Vivocom International Holdings Bhd (Dec 4, 13 sen)

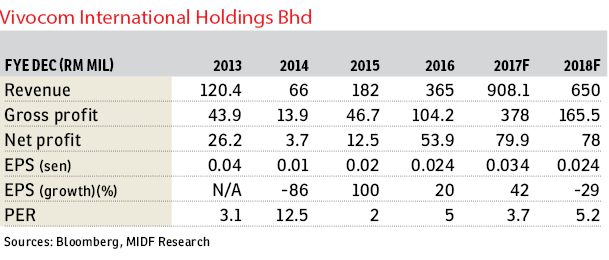

Maintain buy recommendation with an adjusted target price (TP) of 33 sen per share: Vivocom International Bhd’s nine-month financial year 2017 (9MFY17) earnings came below expectations. Its 9MFY17 earnings of RM5.2 million (-72% year-on-year [y-o-y]) came below our estimates. Its net profit accounted for 5.2% of our full-year forecast. The stark deviation was due to lower revenue recognition from projects due to progress billings and delays in certification of construction progress.

The earnings estimates were varied to reflect a slower pace of construction billings. We make slight variations to our assumption as we believe that FY18 could be a better year for Vivocom to recognise its billings for its order book level but the progress will be slower.

Thus, we trim our earnings forecast for FY17 by -25% from RM99.9 million to RM79.9 million to reflect a slower billings recognition. This has resulted in a -30% reduction from the indicative value stemming from the construction segment, from RM806.5 million to RM620.6 million resulting in -22.8% of its per share value from 24.9 sen to 19.2 sen.

We are expecting Vivocom to continue to bid for affordable housing and infrastructure projects in Perak, Terengganu and the Klang Valley. We have reasoned before in our previous note that Vivocom’s margin is facing stiff pressure from higher mobilisation costs. The projects then would be strategic as it would be connected to mixed development with lower mobilisation cost hence maintaining its current margin level.

We reaffirm our “buy” recommendation with a TP of 33 sen per share based on a discounted cash flow with weighted average cost of capital of 7.4% and an enlarged share base. — MIDF Research, Dec 4

This article first appeared in The Edge Financial Daily, on Dec 5, 2017.

For more stories, download EdgeProp.my pullout here for free.

TOP PICKS BY EDGEPROP

S2 HEIGHTS(SEREMBAN 2)

Seremban, Negeri Sembilan

KL Gateway Premium Residence

Bangsar South, Kuala Lumpur

Impian Bukit Tunku

Kenny Hills (Bukit Tunku), Kuala Lumpur