Construction sector

Maintain underweight: The Star daily on Sunday quoted Penang Chief Minister Chow Kon Yeow that since the RM1 billion bridging loan from the federal government for the Penang Transport Master Plan (PTMP) was not forthcoming, the project delivery partner (PDP), SRS Consortium, would now have to source for the funds.

However, SRS Consortium project director Szeto Wai Loong said the state should stick to the agreement in the request for proposal, which mentioned that the state would come up with RM1 billion, while the company would source for RM1.3 billion in bridging loans to kick-start the project.

At this juncture, the government is still waiting for the environmental impact assessment (EIA) of the Penang South Reclamation project. Approval is expected to be obtained by June. The necessary regulatory works and award of contracts would take place after the approval and actual construction would only commence a year later.

While the unavailability of the RM1 billion bridging loan from the federal government is a setback, we opine that the roll-out of the PTMP would very much hinge on the approval for the Penang South Reclamation project as the proposed reclaimed land (approximately 4,500 acres or 1,821ha) would be the main source of funding for the PTMP. In addition to the required approval for the EIA, we understand that another approval from the National Physical Planning Council, which is scheduled to meet in April 2019 to debate on the PTMP, is required as well.

As an option, the PDP could consider prioritising the implementation of the Bayan Lepas light rail transit (LRT) line, instead of building the LRT line and Pan Island Link 1 concurrently.

While Gamuda Bhd, a leading joint-venture partner in the PDP, may potentially receive strong cash injections from the proposed disposals of toll roads under its portfolio to the government, we are reserved about whether the PDP would be willing to inject substantial additional amounts into the PTMP in view of the political uncertainties and heightened political risks after the 14th general election.

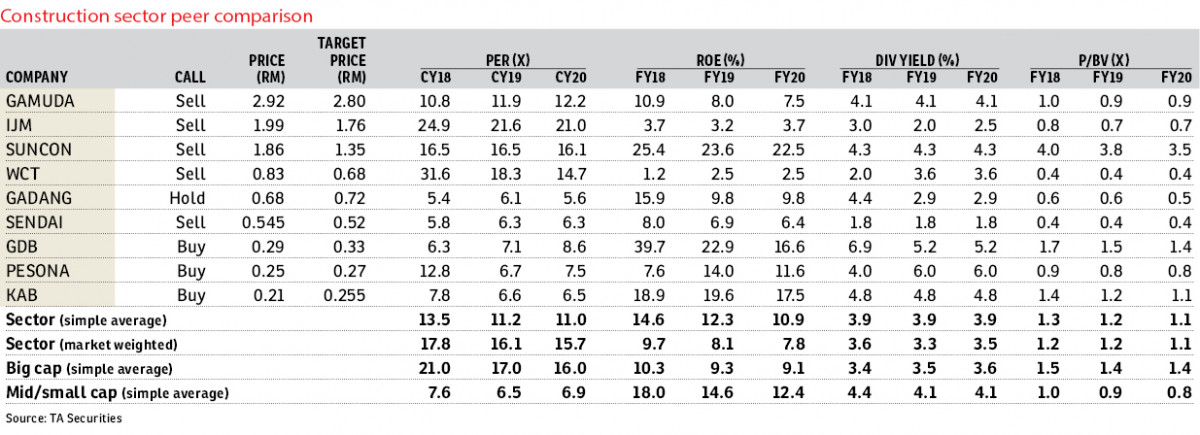

We have maintained our call on the construction sector as we think valuations have run ahead of the fundamentals after the recent rally in share prices. Besides, the property market in which most of the contractors have direct or indirect exposure to remains challenging.

Following the recent cancellations/postponements of megaprojects and downsizing of the mass rapid transit 2 and LRT3 projects, coupled with a slower property market, we expect competition in project tenders to intensify. Contractors may have to sacrifice some margins to secure new projects as they compete for a smaller pie of upcoming jobs.

With prices of key construction materials such as cement and steel bars at depressed levels, in the event of an imbalance in the demand and supply of these construction materials that lead to price escalations, it could pose a risk of margin contraction to the existing jobs in hand.

The share price of Gadang Holdings Bhd has surged 16.2% since our company update report with a “buy” recommendation and a target price (TP) of 72 sen a month ago. Given the limited potential upside to Gadang’s share price, we have downgraded the stock to “hold”, with the TP unchanged at 72 sen. — TA Securities, March 18

This article first appeared in The Edge Financial Daily, on March 19, 2019.

Click here for more property stories.

TOP PICKS BY EDGEPROP

R&F Princess Cove, Tanjung Puteri

Johor Bahru, Johor

Eco Botanic

Iskandar Puteri (Nusajaya), Johor

22x85 Facing Open, Freehold, Walking Distance to Faber Tower & Faber Plaza

Taman Desa, Kuala Lumpur

Taman Perindustrian Bukit Rahman Putra

Sungai Buloh, Selangor

Taman Perindustrian Bukit Rahman Putra

Sungai Buloh, Selangor