The rule of life is simple: When you know better, you can always do better. It’s exactly the same in property investment — a seasoned investor must always strive to increase choices and options so that he or she is flexible enough to make the most out of any situation. The key, therefore, is to start with what you can do with property as an asset class in your diversified investment portfolio. Survival of the fittest is the golden rule in any competition; always aim to keep yourself in the game for as long as you can.

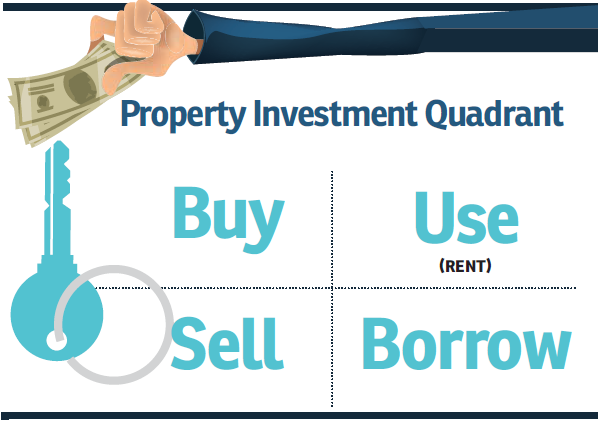

Mirroring Robert Kiyosaki’s acclaimed “Rich Dad’s Cashflow Quadrant”, I humbly put forward my parody adoption of the same in Property Investment Quadrant (PIQ). Like Kiyosaki’s “ESBI” in Employment, Self-employed, Business and Investment, my quadrant is “BSUB” in the four actions that you can really do with your property investment, namely Buy, Sell, Use (Rent) and Borrow.

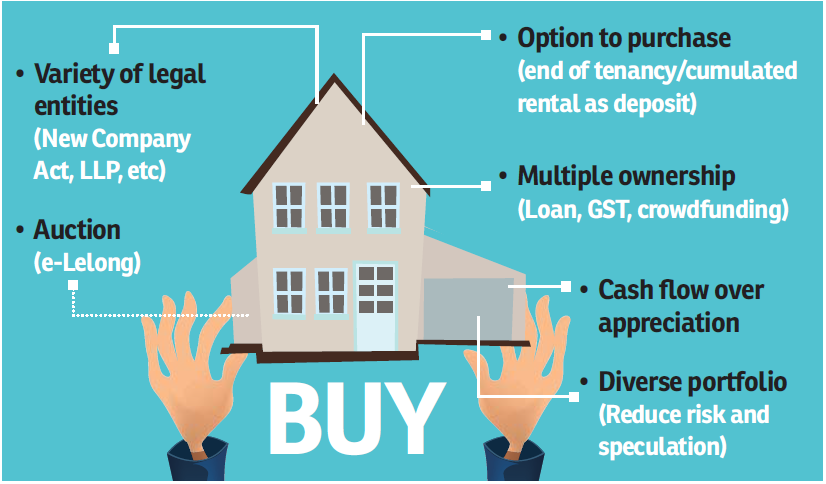

This is therefore the first of a four-part series addressing the “Buy” in the PIQ. Here are some unconventional suggestions to buy (acquire) property in light of the current challenging environment and some new trends as well as developments in law. These are by no means exhaustive and in no particular order in matching your risk portfolio and your unique requirements.

1. Option to purchase

Lately, the intended first-homeownership regime promoted by the government has taken a twist. From the affordable prices and little or no money down to assist first-time homebuyers through public intervention, it is now “rent to own” and also urban transit housing from the last two national budgets tabled. The government, through their intelligence and their action, is recognising the disparity between the disposable income and the increasing home prices amid the already alarming household debts.

Investors can easily capitalise on this unique trend by replicating “rent to own” in the secondary market to offer such an option to tenant-turned-purchaser in the long run. They can consider a higher rental with premium for part or whole of it to be accumulated as the deposit in the long run for the eventual purchase. This will allow the tenant-turned-purchaser longer time to improve his or her income to secure the eventual bank loan, indirect saving of the deposit to even procurement of potentially favourable purchase price at the start of the tenancy, as well as the increased degree of certainty of continuously staying in the same premises without moving. The landlord will also enjoy less speculation with a potential purchaser in place beforehand, to even a tenant who takes more “ownership” of the premises for the likelihood of eventual ownership. It’s a win-win solution for all that is equally applicable for commercial, retail or industrial properties.

