Mitrajaya Holdings Bhd (Jan 10, 97 sen)

Maintain buy with a higher cum/ex-target price of RM1.20/RM1.03: Mitrajaya Holdings Bhd announced this week that it had bagged a 1Malaysia Civil Servants Housing Project (PPA1M) job from Putrajaya Home Sdn Bhd worth RM103.1 million slated for completion on Jan 14, 2021. The scope of work entails construction of 404 units of PPA1M apartments inclusive of one block of multilevel parking, one surau, and common facilities in Precinct 17, Putrajaya.

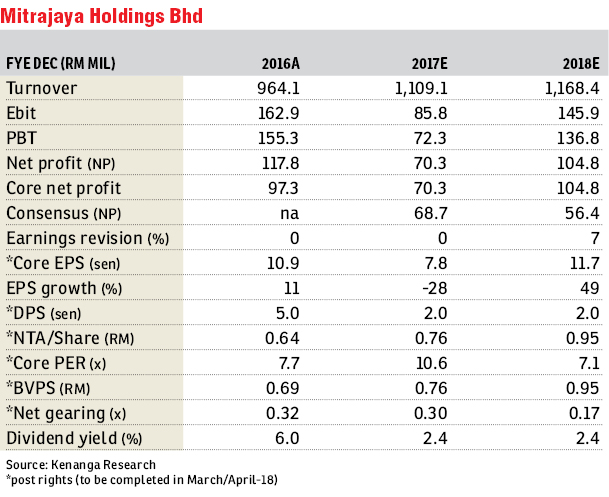

We remain neutral about this win as it is within our financial year 2018 (FY18) replenishment target of RM1 billion. Assuming a profit before tax margin of 8%, we expect this PPA1M job to contribute about RM2 million per annum to Mitrajaya’s bottom line for the next three years. To recap, Mitrajaya clinched RM1.02 billion of contract wins in FY17 — slightly above our FY17 replenishment target of RM800 million. That said, we highlight that one of the contracts worth RM132.5 million secured in FY17 will only commence in August 2018 when profit contributions start kicking in.

Moving forward, we believe Mitrajaya is backed by a strong flow of contracts possibly from: i) Bank Negara Malaysia (BNM) — given Mitrajaya’s close working relationship with BNM, who recently acquired a tract of land (22.5ha) from the government for RM2 billion to develop education and training facilities; ii) OSK’s “Ryan and Miho” (gross development value of RM756 million) condominium project in Section 13 given that Mitrajaya is currently working on OSK’s Petaling Jaya Midtown project (RM293 million contract value), which is within the vicinity; iii) light rail transit 3 station sub-packages; and iv) refinery and petrochemical integrated development infrastructure jobs.

Building jobs aside, we also believe Mitrajaya could be a potential contender for mega rail projects such as the East Coast Rail Line (ECRL) and high-speed rail (HSR) given that these projects are non-urban infrastructure jobs that fit in Mitrajaya’s operating space. Unlike the mass rapid transit 3 (urban job) which has higher risks of delays/cost overruns due to traffic conditions, the ECRL and HSR are greenfield projects that Mitrajaya favours. On the back of the potential contract flows and a stronger balance sheet post-rights issuance, we are positive about Mitrajaya’s outlook, hence we upgrade our FY18 replenishment target to RM1.2 billion (from RM1 billion). Currently, our outstanding construction order book stands at RM1.8 billion, providing visibility for 1.5 to two years, while its property unbilled sales stand at RM200 million. — Kenanga Research, Jan 10

This article first appeared in The Edge Financial Daily, on Jan 11, 2018.

For more stories, download EdgeProp.my pullout here for free.

TOP PICKS BY EDGEPROP

Bandar Baru Sungai Buloh

Sungai Buloh, Selangor

Jardin Residences @ Bandar Seri Coalfields

Sungai Buloh, Selangor

Jardin Residences @ Bandar Seri Coalfields

Sungai Buloh, Selangor

Jardin Residences @ Bandar Seri Coalfields

Sungai Buloh, Selangor

Subang Hi-tech Industrial Park

Subang Jaya, Selangor

Taman Wawasan, Pusat Bandar Puchong

Puchong, Selangor