- SkyWorld Capital is the funding vehicle of parent SkyWorld Development Bhd (SkyWorld) to undertake the sukuk issuance. SkyWorld has extended an irrevocable and unconditional guarantee on the programme.

KUALA LUMPUR (Feb 1): MARC Ratings has assigned preliminary ratings of AIS(cg)/MARC-1IS(cg) to SkyWorld Capital Bhd’s proposed RM300 million Islamic medium-term notes (MTN)/commercial papers programmes with a stable outlook.

SkyWorld Capital is the funding vehicle of parent SkyWorld Development Bhd (SkyWorld) to undertake the sukuk issuance. SkyWorld has extended an irrevocable and unconditional guarantee on the programme.

MARC in a statement on Jan 31 said the assigned ratings incorporate SkyWorld’s strong take-up rates and healthy operating margins due to a focused strategy of embarking on projects within populous urban areas that mitigates demand risk.

“Moderating the ratings are the weakening outlook on the domestic property market and SkyWorld’s highly leveraged balance sheet with its debt-to-equity (DE) ratio of 0.95 times as at June 2022 (1QFY2023).

“In assigning the rating, MARC Ratings has factored in a potential decline in the DE ratio to 0.6 times on an expected increase in total equity by the end [of the first half of 2023 (1H2023)],” it said.

The rating agency said SkyWorld is relatively a new player in the domestic property industry, with its maiden project, SkyArena, a RM2.3 billion master development project on about 30 acres of land in Setapak, Kuala Lumpur, launched in 2014.

The project comprises high-rise residential projects and a commercial-cum-retail centre; of these, two residential blocks (Phase 1 and 2) have been completed. Phase 3 comprising another high-rise residential development is upcoming and slated for completion in 2027 while Phase 4 consisting of a commercial-retail centre is targeted to be launched in 2026.

SkyWorld’s other category of development is the SkyAwani projects comprising affordable units under the government’s affordable housing programme known as the “Residensi Wilayah Keluarga Malaysia”. As of date, SkyWorld has completed three of its five SkyAwani projects with a total gross development value (GDV) of RM1.31 billion comprising 3,839 residential units and 162 commercial units. SkyAwani IV and SkyAwani V are currently ongoing and carry a combined GDV of RM723.2 million. SkyAwani IV is slated for completion in 2023 and SkyAwani V in 2024.

As at end-June 2022, SkyWorld’s ongoing projects with a combined GDV of RM2.3 billion recorded an average take-up rate of 89.9%.

The rating agency notes that with sizeable unbilled sales of RM1 billion, SkyWorld has earnings visibility over the medium term. Its land bank of 60.1 acres in urban and suburban areas in Kuala Lumpur would provide development opportunities for high-rise projects.

For the financial year 2022 (FY2022), SkyWorld’s revenue rose sharply year-on-year to RM790.4 million from RM488.8 million, following the accelerated completion of projects; this was on resumption of economic activities following the easing of pandemic-induced restrictions.

SkyWorld’s operating profit margin of around 20% is commendable given its present focus on the affordable and medium-priced segments. Its unsold inventory stood at a manageable level of RM96.3 million. Total borrowings stood at RM399.5 million as at end-2QFY2023.

TOP PICKS BY EDGEPROP

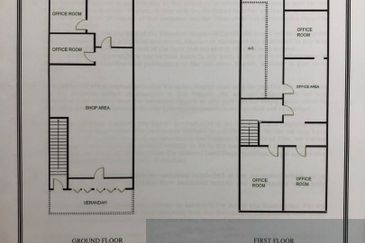

Medan Idaman Business Centre

Setapak, Kuala Lumpur

Taman Sri Putra, Sungai Buloh

Sungai Buloh, Selangor

HiCom-Glenmarie Industrial Park

Shah Alam, Selangor

Muara Tabuan Light Industrial Park

Kuching, Sarawak

METROCITY SQUARE SOHO APARTMENT

Sarawak, Sarawak