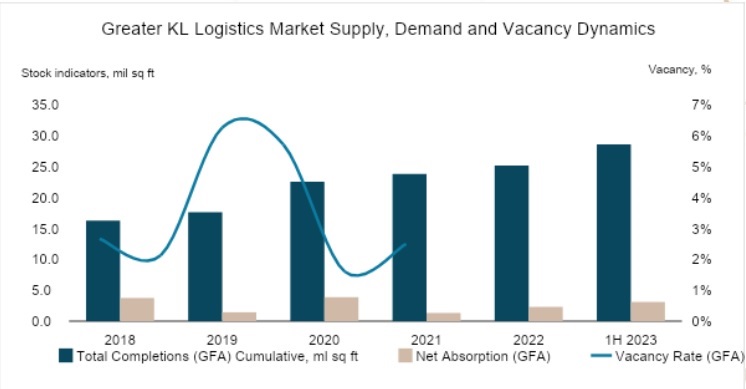

- The demand for warehouse space remains high, with manufacturers being the main drivers as they expand their logistics space.

KUALA LUMPUR (July 28): JLL Property Services (M) Sdn Bhd's latest report, the Greater Kuala Lumpur Property Market Monitor 2Q2023, reveals strong and sustained demand for warehouse space, signaling positive trends for the future.

“We witnessed a dramatic shift in demand for modern warehouses during the pandemic as companies were looking to optimise their supply chain and reduce costs,” JLL shared.

In the first half of 2023, approximately 3.3 million sq ft of modern warehousing space was added to the stock through three completed projects, namely LYL U10 Phase 2 (Lot 5,2A & 6), Bukit Raja Industrial Warehouse (Block A), and Mapletree Seksyen 22. The 14% increase in supply led to a slight vacancy rate growth from 1.6% at the end of 2022 to 2.5% in 1H2023.

In 2H2023, three additional warehouses are expected to be completed, namely E-Metro Logistics Park Metrohub 2, Bukit Raja Industrial Warehouse (Block B), and Bukit Raja Distribution Centre 2. They will contribute to approximately 1.9 million sq ft in total.

The demand for warehouse space remains high, with manufacturers being the main drivers as they expand their logistics space. Additionally, the China Plus One strategy, third-party logistics (3PLs) expansion and space upgrades, and growth sectors like electrical & electronics (E&E), pharma/medical devices, oil & gas, cold chain logistics and automotive subsectors are further driving the demand.

The rental market remains hot, with rents continuously climbing since 2019 due to newly completed projects with more desirable specifications. With the demand for high-quality warehouses along with inflationary pressures, minimum wage hikes, and increasing operational expenses, expect the rental rates to increase in the foreseeable future.

Malaysia’s data centre market experiencing rapid growth

Ongoing and planned data centre projects are expected to triple the live capacity from 195MW to approximately 607MW by 2025. Foreign interest in the market remains strong, with significant investments being announced by Singtel, Bridge Data Centre and NextDC's RM3 billion investment in a 65MW Colocation Data Centre in the fringe of KL.

The Ministry of Transport Malaysia’s (MOT) plan to exempt the cabotage policy on foreign vessels for undersea cable repair work will increase Malaysia’s competitiveness in attracting new foreign investments. Moreover, the Energy Transition Roadmap, scheduled to be launched in phases by Economy Minister Rafizi Ramli, will support the government's structural reforms of the economy.

Singapore, the region’s leading digital hub, is also witnessing new data centre development with the lifting of the data centre moratorium. Reputable companies, namely Equinix, Microsoft, AirTrunk-Bytedance, and GDS, are collaborating to address challenges in energy efficiency, sustainability, and scalability.

