- EdgeProp editorial and branding head Jacqueline Lim: Penang’s residential overhang steadily eased from 5,493 units in 2020 to 2,069 units in 2024, reflecting a gradual absorption of unsold stock.

GEORGE TOWN (Sept 18): The Penang property market is showing signs of stabilisation after the post-pandemic rebound, with both transaction volume and value holding steady.

"Transaction volume in 2024 (18,122 units) was slightly lower than in 2023 (18,663 units), but the total transaction value in 2024 increased to RM8.374 billion, up from RM8.207 billion in 2023. This indicates that while fewer properties were sold, the average price of each property rose,” said EdgeProp editorial and branding head Jacqueline Lim in her presentation: “Insights from EdgeProp EPIQ: Penang’s Property Market Towards 2030” at the Malaysian Property Development Process (MPDP) (Penang Edition) held at Eastern & Oriental Hotel in Penang last week.

Overhang declining

Lim also highlighted that overhang was trending down.

Read also:

MPDP (Penang Edition): Developers urged to rethink strategies in selling bumi lots

“Penang’s residential overhang steadily eased from 5,493 units in 2020 to 2,069 units in 2024, reflecting a gradual absorption of unsold stock,” she noted.

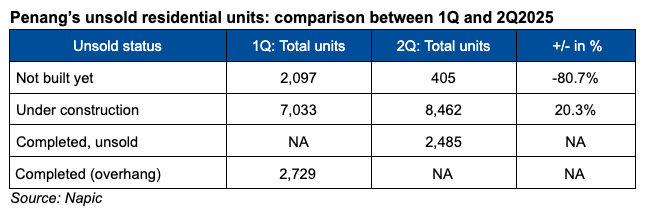

More recently, based on National Property Information Centre (Napic)’s available data up to 2Q2025, Penang’s unsold stock appeared to be at manageable levels.

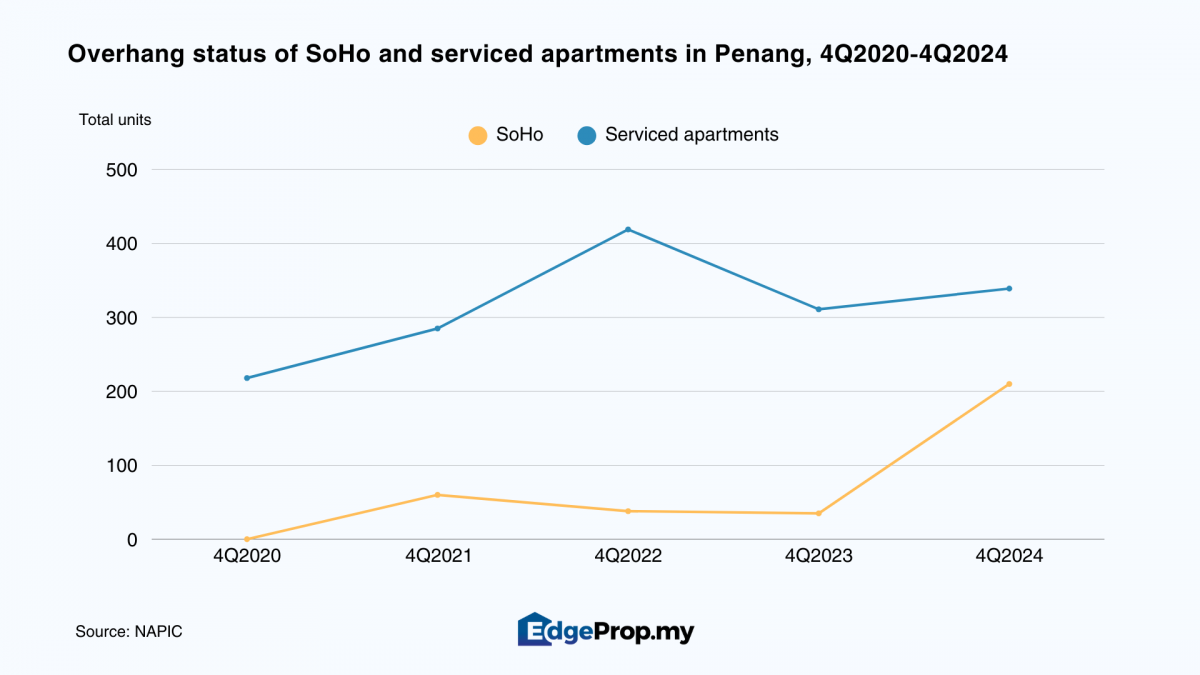

Meanwhile, the overhang numbers of SoHo (Small office, Home office) and serviced apartments units, which are categorised under the commercial segment, increased from 2023 to 2024, but the figures are considered small as of 4Q2024 (210 for SoHo and 339 for serviced apartments).

