KUALA LUMPUR: Prime residential price growth across global cities has slowed, in the 12 months leading up to the second quarter of 2018 (2Q18), according to Knight Frank’s Prime Global Cities Index.

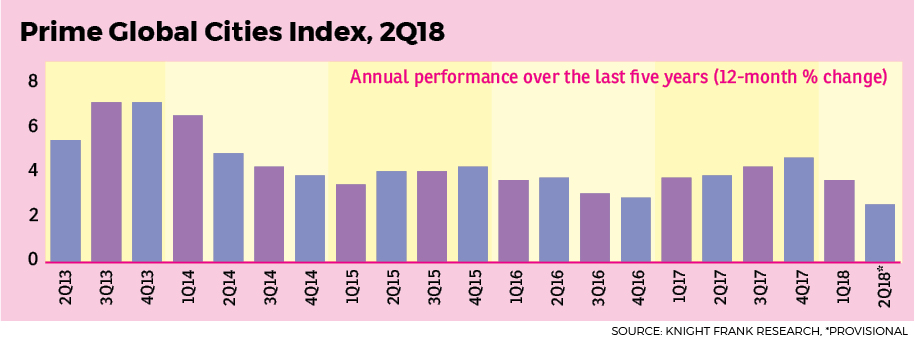

The index monitors performance of prime residential prices across key global cities, and has climbed 2.6% in the year to June 2018, its weakest annual rate of growth since 4Q12. Prime property corresponds to the top 5% of the housing market in each city.

Global real estate consultancy Knight Frank said the decline in the overall prime residential index performance is not due to a rise in the number of cities registering an annual decline but rather due to slower growth among the top performing cities.

“The gap between the strongest and weakest performing city has shrunk from 33 to 20 percentage points in the last quarter,” said Knight Frank International Residential Research partner Kate Everett-Allen.

“The introduction of new, and the strengthening of existing property market regulations, along with the rising cost of finance and a degree of political uncertainty are resulting in more moderate price growth at the luxury end of the world’s top residential markets,” she said.

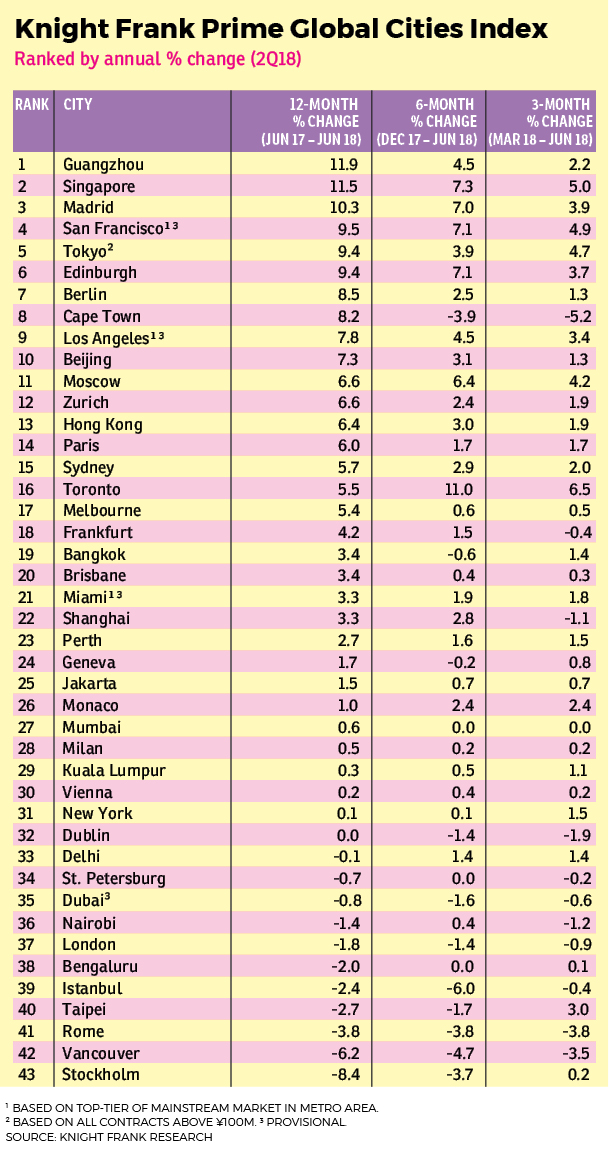

The index showed that in 1Q18, seven cities registered double-digit annual price growth but 2Q18 has only three — Guangzhou (11.9%), Singapore (11.5%) and Madrid (10.3%).

Guangzhou leads 2Q18’s 12-month price growth while Beijing (7.3%) and Shanghai (3.3%) were in 10th and 22nd place respectively.

“The recent decision by the Chinese authorities to scale back a major housing subsidy programme is expected to dent sales volumes in the second and third tier cities but prime prices in first tier cities are expected to see steady growth in the coming year,” Everett-Allen said.

Meanwhile, luxury home prices in Singapore have rebounded strongly, moving up the annual rankings to sit in second place.

Everett-Allen believes that high land-bids by developers have translated into higher new-build values. However, recent stamp duty changes may impact price growth.

“In an attempt to curb price inflation, the Singapore authorities announced further increases to the Additional Buyer Stamp Duty (ABSD) in July. This includes higher rates for foreign buyers (20%) and for developers (30%) as well as tighter lending rules,” the report noted.

Hong Kong has also introduced a new cooling measure — a new vacancy tax where developers will incur a penalty of 200% of annual rental value for new apartments that are left unsold and empty for six months or more.

According to the index, Kuala Lumpur is ranked 29 with only a 0.3% increase in luxury residential property prices over the 12 months from 2Q17 to 2Q18.

Meanwhile, luxury price growth in the city of Cape Town (South Africa) and Dublin (Ireland) has softened in the last six months.

“The rate of annual growth in Cape Town has halved in the last six months from 19.9% to 8.2%. The citywide drought and the uncertainty over the process of land expropriation without compensation has weakened sales activity,” the report stated.

In Dublin, tighter lending rules, rising luxury home supply and a reduction in sterling-denominated buyers has led to more moderate price appreciation.

This story first appeared in the EdgeProp.my pullout on Aug 10, 2018. Download EdgeProp.my pullout here for free.

TOP PICKS BY EDGEPROP

Taman Tun Dr Ismail (TTDI)

Taman Tun Dr Ismail, Kuala Lumpur

Mitsui Serviced Suites @Bukit Bintang

Bukit Bintang, Kuala Lumpur

TSLAW Tower, Jalan Kemuning

KL City, Kuala Lumpur

Fairfield Residences, Tropicana Heights

Kajang, Selangor

Savanna Executive Suites @ Southville City

Bangi, Selangor