THE Kuala Lumpur office market is in correction since the Ministry of Federal Territories tightened the approval for new such developments in the second quarter of the year in the face of an oversupply.

“New office buildings, except those being constructed for the owner’s use, will not get the green light from the ministry,” says Knight Frank Malaysia managing director Sarkunan Subramaniam when presenting the The Edge/Knight Frank Klang Valley Office Monitor 2Q2016.

“DBKL froze new office buildings of more than 20 storeys in the Golden Triangle following a huge surplus of such space after the 1997/98 Asian financial crisis.

“In the short term, this move by the government may help stabilise the current office market, allowing demand — take-up/absorption rate — to catch up with supply. In the longer term, the relevant authorities should review applications for the construction of new offices on a case-by-case basis and only approve those that are feasible in terms of location, connectivity, synergy between the project and neighbouring developments, the level of business and commercial activities and so on,” remarks Sarkunan.

“Generally, it is a good thing that overall occupancy and rents are stagnant despite prolonged low oil prices. Impacted by the low oil prices, the overall office market is correcting itself, particularly in KL City where most of the oil and gas businesses are located.”

“Generally, it is a good thing that overall occupancy and rents are stagnant despite prolonged low oil prices. Impacted by the low oil prices, the overall office market is correcting itself, particularly in KL City where most of the oil and gas businesses are located.”

However, the overall office market is expected to remain subdued in the coming quarters.

“Pressure is expected to grow on the occupancy level amid the widening gap between supply and demand. The impending supply is high while demand and the absorption rate are lacklustre. The office market is expected to be more tenant-led with attractive leasing terms as the landlords of existing and newly completed buildings compete to retain and attract new tenants respectively,” says Sarkunan.

“In the coming quarter, high supply and fewer enquiries on office space are anticipated to increase vacancies. More office space is expected to be available for sub-lease as tenants from the O&G and related industries continue to reduce operational cost,” he adds.

In the next quarter, two office towers are expected to be completed in KL City, namely Public Mutual Tower and JKG Tower, while three are slated for completion in KL Fringe, namely Menara Hong Leong (Tower A of Damansara City) in Damansara Heights, UOA Corporate Tower in Bangsar South (formerly Vertical 38) and Signature Offices in KL Eco City. Collectively, these towers are expected to add three million sq ft to the existing stock.

Second quarter review

The Kuala Lumpur office market remained soft with a notable drop in net absorption in 2Q2016.

“Organisations in selected sectors, particularly O&G-related and banking, continue to downsize [in terms of reducing their workforce and/or freezing hiring] due to the challenging operating environment. This is happening despite new take-ups from selected industries, such as information technology, pharmaceuticals, insurance and shared services,” says Sarkunan.

“The limited expansion of existing businesses and new set-ups as well as the lateral movement of tenants collectively led to a notable drop in net absorption.”

This is reflected in the lower net absorption in Kuala Lumpur (about 63,311 sq ft during the quarter), reflecting a sharp contraction of 38.22% quarter on quarter and 79.94% year on year.

“The lack of impetus for growth — in terms of demand — and the prevailing challenging economic, business and property market environment continued to weigh on the subsector. The office markets in KL City, KL Fringe and Beyond KL (Selangor) were subdued during the review period,” says Sarkunan. “The challenge is to entice tenants to relocate to the newly completed buildings.”

In 2Q2016, the cumulative supply of office space in KL City, KL Fringe and Beyond KL (Selangor) stood at 92.7 million sq ft following the completion of Mercu Mustapha Kamal (Tower 2) with 179,800 sq ft of net lettable area (NLA) based on the monitor.

The only purpose-built office building completed in Neo Damansara, it has added its space to an existing supply of 17.9 million sq ft in Beyond KL (Selangor). With no completions in KL City and KL Fringe during the review period, the cumulative supply of purpose-built office space in both regions remained unchanged at 51 million sq ft and 23.8 million sq ft respectively.

Total cumulative office space under construction in KL City, KL Fringe and Beyond KL stood at 16.72 million sq ft in 2Q2016. Supply is projected to increase 18% over the next 2½ years — between 2H2016 and 2018 — with the bulk of new completions in KL Fringe. The cumulative office stock in 2018 is estimated at 109.43 million sq ft.

