KUALA LUMPUR (Nov 15): AmFIRST Real Estate Investment Trust’s (AmFIRST REIT) net property income (NPI) rose 23.6% to RM18.07 million in the second quarter ended Sept 30, 2016 (2QFY17), from RM14.622 million a year ago.

Revenue rose 13.3% to RM27.99 million from RM24.7 million.

AmFIRST REIT said NPI for the first six months to Sept 30, 2016 (1HFY17) rose 18.03% to RM35.58 million, from RM30.144 million a year ago. Gross revenue rose 12.3% from RM49.59 million to RM55.67 million, mainly contributed by additional revenue from the newly acquired Mydin HyperMall in Penang as well as higher occupancy and rental reversion of Menara AmBank.

“However, the increase was partially offset by lower revenue from Prima 10, The Summit Subang in USJ and Wisma AmFIRST as a result of lower occupancy as well as the exclusion of AmBank Group Leadership Centre upon its divestment on March 31 [this year],” the trust said.

AmFIRST REIT has declared an interim income distribution of 1.93 sen per unit for 1HFY17 amounting to RM13.25 million representing approximately 100% of the realised distributable net income for the period.

Overall realised distributable net income from operation for 1HFY17 was RM13.3 million, down RM600,000 or 4.7% compared to 1HFY16.

AmFIRST REIT noted that interest expense for 1HFY17 rose 44% to RM17.8 million from a year ago due to additional borrowings to finance the acquisition of the Mydin HyperMall in January this year as well as various asset enhancement initiatives of its existing properties.

AmFIRST REIT opined that the prevailing slow economy would continue to negatively impact the overall office and retail market as “tenants are not expanding”.

This article first appeared in The Edge Financial Daily, on Nov 15, 2016. Subscribe to The Edge Financial Daily here.

TOP PICKS BY EDGEPROP

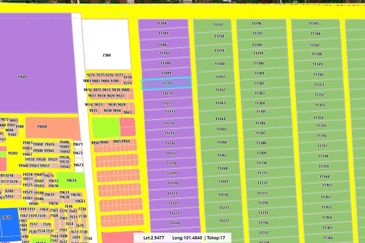

Ayuman Suites Serviced Residence

Gombak, Selangor

Sri Meranti, Bandar Sri Damansara

Bandar Sri Damansara, Selangor

KSL Residence 2 @ Kangkar Tebrau

Johor Bahru, Johor

Eastern Heritage, Setia Eco Glades

Cyberjaya, Selangor

Isle of Kamares, Setia Eco Glades

Cyberjaya, Selangor

Liu Li Garden, Setia Eco Glades

Cyberjaya, Selangor