KUALA LUMPUR (May 5): Two wholly-owned subsidiaries of UEM Sunrise Bhd have been slapped with additional taxes and penalties amounting to RM82.18 million by the Director General of Inland Revenue Board (IRB).

In a filing with Bursa Malaysia today, UEM Sunrise said the notice of additional assessment and penalty of RM8.49 million for the years 2013 to 2018 was issued to UEM Land Bhd, following the removal of Bumiputera quota and low-cost requirements at its selected developments in Iskandar Puteri.

Meanwhile, another unit, Symphony Hills Sdn Bhd, got a tax bill for RM73.69 million, following the reversal of tax losses utilisation for the years of assessment from 2006 to 2017.

“After taking into account the advice from both the company’s tax consultant and solicitors, UEM Sunrise believes there are reasonable grounds to appeal and contest the basis of the assessments,” said UEM Sunrise.

It also said it will make no additional provision for the additional taxes and penalties, and that both UEM Land and Symphony Hills will be seeking judicial reviews and file a stay order on the notices.

The group, which is of the opinion that there will not be any significant financial and operational impact as a result of these additional assessments, added that it will continue to take all necessary actions to protect its interest and will make further announcements when there are material developments on the matter.

UEM Sunrise’s shares closed half a sen or 1.19% higher at 42.5 sen today, valuing the company at RM2.15 billion.

Get the latest news @ www.EdgeProp.my

Subscribe to our Telegram channel for the latest stories and updates

TOP PICKS BY EDGEPROP

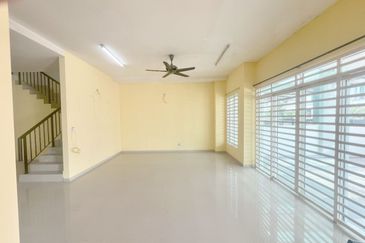

Tenderfields @ Eco Majestic

Semenyih, Selangor

Taman Desa Port Dickson

Port Dickson, Negeri Sembilan

Seksyen 5, Petaling Jaya

Petaling Jaya, Selangor