- Immediate past MIEA president Chan Ai Cheng highlighted the significant opportunity in the market arising from KPKT’s recent proposal to reduce the 100% consent threshold requirement for en-bloc sales.

PETALING JAYA (Feb 1): The recent Malaysian Institute of Estate Agents (MIEA) Property Market 2023 Review & 2024 Outlook provided an insightful look into growth and potential opportunities in the property market nationwide.

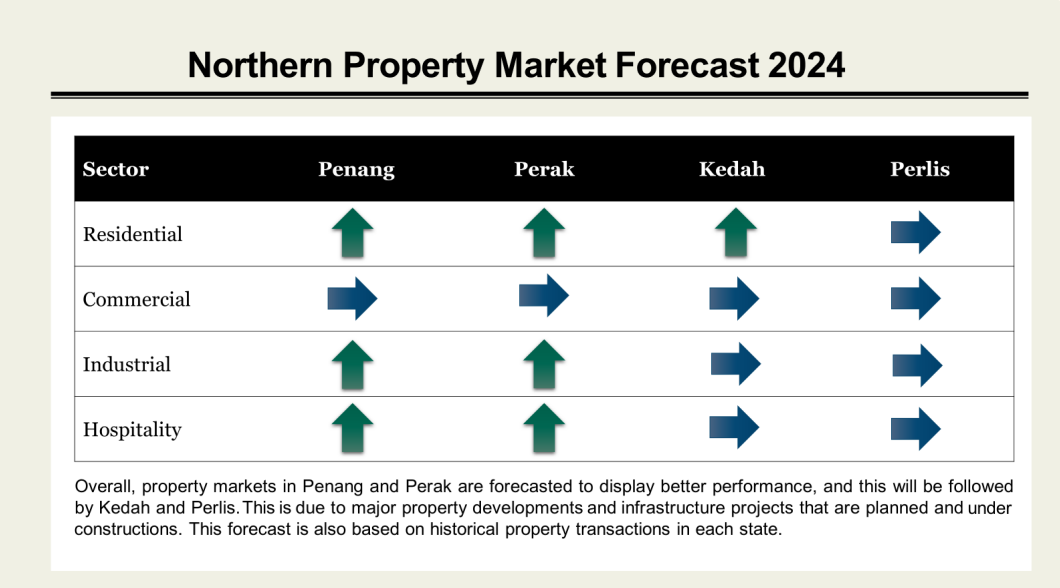

Starting with the northern region, the industrial sector is growing rapidly. Besides key industrial projects such as Perak’s first Halal Industrial Park and another RM1 billion-gross development value (GDV) industrial project to be developed in the state, another 21 major manufacturing investments will take place, mostly in Penang, Perak and Kedah.

“The industrial sector for Penang and Perak will be promising, while Kedah and Perlis will be stable in 2024. Kulim city (in Kedah) however, especially the Kulim Hi-Tech Park area, will be promising because of the spillover from Penang and its industrial activities,” said MIEA Penang branch chairman Long Soo Keat, who presented the “Northern Malaysia Property Market Overview and Forecast 2024”.

The northern region also sees major Infrastructure project developments, including Penang’s first Light Rail Transit (LRT), the expansion of Penang International Airport, Ayer Itam-Tun Dr Lim Chong Eu Expressway bypass, the construction of the new Penang Hill cable car, and West Ipoh Span Expressway construction.

Additionally, Long revealed that the residential sector in Penang, Perak and Kedah is expected to be promising, while Perlis will be stable in 2024. This can be attributed to key drivers such as the extension of the Penang Home Ownership Campaign (HOC) 3.0+ until the end of 2024, ban on short-term rental accommodation on residential premises in Penang island, growing focus on affordable housing in the northern region, and the revamped Malaysia My Second Home (MM2H) programme.

