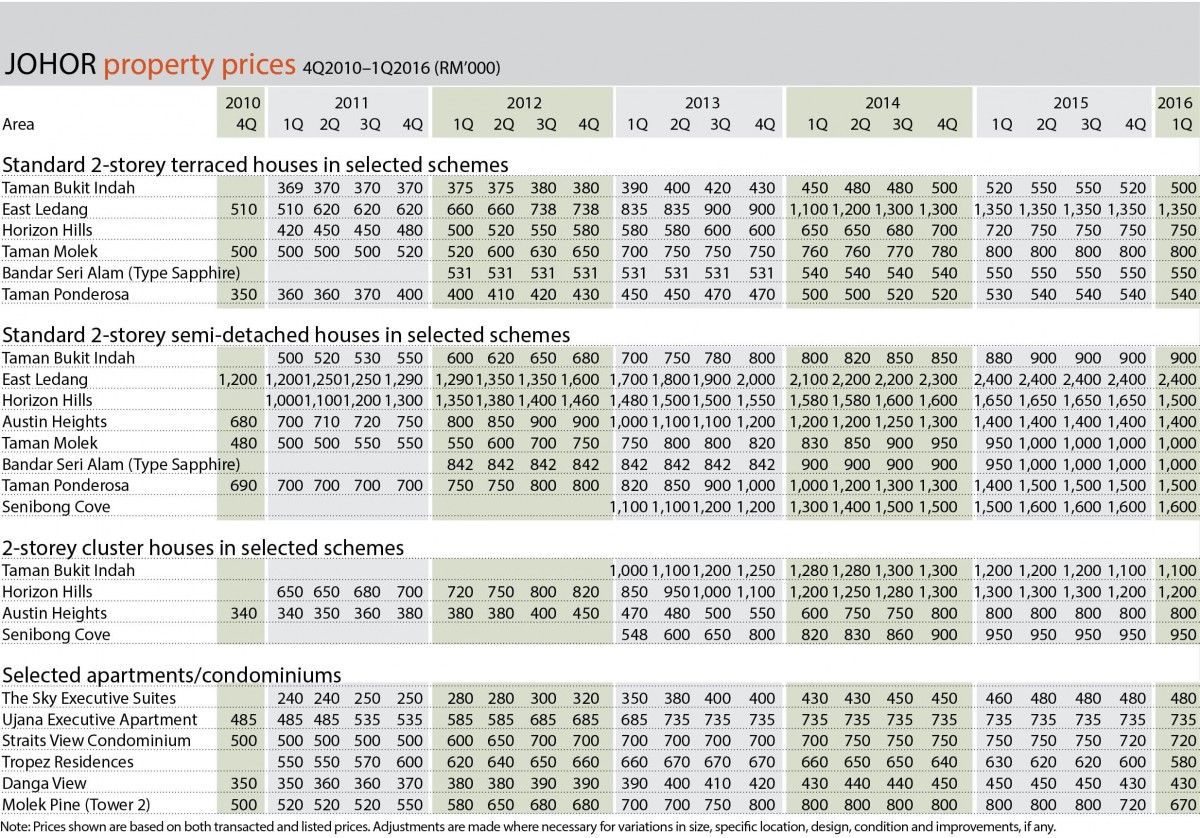

Tan believes the Johor property market is likely to remain quiet in the near future as developers try to clear unsold stock. KGV data shows that transaction prices for most landed residential properties sampled remained flat in 1Q2016. The exception was Taman Bukit Indah, where a 2-storey terraced house, with a built-up of 1,400 sq ft, dipped to RM500,000, from RM520,000 in the previous quarter.

While the bulk of non-landed residential properties experienced slight drops in value in the previous quarter, most remained flat in 1Q2016. In Molek Pine, Tower 2, however, a mid-level, 1,469 sq ft unit fell to RM670,000, from RM720,000 in 4Q2015.

Even though prices remained unchanged, Tan notes that listings in some property search engines are showing lower asking prices for both landed and non-landed properties.

