KUALA LUMPUR (Nov 3): Trive Property Bhd plans to raise up to RM19.89 million via a private placement to upgrade an office building.

In a bourse filing, Trive Property said the private placement involves the issuance of 342.93 million new shares or up to 20% of the group’s issued shares, to be placed to third party investors who have yet to be identified.

The issue price of the placement shares will be fixed at a later date, Trive Property said. But based on an illustrative price of 5.8 sen per placement share, the placement is expected to raise up to RM19.89 million to fund the upgrading works of Persoft Tower.

The group had previously earmarked RM20 million for the refurbishment and renovation expenses for Persoft Tower via a rights issue with warrants which was completed on Feb 4.

Including the latest private placement and the rights issue, the group has made four cash calls in the past two years. It completed two private placements in May and June last year.

The placements raised RM4.1 million and RM2.5 million respectively, used mainly to repay borrowings and for working capital.

It said the average monthly occupancy rate of Persoft Tower stood between 38% and 47% from April to Oct 5 this year.

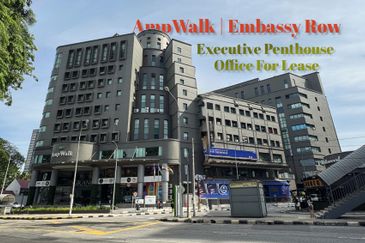

Persoft Tower is located within Tropicana Golf and Country Resort. The tower comprises 25 units of stratified office and one unit of lower and upper penthouse within a 19-storey commercial office building.

Trive Property owns Persoft Tower, after completing the acquisition of the remaining 40% stake of Avenue Escapade Sdn Bhd for RM9.9 million in March 2021 — which was also partly funded by proceeds raised from rights issues. The group acquired the other 60% stake in AESB for RM17.36 million in 2019.

Get the latest news @ www.EdgeProp.my

Subscribe to our Telegram channel for the latest stories and updates

TOP PICKS BY EDGEPROP

Mah Sing Integrated Industrial Park

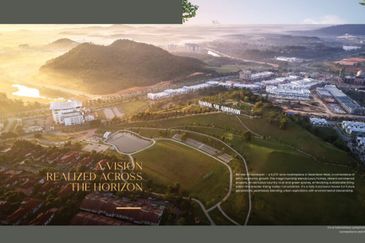

Subang Bestari, Selangor

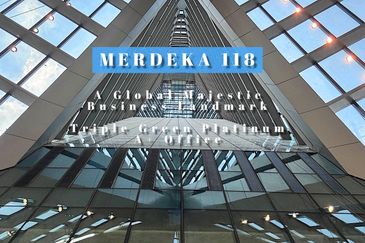

Merdeka 118 @ Warisan Merdeka 118

KLCC, Kuala Lumpur

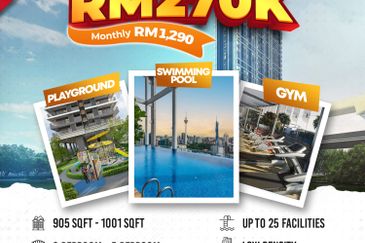

Horizon Residence (Dwi Mutiara)

Bukit Indah, Johor