- “I am cautiously optimistic on the Malaysia property market going forward in the short-term perspective.”

- “A range of positive conditions support the market, despite moderately lower economic growth.”

KUALA LUMPUR (Aug 9): The real estate market has been on edge since Bank Negara Malaysia (BNM) announced an unexpected increase of 25 basis points on the overnight policy rate (OPR) on May 3. Much to the relief of many, the OPR rate was maintained at 3% in early July, but an analyst is already foreseeing another hike in the next round of review.

However, despite the spectre of increased lending rates, some property analysts are still optimistic, albeit cautiously, about the real estate market.

“In 2022, despite the OPR being increased four times, with a total hike of 1% from 1.75% to 2.75%, the market still registered the highest volume of transactions, standing at 389,107 transactions, which is the highest ever recorded since 2012,” ESP Global Services Sdn Bhd chief executive officer, who is also Esprit Estate Agent Sdn Bhd managing director, Aldrin Tan, told EdgeProp.my.

He explained that while hikes in the OPR are one of the measures used to manage inflationary pressure, which leads to a higher cost of financing and mortgages, there may also be a short-term effect of increased demand for housing due to anticipation or sentiment of a price hike.

“While we do not have the full data of the volume of transaction for 1H2023, 1Q2023 registered 89,182 transactions. Though it was down by 5.7% from 94,526 in 1Q2022, the volume in 1Q2023 surpassed the pre-pandemic level of 1Q2020 at 72,867, 1Q2019 at 84,424, and 1Q2018 at 79,480.

“Unless there is a further slowdown of momentum in volume of transaction in 2Q2023, we can safely say that based on volume of transactions on 1H to 1H data, we are likely to see 1H2023 perform better than pre-pandemic 1H2020, 1H2019 and 1H2018, and this may likely reflect an overall post-pandemic recovery of the Malaysian property market,” added Tan.

“I am cautiously optimistic on the Malaysia property market going forward in the short-term perspective,” he said.

Home prices likely to grow

Meanwhile, Juwai IQI co-founder and group managing director, Daniel Ho, said the residential property market rebounded strongly in 2022, and “we expect it to show further gains in the remainder of this year”.

“A range of positive conditions support the market, despite moderately lower economic growth. First-time homebuyer purchases have increased, driven by factors such as weddings that were delayed due to Covid-19 closures.

“The full opening of international borders has put Malaysia in the radar of regional and international investments, particular from China. We forecast a home price growth of 1.5% to 4% during the second half of the year compared to a year earlier,” he told EdgeProp.my.

“In 2022, transaction volume climbed by 47% to 42,000, and total transaction value rose by 38% to RM12.8 billion compared to the prior year. For 2023, the official data are not available yet, but Juwai IQI’s internal metrics are all up,” Ho revealed.

“Sales volume is up and prices are inching up on certain property types such as D'Ivo Residences, Mossaz @ Empire City, The Fiddlewoodz @ KL Metropolis, D'Starlingtton. We see more cross-border buyers in Johor, increased demand in Kuala Lumpur and Selangor, and a reduction in the property overhang by as much as 35%, although that varies by state,” he added.

Declining inflation rates raise consumer confidence

As for interest rates and inflation, Ho is of the view that “compared to many other countries, Malaysia has a significant advantage because it has already tamed inflation. BNM was one of the first in Asia to begin raising rates in 2022 and now has lifted the OPR to 3.0%. That means BNM has reversed all the pandemic-era lowering of interest rates. The economy has recovered sufficiently and no longer needs that extra boost”.

"Falling inflation rates improve consumer confidence, and can raise the prospect of stable or lower interest rates. Core inflation fell from 3.1% to 2.9% in the first quarter. We believe inflation has been tamed and will continue to drop moderately in the six months ahead.

“The property market has absorbed the OPR increases without much impact on demand due to strong household finances and employment,” he said.

On the other hand, Tan expects some turbulence ahead as “Malaysia’s GDP (gross domestic product) is also expected to undergo contraction under the Budget 2023 – from 5.6% in 2022, to 5.0% in 2023 and down to 3.2% in 2025, due to global concerns and pressure of inflation”.

To him, a shrinking economy in the near-term outlook will lead to a reduction in consumer expenditure and a lack of confidence, which may affect the property market negatively.

Opportunity to buy

Nevertheless, both Tan and Ho think it is a good time for homebuyers to commit to a purchase over the next six months.

“This is a good market for buyers. While the market has recovered, in most property types, prices are still stable or only slowly increasing. That creates an opportunity to purchase.

“Of course, we always advise buyers to have a good understanding of their finances and to not overstretch themselves. Owning property is the time-honoured way to build financial security and family wealth. Today’s buyers will likely benefit from increased values over the next few years,” Ho said.

Tan agreed, saying, “The property market has been experiencing a soft landing since the peak of 2011/12, and as global economies are rebounding after the pandemic, coupled with a decline in Malaysia's overhang properties and a consistent upward trend in the property market since 3Q2020, it's probable that property prices are pushing upwards.

“Consequently, it might make sense for prospective buyers who have been waiting on the sidelines to take the plunge and commit to a purchase now,” he added.

Looking to buy a home? Discover exclusive rewards and vouchers for your dream home when you sign in to EdgeProp START.

TOP PICKS BY EDGEPROP

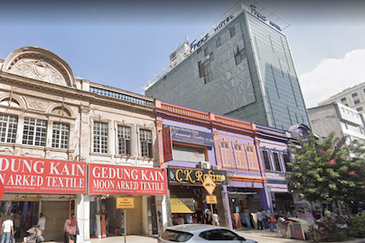

Jalan Tuanku Abdul Rahman

KL City, Kuala Lumpur

Jalan Tuanku Abdul Rahman

KL City, Kuala Lumpur

Damansara Heights (Bukit Damansara)

Damansara Heights, Kuala Lumpur

Pangsapuri Baiduri, Bandar Tasik Kesuma

Beranang, Selangor