Econpile Holdings Bhd (Sept 28, RM1.72)

Maintain buy with target price (TP) of RM2.02: We revise our financial year 2017 (FY17) and FY18 earnings forecast higher by 16.3% to RM83.2 million, and by 26.2% to RM96.6 million respectively, following an upward revision in our job win assumption to RM800 million from RM400 million earlier.

While the number of ongoing property projects in the market is limited due to the gloomy property outlook, we believe the group will still be able to secure projects, given several of its advantages.

Among the property projects near finalisation are Pusat Bandar Damansara (Pavilion Damansara), and residential properties in Sungai Besi and Jalan Pudu. These projects are expected to be awarded within the next month.

Infrastructure projects, namely KVMRT Line II, LRT 3, Suke and DASH are still high in the group’s to-do list. The group is now finalising commercial terms with AZRB for the KVMRT Line II project under package V202. According to management, it would be awarded in a month’s time.

We reiterate our “buy” recommendation on Econpile with a new TP of RM2.02 based on industry average price-earnings ratio of 13 times over FY17 earnings per share. — BIMB Securities Research, Sept 28

Try out one of our super tools, the rental yield calculator, here.

This article first appeared in The Edge Financial Daily, on Sept 29, 2016. Subscribe to The Edge Financial Daily here.

TOP PICKS BY EDGEPROP

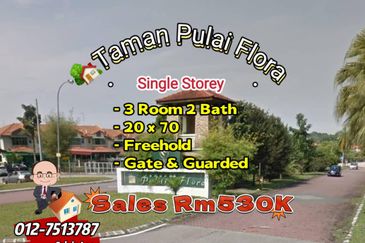

Tate Dalton @ Eco Botanic 2

Iskandar Puteri, Johor

Flat Tasek 64, Bandar Baru Seri Alam

Masai, Johor

Prima Regency (Dorchester Court)

Plentong, Johor

Taman Bukit Indah @ Iskandar Puteri

Johor Bahru, Johor

Taman Bukit Indah @ Iskandar Puteri

Johor Bahru, Johor