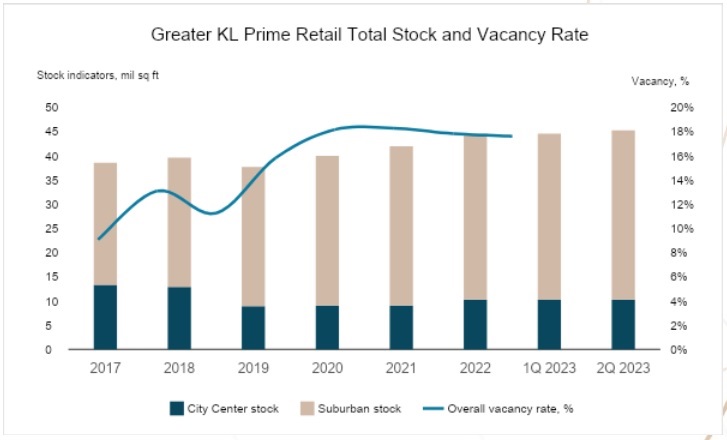

Retail sector showing signs of recovery

In the retail sector, developers are approaching new mall openings cautiously. Only one mall, KSL Esplanade Mall in Klang, was opened in 2023, with a few more expected to open by the end of the year, including Exchange Mall and Pavilion Damansara Heights Mall, contributing to approximately 2.7 million sq ft of net lettable area.

Shopping traffic has returned to pre-COVID-19 level, driven by strong domestic demand. While the industry has seen growth surpassing pre-pandemic volumes, concerns regarding the rising cost of living and future job prospects have affected consumer spending.

The government’s temporary increase in electricity charges for commercial users starting this July is likely to lead to gross rental increase across the entire market. Market rents are gradually recovering but still remain below pre-pandemic levels.

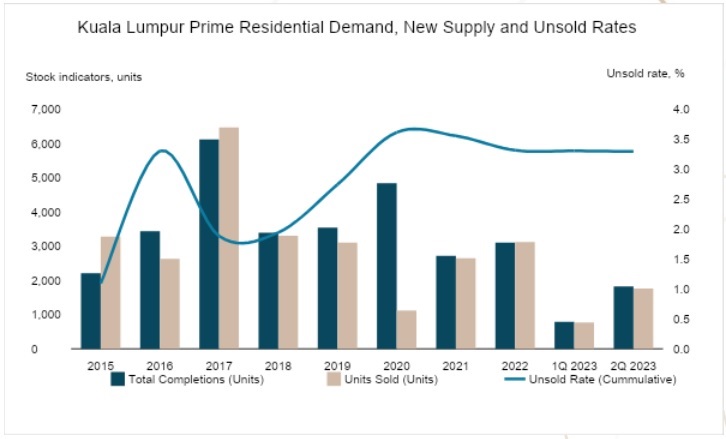

Promising growth in prime residential segment

According to JLL’s findings, the Kuala Lumpur prime residential segment is facing challenges in accelerating delivery of new projects due to increased construction costs and foreign labour issues. While several projects have announced postponed completion dates from 2023 to 2024, the estimated volume of new units to be delivered in 2023 is expected to exceed 5,000 units, a 40% increase from 2022.

The increase in the Overnight Policy Rate (OPR) to 3% has resulted in higher financing costs, which may prompt buyers to reconsider large-ticket purchases. However, foreign buyers continue to support demand while local buyers remain sensitive to economic changes.

Prime residential sale prices experienced a slight improvement by 1.5% in 1Q2023 but dropped by 2.9% in 2Q2023 due to weaker demand from local investors. “Looking ahead, we anticipate market prices to grow moderately, given the high sold units’ ratio for projects expected to be delivered in 2023-2024, implying lower market risks for the new supply,” it reported.

TOP PICKS BY EDGEPROP

Jalan Tuanku Abdul Rahman

KL City, Kuala Lumpur

Jalan Tuanku Abdul Rahman

KL City, Kuala Lumpur

Damansara Heights (Bukit Damansara)

Damansara Heights, Kuala Lumpur

Pangsapuri Baiduri, Bandar Tasik Kesuma

Beranang, Selangor