Source: MIEA

Source: MIEA

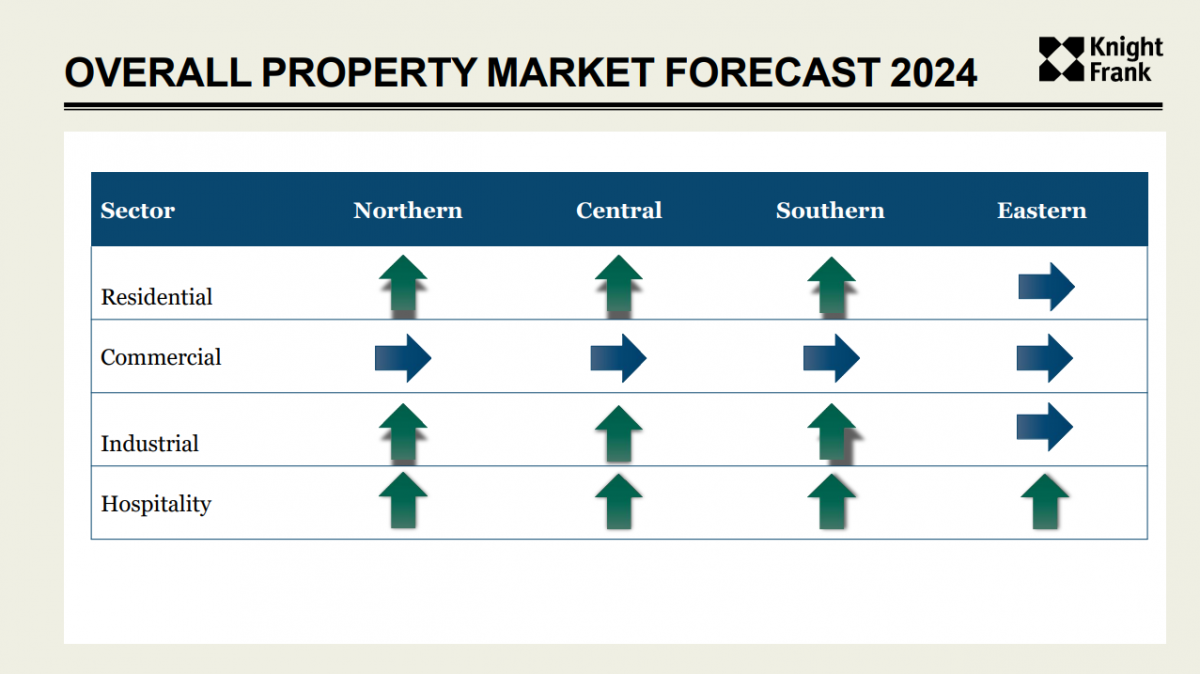

Mega projects reshaping Johor’s landscape

“Johor currently is very happening because of mega projects that are running in the state, especially the Johor Bahru (JB)-Singapore Rapid Transit System (RTS Link), the first cross-border infrastructure project in Malaysia with targeted completion in 2026,” said MIEA member Chia Zi Jin in his presentation on the southern region.

Besides the RTS Link development, another mega project, Wadihana Depot, the future train depot in JB serving the RTS link, is also under construction. Meanwhile, the Johor LRT is a planned infrastructure project encompassing a total length of 30km, 50 stations and three proposed lines with terminal stations situated in Ikea Tebrau, Iskandar Puteri and Senai.

The state also sees a lot of abandoned projects being revived. One of them is the mega project by Greenland Group in Danga Bay, JB, which has been stopped since the Covid-19 pandemic. Chia stated that “MB World Properties Sdn Bhd, one of JB’s local, well-known developers, took over the development rights from Greenland to revive the project”. The mixed-development project spans 17 acres with an estimated GDV of RM2.4 billion.

Other projects that are being revived include abandoned apartment buildings that SKS Group took over to build a mixed-development project and to open the first Sheraton hotel in JB with Marriott International, and abandoned malls such as Danga City Mall, Waterfront City Mall and Pacific Mall JB.

As for the Johor market, with the development of the RTS Link and the recently signed deals for the Johor-Singapore Special Economic Zone (SEZ) between Malaysia and Singapore, the focus has shifted towards the JB city centre, which is a walking distance to the RTS side, Chia noted.

En-bloc sales redevelopment – the cream of the crop

Immediate past MIEA president Chan Ai Cheng, who presented the central region outlook, highlighted the significant opportunity in the market arising from the recent proposal to reduce the 100% consent threshold requirement for en-bloc sales.

“If say 70-80% of the owners agreed, following the Budget 2024 announcement of the relaxation consistent with international standards like Singapore, then there are possibilities for en-bloc sales to developers for redevelopment, especially in the older parts of the very centralised locations. So, for all of you who are doing these kinds of big transactions, I think this is the market for you to really specialise and focus on, and probably be one of the first few that capture the cream of the crop here,” she said.

Additionally, Chan anticipated that with the government’s decision to double up the allocation for the Housing Credit Guarantee Scheme, from RM5 billion in 2023 to RM10 billion in 2024, and guarantee the loans for a total of 40,000 borrowers from the gig economy, this represents another segment that will thrive this year.

She also mentioned that the 3% overnight policy rate (OPR) is very reasonable, as it mirrors the 2019 rate. In regards to the flat 4% stamp duty for foreign buyers that was announced in Budget 2024, she said based on a RM1 million property, the increase is only RM16,000, which she believes is not a major impact on the purchase decision.