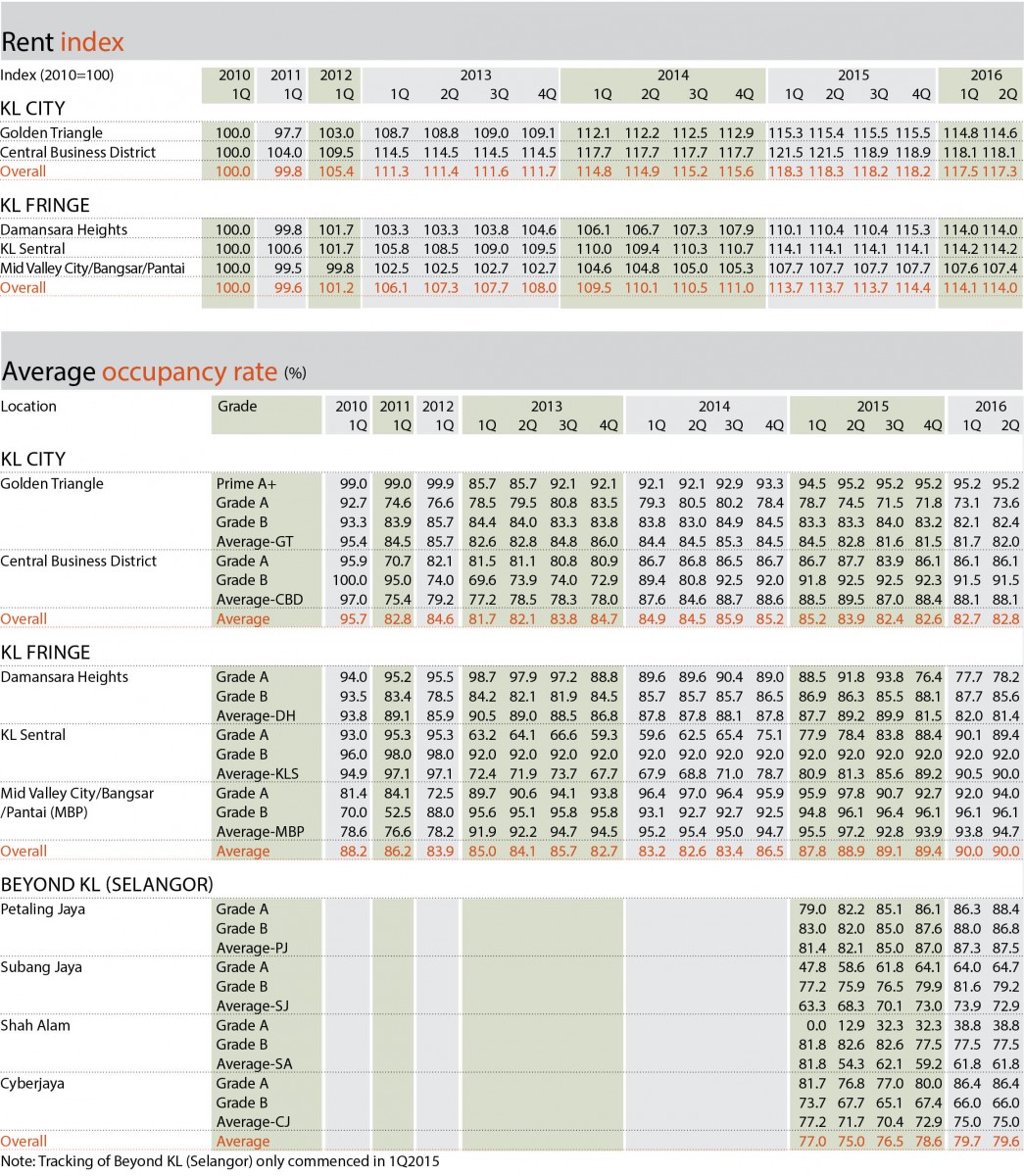

Stable occupancy and rents

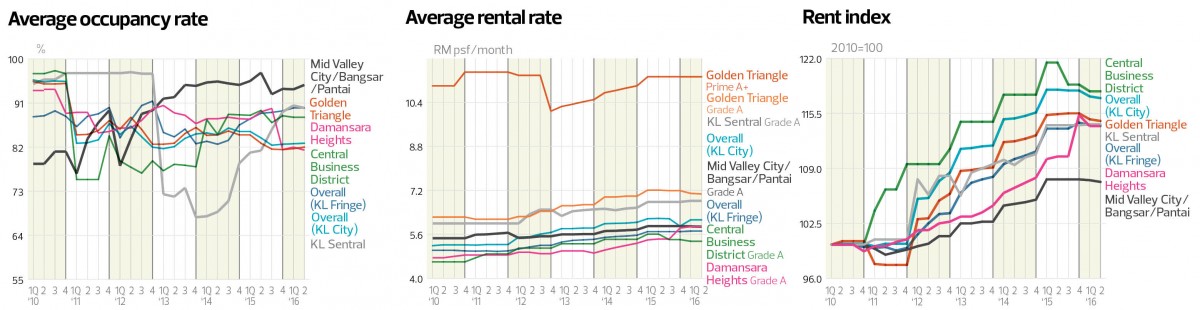

The overall occupancy rate in KL City was stable at 82.8% (+0.2% from 1Q2016). Occupancy in the central business district (CBD) remained unchanged at 88.1% while the Golden Triangle recorded an increase of 0.4% to 82%. “The increase was due to movements at Menara Hap Seng 2,” comments Sarkunan.

Over in KL Fringe, the overall occupancy rate remained unchanged at 90% while in Damansara Heights and KL Sentral, it dipped 0.8% to 81.4% and 0.6% to 90% respectively. Mid Valley City/Bangsar/Pantai experienced a 1% quarter-on-quarter increase to 94.7%.

Sarkunan considers Damansara Heights an up-and-coming location, thanks to the nearly completed Damansara City project by Guocoland and the ongoing redevelopment of Pusat Bandar Damansara by Pavilion Group and its JV partner (Canada Pension Plan Investment Board). The presence of the Semantan and Pusat Bandar Damansara mass rapid transit stations, which translates into improved accessibility and connectivity, also augurs well for the office market in the location.

KL Eco City, the integrated development next to Mid Valley City, is also expected to become a major office location in KL Fringe after its scheduled completion in 2016/2017. Besides seven office buildings — six purpose-built and one stratified — the project also features three high-rise residential blocks and one serviced apartment block, says Sarkunan.

At Beyond KL (Selangor), the overall occupancy rate held steady at 79.6% in 2Q2016 while it rose 0.1% to 87.5% in Petaling Jaya.

“The average occupancy rate in the Petaling Jaya commercial district recorded a slight decline in 2Q as several tenants moved out of Jaya 33 and Menara AmFirst. However, there was little movement of notable tenants at The Ascent @ Paradigm in the Ara Damansara/Tropicana/Kelana Jaya area, propping up overall occupancy in the Petaling Jaya locality,” says Sarkunan.

In Subang Jaya, the occupancy rate declined 1.4% to 72.9% in 2Q. “Similarly, with several tenants vacating their space in Wisma Consplant and Menara Summit, the overall occupancy rate in Subang Jaya declined marginally,” Sarkunan adds. Occupancy rates in Shah Alam and Cyberjaya were unchanged at 61.8% and 75% respectively.

“The UOA Business Park in Shah Alam, formerly known as Kenchana Square, is a mixed-use development comprising nine blocks of boutique offices and a row of retail shops. With Federal Highway frontage and direct access to the Subang Jaya light rail transit and KTM stations, the project is anticipated to become a major office location similar to Bangsar South,” says Sarkunan.

