Gamuda Bhd (Sept 29, RM5.28)

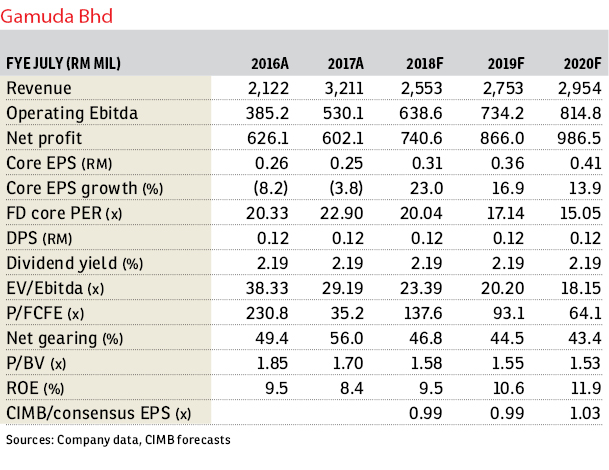

Retain add call with an unchanged target price (TP) of RM6.15: Gamuda Bhd’s financial year 2017 (FY17) core net profit was 3% above our forecast and 7% above consensus’, due largely to stronger-than-expected construction billings and property sales.

Core net profit (excluding RM99 million impairment by Storm Water Management and Road Tunnel [Smart] Highway) grew by 12% year-on-year (y-o-y) to a new high of RM700 million. All divisions recorded growth in core earnings, led by construction’s stellar 40% y-o-y surge in pre-tax profit due to stronger MRT 2 billings and margins, and property development’s 22% growth as full-year sales of RM2.4 billion exceeded its target by 14%.

The construction pre-tax margin grew slightly to 8% in FY17 (FY16: 7%) but we foresee more upside once MRT 2 underground works accelerate from FY18 onwards. As at the end of FY17, progress of the MRT 2 underground scope stood at 10%.

The 12 tunnel boring machines (TBMs) will begin work in February next year, including the construction of some underground stations. We note a sequential improvement in quarterly construction pre-tax margins from 8.3% in the third quarter of FY17 (3QFY17) to 9.9% in 4QFY17.

Gamuda has revised up its FY17/18 property presales target by nearly 50% to RM3.5 billion, after exceeding RM1 billion in sales for its Vietnam projects, namely Gamuda City and Celadon City. The group has indicated that RM1.6 billion of the projected new sales would come from its international property developments. This, however, would cap upside to margins because properties in Vietnam are of lower value, apart from high start-up costs for new townships.

A slight negative surprise during the results briefing by Gamuda’s management was on the LRT 3 project. We understand that the tender/award of the 2km underground portion has been suspended to make way for a potential revision in project scope, which may exclude underground construction altogether.

We view this as a minor setback as it accounts for about 10% of the group’s total RM10 billion job target by the end of 2017. Chances of securing a package from the RM55 billion East Coast Rail Line (ECRL) remain intact, in our view.

We gathered that in all likelihood, Gamuda’s 40%-owned associate, Syarikat Pengeluar Air Selangor Sdn Bhd (SPLASH), could see some positive news ahead of the takeover negotiation’s deadline of Oct 5. While no new details were revealed, a new takeover proposal has emerged and the takeover structure could be more favourable.

We retain our FY18-FY19 earnings per share forecasts and introduce our FY20 numbers. We forecast FY18 to be another record year, driven mainly by construction. Our TP remains pegged at a 10% revalued net asset value (RNAV) discount.

Gamuda remains our top big-cap rail play for both government-driven urban rail jobs and China-led rail contracts. We retain our “add” call with a potentially strong rail job win catalyst in 4Q of 2017, with potential upside to its 33% foreign shareholding as a bonus. Key downside risks are job delays and a lower contract win success rate. — CIMB Research, Sept 29

This article first appeared in The Edge Financial Daily, on Oct 2, 2017.

For more stories, download EdgeProp.my pullout here for free.

TOP PICKS BY EDGEPROP

Royal Domain Sri Putramas II

Dutamas, Kuala Lumpur

Saville Residence

Jalan Klang Lama (Old Klang Road), Kuala Lumpur

Bandar Kinrara 2

Bandar Kinrara Puchong, Selangor