2. Multiple ownership

Property investment has long been a very individual thing in the past, or at best limited to the closest of family or friends. Affordability in prices in the past has certainly played a part in cultivating this behaviour. The lone ranger that hunts successfully like a tiger before will learn a new skill to hunt in a pack just like the lions. Embracing both the pros and cons of multiple ownership of a single property is essential for any investor.

Multiple sources of income or higher accumulated income of the purchasers as well as the ability to offer more personal guarantors would be most welcomed by banks as better risk management in giving loans. Different combination of owners for non-residential property would also accord some flexibilities and benefits in GST.

Of course, these benefits have to be balanced with proper documentation to address certain fundamental issues and decision-making processes.

Investors can even explore the regulated regime in crowdfunding to invest in property, either in equity or the more recently approved Peer to Peer. Property investment with total strangers is no longer a dream.

3. Variety of legal entities

The recent changes in law in the diversity of legal entities available for property ownership have also increased the possibility of implementing multiple ownership discussed above. Today, investors can buy properties under their personal name, a combination of a few personal names, public and private limited companies (in the new structures offered under the new Companies Act 2016), limited liabilities partnership (LLP) and even trust companies.

This gives investors more options in structuring their property investment. LLP is a hybrid of a common law partnership with the benefits of a separate corporate entity with limited liability — a Sdn Bhd can now be with a single shareholder and a single director and an annual general meeting is only optional. These changes bridged the gaps between Corporate Malaysia and the modern first world to ensure our competitiveness in attracting investment.

A word of caution to the most contemporary property investors: A lot of banks, relevant authorities as well as fellow investors are still not familiar with the new company structures especially LLP. Be prepared to make some adjustments along the way to make the most out of these new changes.

4. Diverse portfolio

“Never put all your eggs in the same basket” is still a ringing truth as the fundamental of risk management. As investors are acquiring more properties, they need not be all the same type of properties. A diverse portfolio is favoured, whether it is of different price range that targets different strata of users or buyers, or simply the different usage from residential, commercial, industrial, retail, agricultural or land properties. It can get even more sophisticated in a single element in a mixed-use development.

There can even be sophistication in terms of land tenure. From the conventional freehold and leasehold, we now have this unique concept of lease right in Medini Iskandar as well as the unchartered waters in new territory like the very ambitious Forrest City in the south.

Most investors started in the residential property and slowly move up the price bracket to the narrower top of the investment pyramid and become adventurous, going into non-residential sectors. Do not fall into the trap of believing that all properties are the same, as residential property investments are the most elementary of them all.

While you are encouraged to have diverse portfolio in property investment, you should also increase your capabilities and resources along the way.

5. Auction

Auction or bank foreclosure proceedings are most often perceived as a lower entry into the property market. However, it also means a higher level of complexity as banks are only interested in recovery, and a lot of issues with the property are left to the investor on a “buyer beware” basis. Reading into the details of the proclamation of sales is absolutely essential.

One initiative in this type of property acquisition is the court’s attempt in executing online bidding through a system of “e-lelong”. Recently, the pilot test of the system scheduled for April 2017 in the High Court of Kuantan has been postponed. Let’s keep an eye on this development as it will make court foreclosed properties more accessible to all.

6. Cash flow over appreciation

We are now in the era of “lower yield, higher return” of property investment. From the 12% annual return on investment two decades ago, we are now effectively looking at returns higher than interest rates on fixed deposits offered by conventional banking, especially in urban Malaysia. Even then, cumulative appreciation is getting slower than the last 10 years.

Investors must therefore be very cautious in selecting property investments, with great importance placed on positive cash-flow to ensure that they stay in the game long enough.

You do better when you know better — and yes, you can always know better. Watch out for part 2 and keep track of the entire four-part series.

If you have any property-related legal questions for Tan, please go to the Tips section of TheEdgeProperty.com.

Chris Tan is a lawyer, author, speaker and keen observer of real estate locally and abroad. Mainly, he is the founder and now managing partner of Chur Associates.

Disclaimer: The information here does not constitute legal advice. Please seek professional legal advice for your specific needs.

This story first appeared in TheEdgeProperty.com pullout on June 16, 2017. Download TheEdgeProperty.com pullout here for free.

TOP PICKS BY EDGEPROP

Bandar Mahkota Banting (Brooklands)

Banting, Selangor

Bandar Mahkota Banting (Brooklands)

Banting, Selangor

Bandar Mahkota Banting (Brooklands)

Banting, Selangor

Bandar Mahkota Banting (Brooklands)

Banting, Selangor

Jalan SP 7 @ Bandar Saujana Putra

Jenjarom, Selangor

Ion Belian Garden, Batang Kali

Batang Kali, Selangor