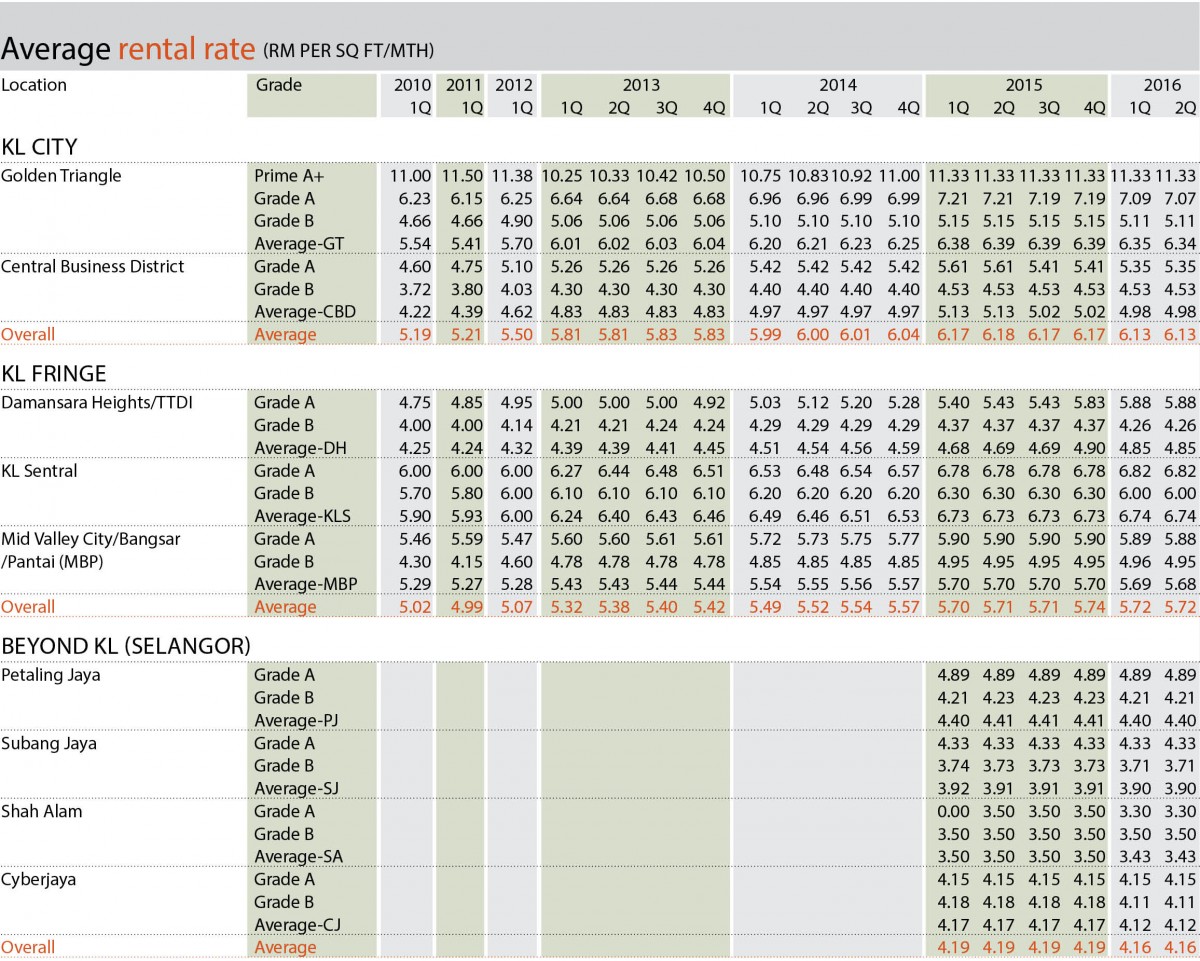

Office rents in Kuala Lumpur remained steady despite downward pressure. They were unchanged at RM6.13 psf in KL City, RM11.33 psf in the Golden Triangle Prime A+ and RM5.35 psf in the CBD Grade A. However, there was a decrease of 0.3% to RM7.07 psf in the Golden Triangle Grade A.

In KL Fringe, overall rents remained unchanged at RM5.72 psf. There was also no movement in Damansara Heights Grade A and KL Sentral Grade A (RM5.88 psf and RM6.82 psf respectively). However, Mid Valley City/Bangsar/Pantai Grade A experienced a slight dip of 0.2% to RM5.88 psf.