“Buyers will be negotiating for a better price while sellers will hope for a predetermined price. The market has not come to a stage where there are fire sales, which is a good sign.”

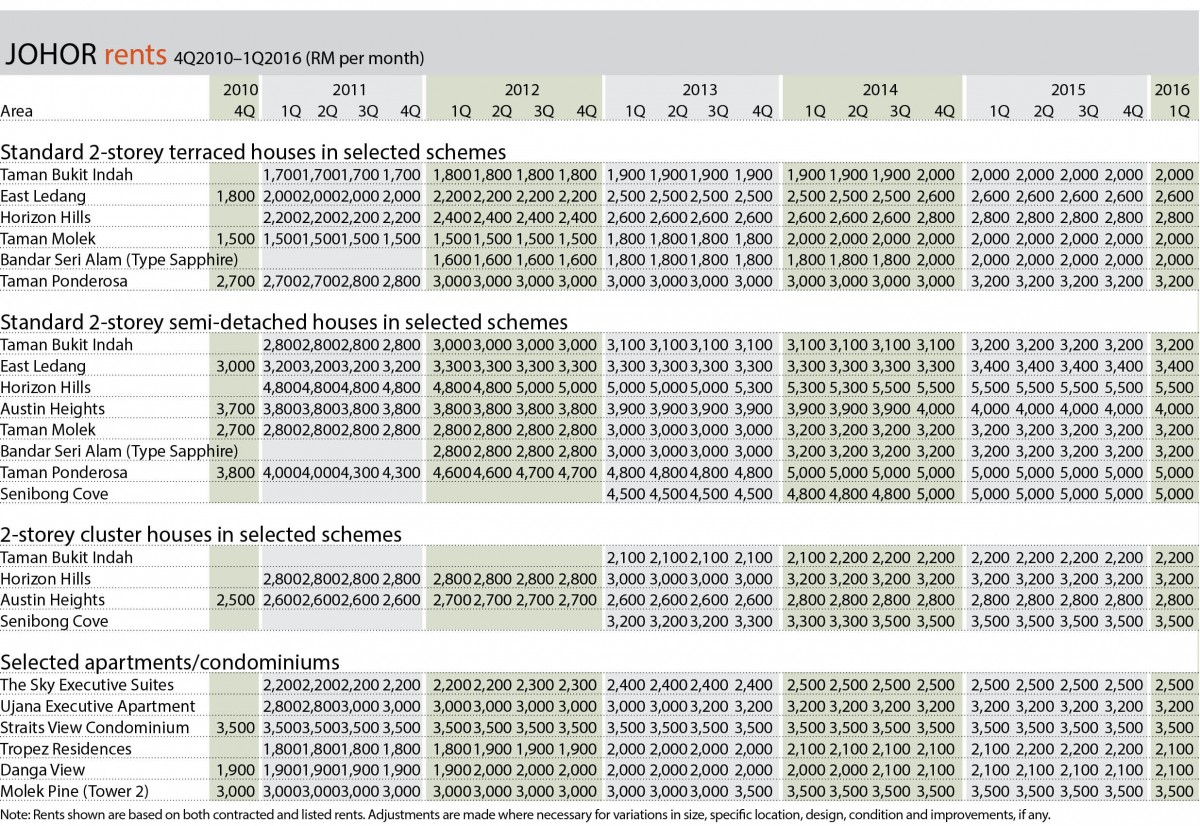

The rental market is generally holding up well, except for high-rise developments, Tan says.

