KUALA LUMPUR (March 22): The Central Boulevard in Singapore, which is slated to be completed next year, could generate RM350 million to RM450 million in rental income a year for IOI Properties Group Bhd, based on a conservative rental rate of S$10 (RM31.01) to S$11 per square feet, according to RHB Research.

In a note on Tuesday (March 22), the research house said it is optimistic on the rental prospects of this asset as quality office space is highly sought after with the expansion of regional technology/telecommunication sectors in recent years.

Management also indicated that the initial response for leasing looks quite promising, it said.

“This should form a good earnings base for the company to raise its dividend payout in the future.

“Despite stable earnings growth, IOI Properties did not enjoy a sustainable share price recovery similar to its peers.

“The company is also a beneficiary of the reopening of the economy as earnings from its property development and property investment should normalise back to pre-pandemic levels,” it said.

Meanwhile, the research house said that during its recent virtual meeting, IOI Properties chief executive officer Datuk Voon Tin Yow indicated that the company is prepared to ride through this volatile period, given its diversified products and geographical locations, as well as contribution from investment properties.

“However, management was guided to be extra careful with the timing of the launches given heightening building material prices,” it said.

On the Home Ownership Campaign, the group expects property sales in Malaysia to be softer in the January-March quarter given the expiry of the campaign in December last year.

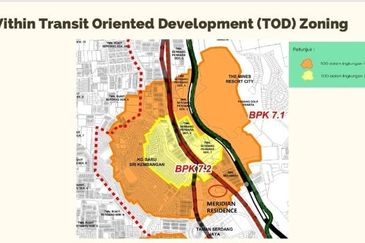

RHB Research also reckoned that IOI City Mall Phase Two will open in the second half of the year, and it estimates that Phase Two will contribute approximately RM30 million to RM40 million in rental income to the group during the initial years of operation.

The research house has set a target price of RM1.38 and maintained its “buy” call on the group, based on an unchanged 65% discount to revalued net asset value (RNAV).

At the time of writing on Tuesday, shares in IOI Properties traded unchanged at RM1.01, valuing the property group at RM5.56 billion.

Edited by Surin Murugiah

Get the latest news @ www.EdgeProp.my

Subscribe to our Telegram channel for the latest stories and updates

TOP PICKS BY EDGEPROP

Semenyih Integrated Industrial Park

Semenyih, Selangor

Kawasan Perindustrian Nilai 3

Nilai, Negeri Sembilan

Taman Perindustrian Kip

Kuala Lumpur, Kuala Lumpur

Kampung Baru Seri Kembangan

Seri Kembangan, Selangor

Kawasan Perindustrian Nilai 3

Nilai, Negeri Sembilan

Pavilion Damansara Heights

Pusat Bandar Damansara, Kuala Lumpur