Better land and air connectivity in Sarawak

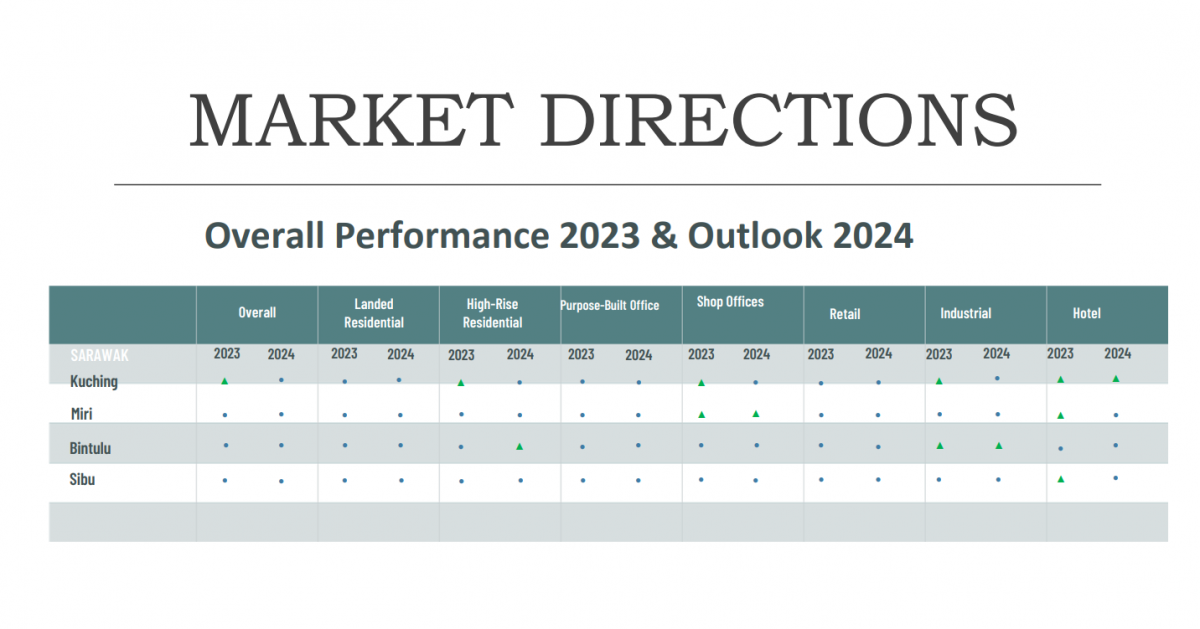

According to MIEA Sarawak chairman Robert Ting, there are rising opportunities in Sarawak with the Pan Borneo Highway Sarawak project.

“Currently, it’s 98% completed and slated to be fully completed by 1Q2024. This will greatly improve our connectivity because Sarawak is considered a big state. With the connectivity improved, more land is available for development especially for agriculture farming, cash crop farming, etc,” he said.

For transportation, Ting stated that the Autonomous Rail Transit (ART) project, running on hydrogen green fuel, is underway in Kuching. It will cover the urban areas, and the first line connecting Kuching to Samarahan is scheduled to be completed by 2026.

As for air connectivity, the Sarawak state announced last year the takeover of Rural Air Services (RAS) from MASWings to ensure affordable and essential flight services and access to all rural and remote areas like Mulu, Bario and Balalang. He said that with the improved air connectivity, there will be more opportunities in trade, business and tourism.

Additionally, Ting noted that the Sarawak state government is aiming towards food security and self-sufficiency, and has recently identified 50,000 hectares of land for paddy cultivation in Sri Aman. There’s also a focus on green fuel energy (hydrogen/sour gas) for the industrial sector.

Source: MIEA

More EV charging stations needed in Sabah

MIEA Sabah branch chairman Stephennie Wong emphasised the need for more electric vehicle (EV) charging infrastructure to support the growing demand for EV in the state. Currently, Sabah only has two EV charging stations.

“To cater for EV needs for the entire Sabah, there’s a demand for the installation of EV charging stations within stratified properties in the future. For commercial and mixed residential developments, we need to incorporate this EV charging station facility as we move towards a cleaner and more sustainable environment in Sabah. So it’s an upcoming market for EV charging stations in Sabah, particularly in our capital city of Kota Kinabalu (KK),” she said.

Additionally, Wong highlighted that the industrial sector has proven to be resilient, experiencing continuous growth since the low point in 2021. With Kota Kinabalu Industrial Park and Sipitang Oil & Gas Industrial Park nearing capacity and limiting potential investors and industrial players eyeing Sabah as their next investment destination, the state government has proposed two new industrial parks as catalysts located in Kimanis and in between Kota Belud and Kota Marudu.

The hotel and retail sectors in Sabah are also seeing new developments. An upcoming Club Med Borneo Kota Kinabalu at Kuala Penyu, which is a 17ha eco-friendly beachfront resort 90 minutes’ drive from Kota Kinabalu International Airport, will inject 400 new rooms.

Additionally, there are the new retail mall in the plan for Tanjung Lipat, including the new Sabah Ports Authority headquarters, and The Cove, a 6.28-acre mixed development with a GDV of RM1.01 billion.

Source: MIEA/ Knight Frank

Looking to buy a home? Sign up for EdgeProp START and get exclusive rewards and vouchers for ANY home purchase in Malaysia (primary or subsale)!

TOP PICKS BY EDGEPROP

Kawasan Perindustrian Balakong

Balakong, Selangor

Balakong Jaya Industrial Park

Balakong, Selangor

Bandar Baru Sungai Buloh

Sungai Buloh, Selangor

Vista Alam Serviced Apartment

Shah Alam, Selangor

Setia City Residences @ Setia City

Setia Alam/Alam Nusantara, Selangor

Setia City Residences @ Setia City

Setia Alam/Alam Nusantara, Selangor