“Meanwhile, as of 2Q2025, the unsold completed SoHo and serviced apartments stood at 985 and 309 units respectively. This is not overhang, which is defined as properties that remain unsold more than nine months after receiving their Certificates of Completion and Compliance (CCC). Hence, the real test is whether the market clears this stock by 4Q2025.

“On top of that, one should look further into the overhang data, such as identifying if there are certain projects that account for bigger portions to it,” she added.

Overall, Lim opined that the Penang residential market remains robust, underpinned by major catalysts such as the Penang LRT (Mutiara Line), which has driven a high percentage of new high-rise residential launches on the island. Medical tourism is also a significant economic booster, with Penang being a top destination for medical tourists, especially from Indonesia.

According to EdgeProp’s recent special report, Penang Investing Towards 2030, more than 130 projects are expected to be completed from 2025 to 2029.

Regulatory compliance key to faster approvals

On the regulatory side, Penang Island City Council (MBPP) One-Stop Centre (OSC) chief Basri Basir stressed that attention to detail at the submission stage is critical.

“From planning permission to building plan approval, developers must ensure every supporting document is in order.

“Missing reports or incomplete paperwork are the main reasons for delays,” he told EdgeProp.

He added that miscommunication between developers, their appointed principal submitting persons (PSPs) and the technical departments often slows down approvals.

“Sometimes the technical team has already stated clearly what must be done, but PSPs still keep asking, ‘Can we do this?’ even after being told no. That back-and-forth only drags the process,” he said.

Basri stated that it is less about mistakes than about commitment.

“If you genuinely fulfil all requirements, approvals will move quickly. The problem arises when developers try to cut corners.

“We should not break the rules, but within reason, we can adjust to make the process smoother as long as it does not compromise regulations,” he said.

Misinterpreted data leading to product mismatch

Meanwhile, MKH Bhd product research and development manager Dr Foo Chee Hung said developers often misread affordability benchmarks, leading to products mismatched with actual buyer capabilities.

“Household affordability is not just about median income. You need to look at disposable income, debt obligations and spending patterns to understand what buyers can realistically commit to,” he said during his presentation: “Translating Market Insights into Development Opportunities: Understanding Property Data and Industry Trends”.

He added that developers who rely only on headline figures risk producing units that meet policy definitions of affordability but fail to attract buyers on the ground.

Another presenter, Kedah office’s Director of Land and Mines chief assistant director (Development) Puan Nurul Azhani Shaharim spoke on “Navigating Land Matters: Policies, Processes and Practical s Guidance for Property Developers”, outlining key procedures and common pitfalls in land applications.

AJC Planning Consultants principal TPr Julie Chok shared insights in her session: “From Vision to Reality: Translating Master Plans into Market-Ready Development Phases”, focusing on the transition from planning to implementation.

In-depth learning for property industry

The MPDP (Penang Edition) is a two-day executive certification programme organised by the Real Estate and Housing Developers’ Association (Rehda) Institute in collaboration with Sunway University’s Institute of Global Strategy and Competitiveness (IGSC), held on Sept 9 and 10.

Supported by Feruni Ceramiche Sdn Bhd, a tile designer and retailer company; Progressture Solar, a renewable energy solutions provider; and FAR Capital, a property investment consultancy firm; the programme offers in-depth learning for industry stakeholders through sessions led by government representatives, academics and industry leaders.

The next edition, MPDP (Klang Valley Edition), will take place on Sept 24 and 25, followed by Rehda Institute’s annual flagship conference later this year.

As Penang girds itself towards the last lap of its Penang2030 vision, check out how the residential segment is keeping pace in EdgeProp’s special report: PENANG Investing Towards 2030.