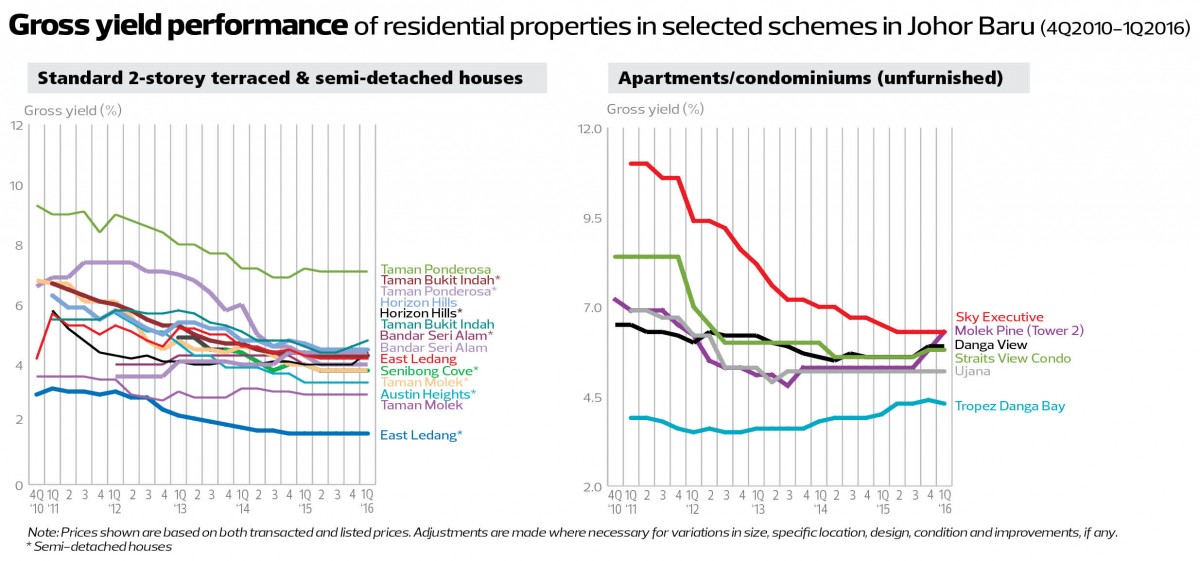

Tropez Danga Bay recorded a 4.3% gross yield in 1Q2016, down from 4.6% in 4Q2015, while gross monthly rental dropped to RM2,100 in 1Q2016, from RM2,200 the previous quarter.

Tropez Danga Bay is part of the 37-acre Tropicana Danga Bay integrated development that will also feature office towers, residences, small offices/home offices, a medical centre, an international school, a hotel and a shopping mall.

Transport issues

An improvement in connectivity between Singapore and Malaysia will contribute to the future appreciation property prices in Johor. Both countries have made several announcements on changes in immigration procedures.

Malaysia plans to put in place automated immigration clearance facilities at both the Causeway and Second Link for motorcyclists, which will make it easier for them to enter and leave Johor Bahru.

All 164 motorcycle counters at the Woodlands and Tuas Checkpoints will be automated by the end of this year, compared with the current 43 automated counters. There will be 100 “M-Bike” lanes at the Causeway and 50 lanes at the Second Link for the scanning of passports.

Meanwhile, Singapore aims to beef up security at its immigration checkpoint by introducing thumbprint scanning, which is expected to result in a longer clearance time.

The BioScreen system will be introduced progressively in the passenger halls at sea and land checkpoints, for travellers aged six and above.

“They obviously have a valid reason to secure their boundaries,” says Tan. However, instead of improving the flow of vehicular and human traffic at the immigration checkpoints between the two countries — a joint effort declared by both sides — the BioScreen system will have the opposite effect, he adds.

He believes the performance of the Johor property market this year will depend on the real and perceived economy of the country, in which job security, cost of living and ease of bank borrowing will have an impact on economic recovery.

“If the economy shows signs of improvement and developers are positioned to sell affordable properties, we will see a more vibrant market. Another sign to watch is the possibility of more auctions, arising from the purchases done over the last three to four years.”

This article first appeared in City & Country, a pullout of The Edge Malaysia Weekly, on May 23, 2016. Subscribe here for your personal copy.

TOP PICKS BY EDGEPROP

La Cottage Taman Putra Perdana

Puchong, Selangor

Perdana Park, Bandar Tasik Puteri

Rawang, Selangor