MGB Bhd (Jan 8, RM1.80)

Maintain buy with a higher target price (TP) of RM2.05: MGB Bhd’s (formerly known as ML Global Bhd) wholly-owned subsidiary MGB Land Sdn Bhd has entered into a share sale and purchase agreement with vendors Datuk Pang Shee Pak and Datuk Kok Chee Khung to purchase the entire equity interest in Multi Court Developers Sdn Bhd (MCDSB). The company is to pay RM2.8 million in cash and settle RM17.3 million in outstanding advances for the entire stake in MCDSB, which equates to a total purchase consideration of RM20.1 million. An affordable housing project is included in the deal.

In return, MGB is to acquire a parcel of land measuring 9.4ha in Batu Pahat, Johor valued at RM22 million. The land comes with an agreement with the 1Malaysia Civil Servants Housing Programme (PPA1M) to build 365 units of double-storey terrace homes with a gross development value (GDV) of RM93.5 million. MCDSB is to also receive a facilitation fee amounting to RM14.6 million. The project is expected to commence in the second quarter of 2018 and is slated for completion by 2020. MGB intends to fund the acquisition and development internally, given that its net gearing is at a healthy 0.11 times.

The deal is fair for MGB, in our opinion, with land cost of RM20.1 million representing 19% of GDV, which amounts to RM108.1 million — this includes the facilitation fee. Nonetheless, the acquisition allows the company to deal directly with PPA1M, as opposed to going through an intermediary. This could increase MGB’s chances of securing similar projects in the future as the company builds up its track record and working relationship with PPA1M.

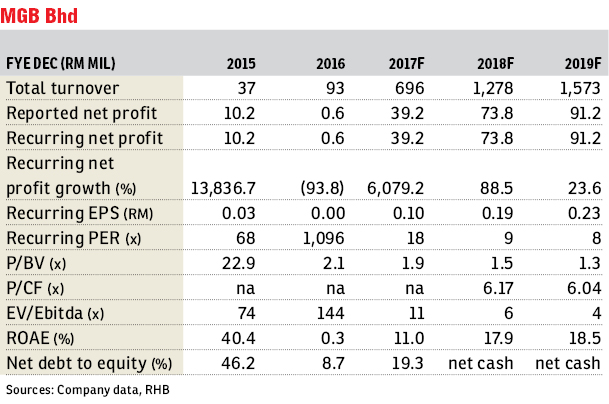

Upward revision to our earnings forecasts. We raise our financial year 2018 (FY18) and FY19 net profit forecast by 5.8% and 4.6% respectively after imputing progress billings for the new Batu Pahat PPA1M project and higher interest expenses. We expect the Batu Pahat project to achieve brisk sales of 90% in FY18 due to a shortage in the supply of affordable housing. We also believe that MGB stands a good chance of securing more PPA1M or other affordable housing projects in the future. We maintain our “buy” call, but raise our sum of the parts-based TP to RM2.05 (from RM1.82). Risks include a further slowdown in the property market and a sharp rise in input cost. — RHB Research Institute, Jan 8

This article first appeared in The Edge Financial Daily, on Jan 9, 2018.

For more stories, download EdgeProp.my pullout here for free.