- “We still see trading opportunities in the stock considering the potential for more contract wins and monetisation news flow. Key catalysts include contract wins.”

KUALA LUMPUR (Aug 20): Shares of IJM Corp Bhd (KL:IJM) rose to their highest in more than two weeks after the construction company announced that it had secured two contracts worth RM561 million.

IJM rose as much as 20 sen or over 6% to RM3.40, its highest since Aug 2, 2024. At 10.30am, the stock was trading at RM3.30, giving the company a market capitalisation of RM12 billion. Trading volume totalled 8.79 million shares so far.

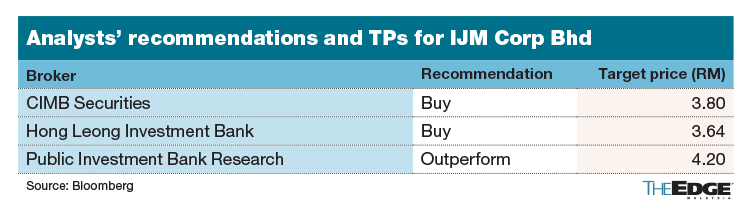

Hong Leong Investment Bank (HLIB) maintained its "buy" call with an unchanged target price (TP) of RM3.64 in line with IJM’s big-cap peer amid stronger prospects.

“We still see trading opportunities in the stock considering the potential for more contract wins and monetisation news flow. Key catalysts include contract wins,” it said in a note on Tuesday.

The research house also noted the company’s RM508 million contract for two data centre buildings in Gelang Patah, Johor, awarded to a Woh Hup Malaysia-IJM Construction JV.

“Building 1 is scheduled for completion in 3QCY2025 and Building 2 in 1QCY2026,” it added.

Furthermore, IJM secured a RM307 million contract for an electrical and electronics (E&E) manufacturing and warehousing facility in Batu Kawan from a US-based company.

“The project will commence on Aug 24 and be completed by Oct 25. The 560k sq ft facility will sit within a 20-acre plot within the much larger technology park,” HLIB said.

Order book reaches RM7.9 bil

Both Public Investment Bank and HLIB commented on the group’s order book, highlighting IJM's expanding construction portfolio.

Public Investment noted a 7.7% rise in project value to RM7.9 billion in IJM’s order book and maintained an "outperform" call with a TP of RM4.20.

"The group’s outstanding orderbook in hand rose by 7.7% to RM7.9 billion. Assuming a low teens profit margin, we expect this (data centre) contract to contribute about RM17.1 million or 2.8% in net profit per annum on average, from FY2025-2026F, based on certain levels of work completion each year," said Public Investment.

Similarly, HLIB pointed out IJM's robust order book, signalling a strong future project pipeline.

At the time of writing, IJM’s share price rose 7 sen or 2.19% to RM3.27, valuing the group at RM11.96 billion.

Looking to buy a home? Sign up for EdgeProp START and get exclusive rewards and vouchers for ANY home purchase in Malaysia (primary or subsale)!

TOP PICKS BY EDGEPROP

Bandar Bukit Tinggi

Bandar Botanic/Bandar Bukit Tinggi, Selangor