In Beyond KL, rents did not move from RM4.16 psf while in Petaling Jaya, Subang Jaya, Shah Alam and Cyberjaya, they remained unchanged at RM4.40 psf, RM3.90 psf, RM3.43 psf and RM4.12 psf respectively.

Notable transactions and movements

Encorp Bhd sold a block (Block P) of office suites in Garden Office @ Encorp Strand in Kota Damansara, Selangor, to Koperasi Permodalan Felda Malaysia Bhd. The 47,977 sq ft NLA fetched RM27 million (RM628 psf) in cash plus the Goods and Services Tax. The price was based on a total NLA of 43,002 sq ft (excluding an accessory parcel of 4,675 sq ft).

In Menara Shell in Jalan Tun Sambathan, Kuala Lumpur, NLA of 557,053 sq ft was transacted at RM640 million (RM1,149 psf). 348 Sentral Sdn Bhd had entered into a conditional sales and purchase agreement with Maybank Trustees Bhd on the proposed disposal in June.

In KL City, 30,000 sq ft was taken up at Menara Hap Seng 2 due to an expansion by Mitsui & Co while at Menara Darussalam, the management of Grand Hyatt Hotel took up 10,900 sq ft.

In Beyond KL, Bayer Co (M) Sdn Bhd and Roche Diagnostics (M) Sdn Bhd took up a total of 41,000 sq ft at The Ascent @ Paradigm.

Also in 2Q2016, China’s Hytera Communications unveiled its Malaysian office in Tower A of Vertical Business Suites in Bangsar South while Denmark’s Sanovo Technology Group opened a new office in Menara OBYU in Selangor.

Notable announcements

In KL City, Tropicana Corp Bhd disposed of Dijaya Plaza in Jalan Tun Razak to Kenanga Investment Bank Bhd for RM140 million cash. The asset comprises a freehold parcel of about 3,674 sq m and a 19-storey office tower with two levels of basement parking (322 bays).

Mulia Property Development Sdn Bhd, the property arm of Mulia Group, will be building its Signature Tower in Tun Razak Exchange. The 92-storey tower with a gross development value (GDV) of RM3.5 billion will be among the top 15 tallest buildings in the world when completed in 2018. With gross and NLA of four million

sq ft and 2.65 million sq ft respectively, the tower offers column-free floors with a typical floor plate of 34,000 sq ft, the largest configuration of column-free floor space in the city.

Eco World Development Group Bhd has unveiled its Bukit Bintang City Centre mixed-use development. The group has received positive response from buyers of The Stride, a 45-storey block with strata offices targeted at small and medium enterprises.

In KL Fringe, IJM Land Bhd will reveal its first commercial development in Pantai Sentral Park in Bukit Kerinchi, Kuala Lumpur, by year end. With a GDV of about RM500 million, it will comprise a 30-storey office tower and 36-storey block of serviced apartments. The office tower will house IJM’s future corporate headquarters. IJM Tower will also comprise retail components (including F&B outlets), which will be retained by the group, to cater for the working population as well as the residents in the future.

This article first appeared in City & Country, a pullout of The Edge Malaysia Weekly, on Oct 3, 2016. Subscribe here for your personal copy.

TOP PICKS BY EDGEPROP

Kota Kemuning [BEST BUY RESORT THEMED CONDO!] 4R2B Big Balcony

Kota Kemuning, Selangor

Kota Kemuning [SUPER WORTH BIG CONDO 4R2B]

Kota Kemuning, Selangor

STOP! LOOK HERE! Get Dream House Here!

Kota Kemuning, Selangor

Kota Kemuning New Launch Resort Themed Condo 4 bedroom! Limited unit!

Kota Kemuning, Selangor

Seksyen 25, Shah Alam (Taman Sri Muda)

Shah Alam, Selangor

Country Heights Kajang

Country Heights, Selangor

Kawasan Perindustrian Klang Utama

Klang, Selangor

Taman Taming Indah 2

Bandar Sungai Long, Selangor

Balakong Jaya Industrial Park

Balakong, Selangor