- Following the sale, the Hong Leong Bank Bhd (KL:HLBB) chairman's interest in the industrial-focused REIT is estimated to have fallen to 23.86 million units or a 4.51% stake.

KUALA LUMPUR (July 31): Tycoon Tan Sri Quek Leng Chan is no longer a substantial unitholder of AME Real Estate Investment Trust (KL:AMEREIT) following the disposal of 5.5 million units, equivalent to a 1.04% stake, by his investment vehicle Hong Leong Assurance Bhd (HLA).

Following the sale, the Hong Leong Bank Bhd (KL:HLBB) chairman's interest in the industrial-focused REIT is estimated to have fallen to 23.86 million units or a 4.51% stake.

Quek became a substantial unitholder in AME REIT by subscribing to 26.59 million units during its initial public offering on Sept 20, 2022, via HLA and Hong Leong MSIG Takaful Bhd. He subsequently increased his holdings by acquiring an additional 2.77 million units through HLA.

Since its listing, AME REIT has delivered a total return of 55.2%

Quek controls 64.23% of Hong Leong Bank Bhd (KL:HLBANK) via Hong Leong Financial Group Bhd (KL:HLFG), which far exceeds the 10% limit on individual shareholdings in financial institutions.

AME REIT last traded unchanged at RM1.57, valuing the trust at RM830 million. Its portfolio comprises 39 properties, including 36 industrial assets and three dormitories.

Does Malaysia have what it takes to become a Blue Zone, marked by health and longevity? Download a copy of EdgeProp’s Blueprint for Wellness to check out townships that are paving the path towards that.

TOP PICKS BY EDGEPROP

Taman Perindustrian Desa Cemerlang

Ulu Tiram, Johor

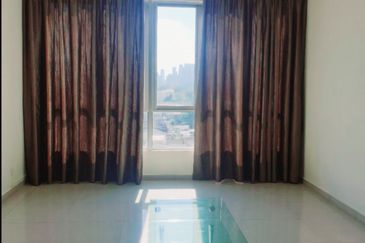

The Gardens Residences

Mid Valley City, Kuala Lumpur

The Gardens Residences

Mid Valley City, Kuala Lumpur

Taman Sri Putra, Sungai Buloh

Sungai Buloh, Selangor

Taman Impian Indah, Sungai Buloh

Sungai Buloh, Selangor

Taman Sri Putra, Sungai Buloh

Sungai Buloh, Selangor

Aradia Residence @ Lake City

Batu Caves, Selangor

Taman Impian Indah, Sungai Buloh

Sungai Buloh, Selangor

Taman Bukit Rahman Putra

Sungai Buloh, Selangor

.jpg?4CjoVxShXkpBIdSi209pUytpwkZNqceD)