- Further enhancing Johor’s appeal is the highly anticipated opening of the Rapid Transit System (RTS) linking Johor and Singapore by the end of 2026.

KUALA LUMPUR (Jan 17): The long-awaited transformation of Johor into a key investment hub is “finally happening” after a couple of “false dawns”, says Jefferies.

In a note on Friday, the rapid development of the data centre industry, coupled with strategic infrastructure projects, is now placing Malaysia back on the radar of dedicated emerging market (EM) investors.

“The latest economic data continues to confirm the upturn in an investment cycle driven in part by an AI-related [artifical intelligence] theme, namely, the construction of data centres primarily in southern Johor close to Singapore to take advantage of cheap land and cheap energy,” it said.

“Among Malaysia’s attractive features are adequate water resources, which is important for cooling purposes, and stable geology from the standpoint of earthquake risk,” it said.

“The power tariff is also highly competitive,” said the "Greed & Fear" publication by Jefferies, a full-service investment banking and capital markets firm based in the US.

In the first nine months of 2024 alone, Malaysia's national utility firm Tenaga Nasional Bhd (KL:TENAGA) reported supplying electricity to eight new data centre projects with a combined maximum demand of 1.1 gigawatts (GW) once fully developed.

This is on top of the nine projects that were completed prior to 2024, which contributed a total capacity of 0.6GW. The momentum continues with another eight data centres currently under construction, expected to add a total capacity of 1.9GW, it said.

“The macro positive is resilient domestic demand based on the booming investment cycle.

“CIMB, Jefferies’ Malaysian research partner, expects private investment to remain strong in 2025 in the context of forecast 5% real GDP growth. Malaysia, with its combination of cheap educated labour and land and quality infrastructure, remains an obvious location for “China Plus One” investments, be it data centres in Johor or a growing semiconductor hub in Penang,” it said.

For Johor, its attractiveness is bolstered by its proximity to Singapore, with its favourable cost arbitrage, particularly driven by the relatively lower cost of operations compared to the more expensive Singaporean market.

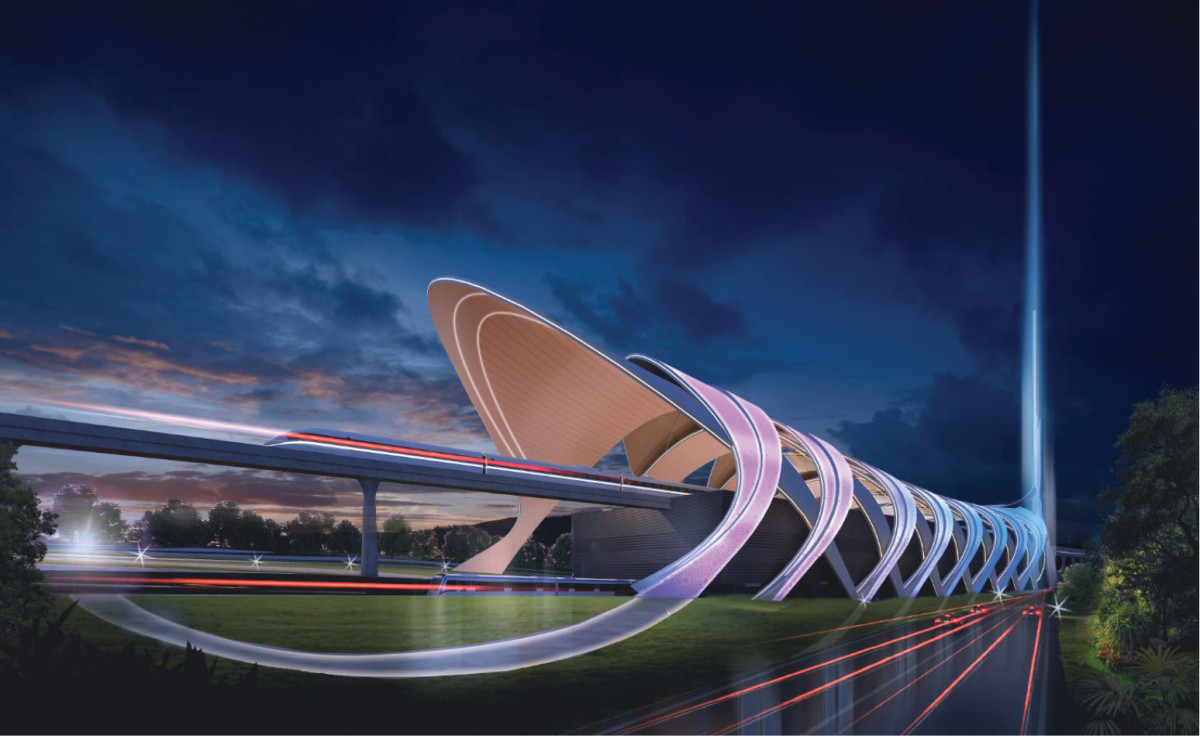

Further enhancing Johor’s appeal is the highly anticipated opening of the Rapid Transit System (RTS) linking Johor and Singapore by the end of 2026.

The RTS, which promises to cut travel time between the two locations to just 15 minutes, is expected to significantly improve cross-border connectivity.

With the infrastructure 95% complete, the RTS is projected to carry up to 10,000 passengers per hour in each direction, further boosting Johor's economic and technological relevance.

In line with these developments, the Johor-Singapore Economic Zone (JS-SEZ), a strategic initiative in the region, is set to create 20,000 skilled jobs within the first five years of its operation.

However, despite this positive momentum, foreign ownership of Malaysia’s stock market remains limited, it said.

“Foreigners still own only 19.7% of the stock market as at the end of last year, near an all-time low of 19.5% reached in December 2023,” it said.

EdgeProp.my is currently on the lookout for writers and contributors to join our team. Please feel free to send your CV to [email protected]

Looking to buy a home? Sign up for EdgeProp START and get exclusive rewards and vouchers for ANY home purchase in Malaysia (primary or subsale)!

TOP PICKS BY EDGEPROP

Regent Garden @ Eco Grandeur

Bandar Puncak Alam, Selangor

Taman Perindustrian Desa Cemerlang

Ulu Tiram, Johor

Taman Mount Austin Commercial

Johor Bahru, Johor

Pelangi Heights Condominium Phase 2

Klang, Selangor