S P Setia Bhd (Oct 29, RM2.08)

Upgrade to buy with a revised target price (TP) of RM2.50: We believe there’s value after S P Setia Bhd’s share price plummeted over the past two months. It is currently trading at 0.7 times price-to-book (P/B) value, already two standard deviation below the 12-year mean. We believe S P Setia’s diversified product offerings in townships catering to various target markets will still sustain its resilient property sales in Malaysia. Meanwhile, expansions overseas continue to gain traction, accounting for 57% of its unbilled sales of RM8.1 billion. Thus, we upgrade our rating to “buy” with a revised TP of RM2.50, based on a 50% discount to our revalued net asset valuation (RNAV).

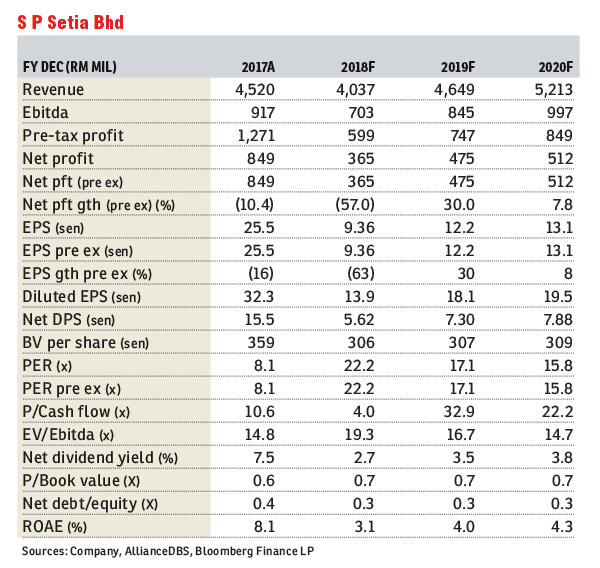

Where we differ? Our financial years 2018 to 2020 forecast earnings are markedly lower than consensus estimates, probably due to our more conservative assumption of property sales. While we like S P Setia’s growing international expansion to diversify its earnings stream, we believe higher sales growth will be more elusive going forward given its sizeable operations.

On potential catalysts, the conclusion of Battersea commercial asset sales to the Employees Provident Fund and Permodalan Nasional Bhd by December 2018 will potentially generate effective property sales of RM3.5 billion for the group, a 40% increase over its existing unbilled sales. Also, a deep brand entrenchment in overseas markets — Singapore, Australia and the UK — will help generate strong earnings visibility, complementing its solid foundation in the Malaysian property market.

We upgrade our rating to “buy” with a revised TP of RM2.50, based on a wider 50% discount versus 35% previously to our RNAV. We like its diversification into overseas markets which could help to shift the burden of property sales from just the Malaysian market. Its current P/B valuation of 0.7 times is the lowest over the past 12 years which, in our view, is unjustified.

We also view the key risks are a weak sentiment towards the property market, and the relatively soft property market could lead to weaker sales. — AllianceDBS Research, Oct 29

This article first appeared in The Edge Financial Daily, on Oct 30, 2018.

TOP PICKS BY EDGEPROP

Megan Phoenix Business Centre

Cheras, Kuala Lumpur

Damansara Heights (Bukit Damansara)

Damansara Heights, Kuala Lumpur

Bandar Sri Menjalara

Kuala Lumpur, Kuala Lumpur

Danau Impian Condominium

Taman Desa, Kuala Lumpur

Megan Phoenix Business Centre

Cheras, Kuala Lumpur

Bandar Damai Perdana

Bandar Damai Perdana, Selangor