Titijaya Land Bhd (Jan 15, 70.5 sen)

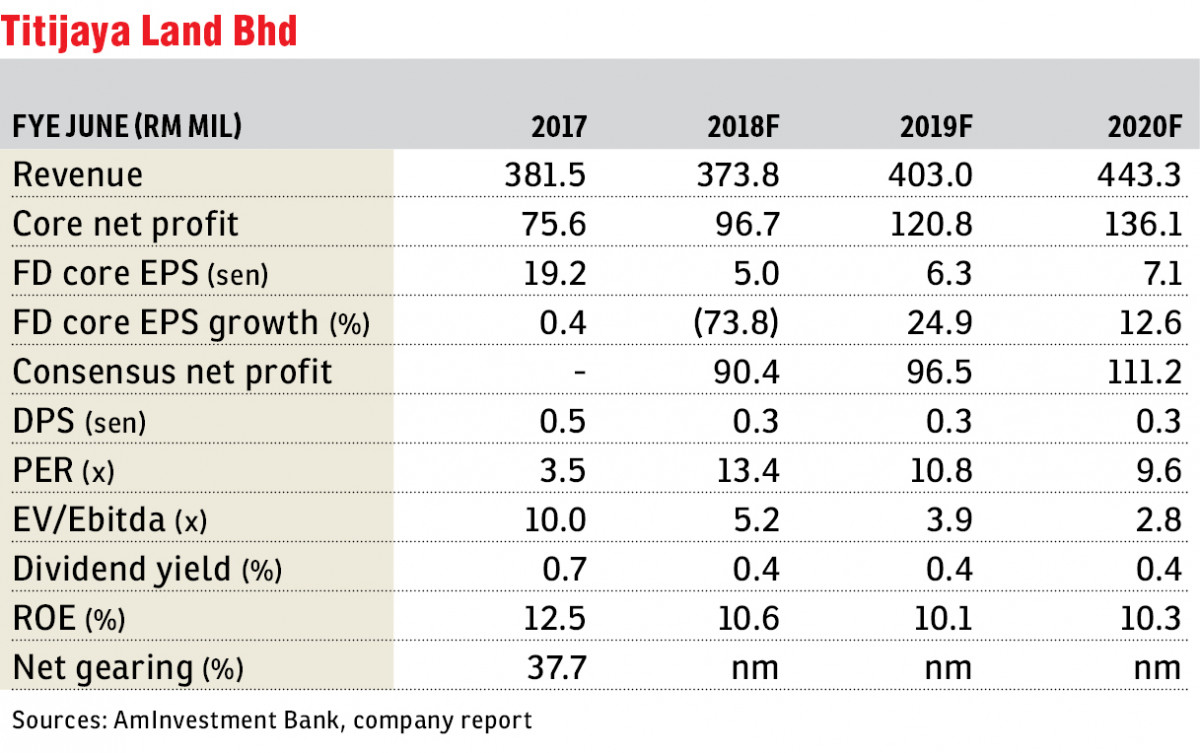

Maintain buy call with a lower fair value of 95 sen: Despite the overall still soft local property market, we estimate that Titijaya Land Bhd in the second quarter ended Dec 31, 2017 of financial year 2018 (2QFY18) has been able to match its sales of about RM100 million achieved in 1QFY18, which helps to sustain its unbilled sales at about RM400 million.

Similar to 1QFY18, we believe the bulk of the sales in 2QFY18 has come from the RM916 million four-block H2O Residences in Ara Damansara, one the most sought-after addresses in the Klang Valley.

At about RM835 per sq ft, we believe the high-rise residential project is being priced at a slight premium to similar products in the vicinity. However, the sales have been strong, we believe, as it is able to differentiate itself from the others by branding itself as an aquatic themed project with, among others, a facade that resembles interlocking ice cubes, a swimming pool with an LED display of marine life and a children’s water playground, and a posh glass-walled gym overlooking the swimming pool. Given the compact sizes of 450 to 1,000 sq ft, the units are considered affordable in absolute terms.

Overall, Titijaya has lined up RM1.45 billion new launches in FY18, largely in the affordable segment, such as high-rise residential units in Damansara West, Bukit Subang (RM300,000 to RM450,000 per unit) and The Shore @ Kota Kinabalu (RM455,000 to RM810,000 per unit), as well as compact serviced suites in Riveria @ KL Sentral (RM340,000 to RM780,000 per unit).

We are cautious about the property sector due to: i) the generally still elevated home prices; ii) the low loan-to-value (LTV) offered by banks; and iii) housebuyers’ inability to qualify for a home mortgage due to their already high debt service ratios.

In addition, the still subdued consumer sentiments against a backdrop of rising cost of living and elevated household debts are holding consumers back from committing themselves to the purchase of big-ticket items like a house. However, we do see a bright spot in the affordable segment.

We continue to like Titijaya for: i) its focus on the affordable high-rise residential segment in the Klang Valley; ii) its strong earnings visibility backed by unbilled sales of about RM400 million, and the RM8 million half-yearly rental for three years from November 2017 it is receiving from Prasarana Malaysia Bhd for the temporary occupation and usage of its 16-acre (6.5ha) land in Shah Alam by LRT3 contractors; and iii) its ability to secure new land bank at attractive prices via joint ventures with landowners, from both the public and private sectors. — AmInvestment Bank Research, Jan 15

This article first appeared in The Edge Financial Daily, on Jan 16, 2018.

For more stories, download EdgeProp.my pullout here for free.

TOP PICKS BY EDGEPROP

Bandar Baru Sri Petaling

Bandar Baru Sri Petaling, Kuala Lumpur

Setia City Residences @ Setia City

Setia Alam/Alam Nusantara, Selangor

Pangsapuri Palma

Bandar Botanic/Bandar Bukit Tinggi, Selangor

Pangsapuri Akasia, Bandar Botanic

Bandar Botanic/Bandar Bukit Tinggi, Selangor

Edusentral @ Setia Alam

Setia Alam/Alam Nusantara, Selangor

Vista Alam Serviced Apartment

Shah Alam, Selangor

Setia City Residences @ Setia City

Setia Alam/Alam Nusantara, Selangor