MB World Group Bhd (June 4, RM1.85)

Maintain buy with a higher target price (TP) of RM2.85: We are positive on MB World Group Bhd’s proposal to acquire 2.4 acres (0.97 ha) of freehold land in Melaka via acquiring the entire equity interest in Crystal Faber Sdn Bhd, the land owner, for RM16 million as it is expected to increase the group’s effective gross domestic value (GDV) by 4.8% to about RM3.7 billion. The move enables the group to expand into Melaka to capture the rising interest in properties, boosted by tourism-related activities. Assuming an earnings before interest and tax margin of 20%, the project’s net present value is estimated at RM24 million or revalued net asset valuation (RNAV) of 15 sen per share (3.6% of our TP).

The implied land cost for MB World is about RM153.1 per sq ft (psf). While the implied land price on a psf basis may not look like a bargain, the land cost to estimated GDV is competitive at only 9.5% and a quick turnaround can be expected given that the foundation and earthworks are mostly done. Net gearing is expected to increase to 0.14 times from the current level of 0.06 times.

The 412-unit twin tower serviced residence with a gross development cost of RM133 million is located at the heart of the Melaka Historic City Centre, a Unesco World Heritage City. It is easily accessible via the AMJ Expressway. Surrounding amenities include but not limited to shopping malls, such as AEON Bandaraya Melaka and Tesco, medical institutions, educational institutions and leisure destinations.

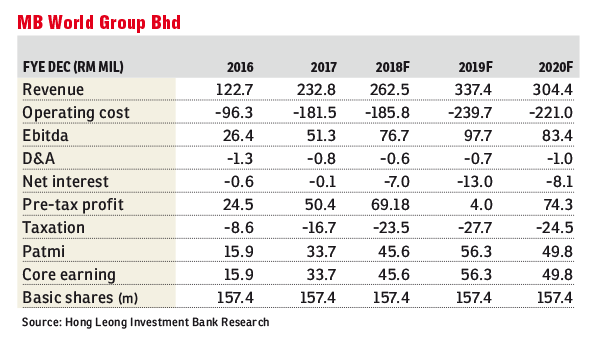

We imputed the contribution from the above development, resulting in higher financial year 2019 (FY19) and FY20 earnings forecasts by 3.3% and 18.7% respectively.

We maintain “buy” with a higher TP of RM2.85 (from RM2.75) based on an unchanged 35% discount to RNAV of RM4.39. We like MB World given its first-mover advantage to capture the spillover growth effect from the refinery and petrochemical integrated development project in Pengerang. Earnings growth is well supported by unbilled sales and strong take-up of newly launched projects. Besides, a potential increase in dividends following the projected strong earnings may be on the cards. — Hong Leong Investment Bank Research, June 4

This article first appeared in The Edge Financial Daily, on June 5, 2018.

For more stories, download EdgeProp.my pullout here for free.

TOP PICKS BY EDGEPROP

HIJAYU 2 - RESORT HOMES

Seremban, Negeri Sembilan

Bandar Springhill

Port Dickson, Negeri Sembilan

SuriaMas, Taman Sri Subang

Bandar Sunway, Selangor

Dedaun Hijau (Greenfield Regency)

Tampoi, Johor