- Additionally, Low believed that the unchanged OPR is expected to help property developers with financing costs.

KUALA LUMPUR (July 18): MIDF Research remained neutral on the property sector, albeit with a positive bias, following the rebound in the number of loans applied for and approved in May, coupled with the unchanged overnight policy rate (OPR) of 3%.

Loan applications for property purchases rose by 23% month-on-month (m-o-m) in May after a decline of 23% m-o-m in April, according to Bank Negara Malaysia data.

MIDF analyst Jessica Low Jze Tieng attributed the rebound in May to the break in April amid the Hari Raya Aidilfitri festivities.

“The rebound in the loan application and loan approved data in May 2023 is slightly positive to the property sector as it signals demand for property remains supported while new property sales outlook for developer is expected to be better,” Low said in a note on Tuesday (July 18).

On a yearly basis, loan applications jumped by 18% year-on-year (y-o-y), raising the cumulative value loan applications to RM246.5 billion (up 4.3% y-o-y) in the five months of 2023 (5MFY2023).

“The higher total loan application in 5MFY2023 indicates better demand for property. Nevertheless, buying interest on the property could be dampened slightly as BNM increased overnight policy rate (OPR) by 25 basis points (bps) to 3% in May 2023,” she said.

However, BNM maintained OPR at 3% in July 2023, which gives short-term relief to the property sector.

“The unchanged OPR is positive to the property sector as buying sentiment is expected to remain healthy without a hike of OPR. Note that higher OPR would raise financing cost of housing loans and hence dampen buying interest on the property,” she said.

Additionally, Low believed that the unchanged OPR is expected to help property developers with financing costs.

“Financing cost for property developers is expected to remain stable in the near-term as some of the developers have considerable high exposure to floating rate debt,” she noted.

Meanwhile, analysts highlighted that the KL Property Index outperformed the FBM KLCI in the first half of 2023 (1HFY2023), registering a gain of 7.6% against KLCI’s losses of 7.9%.

“Property counters saw stronger trading interest following the pause in OPR hike by BNM in January 2023 and March 2023 as a pause in OPR is expected to support buying interest on properties.

“Besides, we think that the declining residential overhang in the first quarter of 2023 (1QFY2023) following the reopening of country borders helped support sentiment on property stocks,” she explained.

The top five performers of property counters in 1HFY2023 are Ewein Bhd, gaining 210%, followed by Yong Tai Bhd (up 113%), Seal Inc Bhd (up 96%), Tanco Holdings Bhd (up 72%) and Eco World International Bhd (up 54%).

MIDF Research’s top picks for the property sector are Mah Sing Group Bhd with a “buy” call and a target price (TP) of 78 sen and Glomac Bhd (buy, TP: 43 sen).

“We like Mah Sing due to its strategy of focusing on building affordable homes. Besides, its recent active land banking exercise should support new sales and earnings growth in the near term.

"We are also positive for Glomac as we see a better earnings outlook in FY2024 which will be driven by higher progress billing. Besides, new sales prospect is better for FY2024 due to launches of key projects in Puchong and projects in its townships,” she added.

TOP PICKS BY EDGEPROP

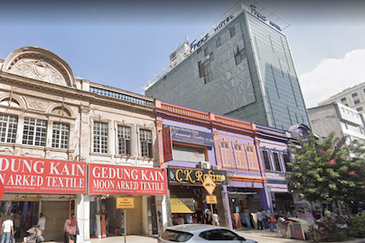

Jalan Tuanku Abdul Rahman

KL City, Kuala Lumpur

Jalan Tuanku Abdul Rahman

KL City, Kuala Lumpur

Damansara Heights (Bukit Damansara)

Damansara Heights, Kuala Lumpur

Pangsapuri Baiduri, Bandar Tasik Kesuma

Beranang, Selangor