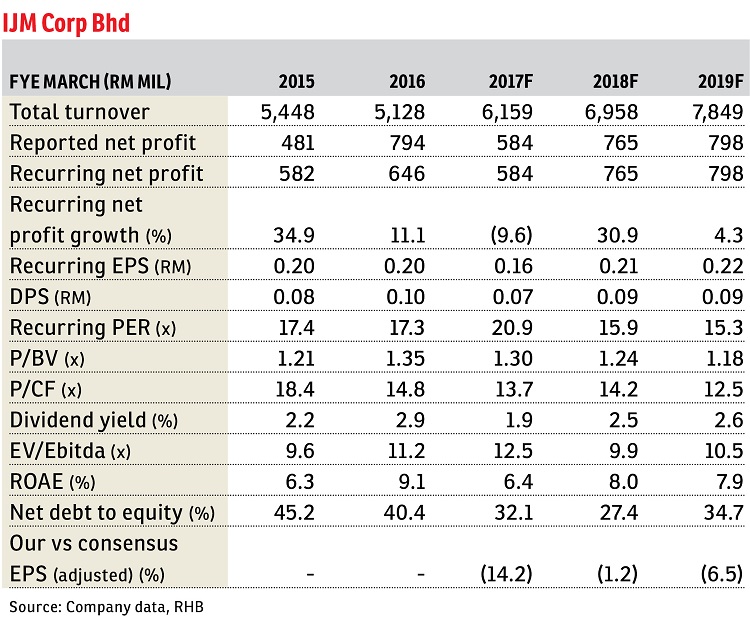

IJM Corp Bhd (Aug 25, RM3.43)

Maintain buy with a lower target price (TP) of RM3.81: A record RM8.5 billion outstanding construction order book should keep IJM Corp Bhd busy for the next five years.

Nonetheless, the company continues to bid for new jobs, while being selective in doing so. The group also enjoys a consistent income stream from its toll road concessions.

While the moratorium imposed on bauxite mining in Pahang dented Kuantan Port’s financial performance in the first quarter ended June 30, 2016 (1QFY17), and led to IJM’s earnings falling short of ours and the street’s estimates, we expect throughput to eventually recover after the second half of FY17 as the mining ban ends on Sept 14.

After trimming our port and plantation estimates, we cut our FY17 to FY19 earnings forecasts by 0.7% to 14.7% respectively.

Key risks include: i) an extended moratorium on bauxite mining in Pahang that could impact Kuantan Port’s throughput and earnings; ii) delays and cost overruns arising from construction jobs; and iii) a prolonged slowdown in the property market.

We continue to like IJM for its strong earnings visibility, underpinned by a record construction order backlog and consistent income stream from its toll road concessions.

Furthermore, throughput at Kuantan Port may eventually recover as the moratorium ends on Sept 14.

Taking into account our latest earnings revisions and in-house weighted average cost of capital revisions after a cut in the overnight policy rate by Bank Negara Malaysia, our sum-of-parts-derived TP is lowered slightly to RM3.81, from RM3.82. — RHB Research Institute, Aug 25

This article first appeared in The Edge Financial Daily, on Aug 26, 2016. Subscribe to The Edge Financial Daily here.

TOP PICKS BY EDGEPROP

Medan Idaman Business Centre

Setapak, Kuala Lumpur

Taman Sri Putra, Sungai Buloh

Sungai Buloh, Selangor

HiCom-Glenmarie Industrial Park

Shah Alam, Selangor