Gamuda Bhd (Sept 30, RM3.70)

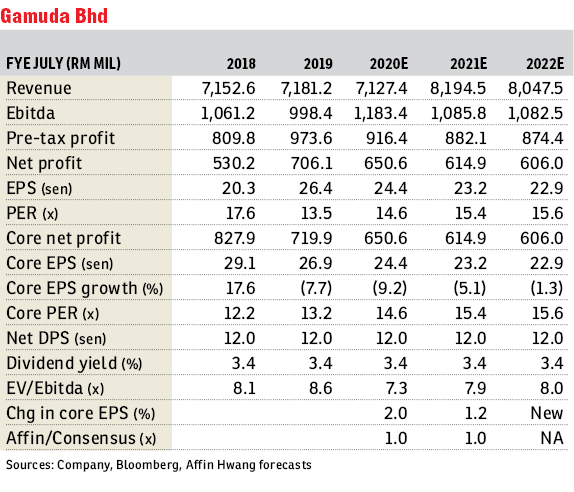

Maintain buy with a higher target price (TP) of RM4.30: Gamuda Bhd’s financial year ended July 31, 2019 (FY19) net profit of RM706 million was in line with our estimate of RM704 million but above the market consensus forecast of RM615 million. Net profit jumped 33% year-on-year (y-o-y) for FY19, mainly due to lower net exceptional losses of RM14 million attributable to impairment of receivables for FY19 compared with RM298 million for FY18 (a loss on the sale of Syarikat Pengeluar Air Selangor Holdings Bhd [SPLASH] and a discount on Gamuda Water’s receivables). Profit before tax was up 20% y-o-y at RM974 million, driven by higher property (+14% y-o-y) and concession (+156% y-o-y) earnings, partly offset by lower construction earnings (-16% y-o-y). Core net profit fell 13% y-o-y to RM720 million due to lower core earnings from construction (a lower Mass Rapid Transit Line 2 contract value) and concessions (the loss of SPLASH earnings following its disposal).

Gamuda has executed a heads of agreement to acquire a 50% stake in Martinus Rail (MR), Australia’s largest independent specialist rail constructor. Gamuda would provide the balance sheet to support MR with its bids for railway projects in Australia worth about A$20 billion (RM56.54 billion). Gamuda achieved lower property sales of RM3.1 billion for FY19 (-14% y-o-y compared with RM3.6 billion for FY18). Sales were below its target of RM4 billion due to weak local market conditions. With sustained strong overseas property sales and an expansion in local sales (more launches for Gamuda Cove, Gamuda Gardens and twentyfive.7 townships), Gamuda is targeting sales of RM4 billion for FY20.

We fine-tune our FY20 to FY21 earnings per share estimates (+1% to +2%) and introduce our FY22 estimates. The weak core earnings prospects (a three-year compound annual growth rate of -5%) are due to potential losses of toll road concession earnings (assumed in our forecasts) following a proposed disposal to the government for RM2.36 billion. However, good prospects are seen for it to expand construction and property earnings with funds for reinvestment. We reiterate our “buy” call with a higher revalued net asset value-based TP of RM4.30 from RM4.25 previously to reflect higher overseas property division valuations. — Affin Hwang Capital, Sept 30

This article first appeared in The Edge Financial Daily, on Oct 1, 2019.

Click here for more property stories.

TOP PICKS BY EDGEPROP

Pangsapuri Nuri, Bandar Baru Kangkar Pulai

Kangkar Pulai, Johor

Menara HLX (formerly Menara HLA)

KL City Centre, Kuala Lumpur

Menara Ilham (Ilham Tower)

KLCC, Kuala Lumpur

Menara Ilham (Ilham Tower)

KLCC, Kuala Lumpur

Menara Ilham (Ilham Tower)

KLCC, Kuala Lumpur

Suasana Sentral Condominium

KL Sentral, Kuala Lumpur

Bandar Baru Wangsa Maju (Seksyen 2)

Wangsa Maju, Kuala Lumpur