KUALA LUMPUR (Dec 15): LBS Bina Group Bhd will set up a RM500 million Sukuk Murabahah programme to finance future acquisitions and development cost of the projects undertaken by the group, to repay borrowings, as well as for working capital.

The sukuk programme will provide the group with flexibility in its fundraising exercise, with varying amount and tenures for optimal asset-liability matching, LBS Bina said in a filing with the bourse today.

The property developer said its wholly-owned subsidiary LBS Bina Holdings Sdn Bhd has lodged with the Securities Commission Malaysia, to set up the sukuk programme.

"The Sukuk Murabahah programme has a tenure of up to 20 years from the date of its first issue. Each Sukuk Murabahah issued under the programme shall have a tenure of more than one year and up to 20 years," the filing added.

Public Investment Bank Bhd has been appointed as the principal adviser and lead arranger for the sukuk programme, while Amanie Advisors Sdn Bhd is the Shariah adviser.

LBS Bina shares closed down 2 sen or 0.86% at RM2.30 today, with 2.96 million shares done, bringing it to a market capitalisation of RM1.58 billion.— theedgemarkets.com

For more stories, download EdgeProp.my pullout here for free.

TOP PICKS BY EDGEPROP

HIJAYU 1, Bandar Sri Sendayan

Seremban, Negeri Sembilan

Taman Setiawangsa

Taman Setiawangsa, Kuala Lumpur

Residensi Zamrud (Zamrud Residensi)

Kajang, Selangor

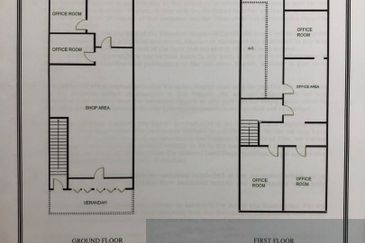

Medan Idaman Business Centre

Setapak, Kuala Lumpur

Taman Sri Putra, Sungai Buloh

Sungai Buloh, Selangor