Al-Salam Real Estate Investment Trust (Feb 16, RM1.04)

Maintain buy with an unchanged target price (TP) of RM1.18: Having Johor Corp (JCorp) as a strong sponsor provides Al-Salam Real Estate Investment Trust (REIT) with a good potential to grow inorganically. With the first right of refusal in place over JCorp properties, we expect more of JCorp’s assets to be injected in over the next one to two years.

Komtar JBCC currently contributes about 50% of the REIT’s revenue. We expect its occupancy rate of about 94% currently and rental reversion to improve further as the mall should benefit from the weekend shopping crowd from Singapore, given the weak ringgit.

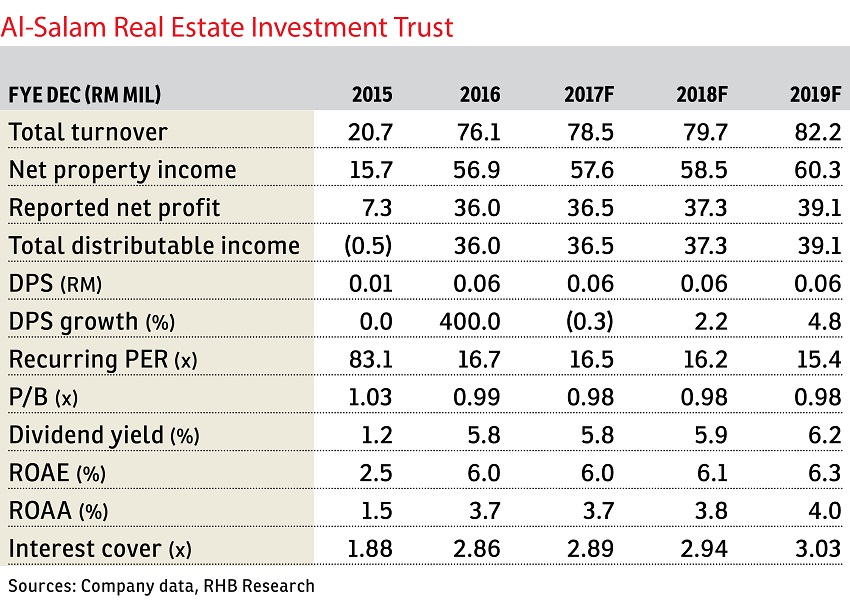

Al-Salam’s dividend yield of about 6% is higher than the sector average of around 5%.

We raise our financial year 2017 (FY2017) and FY2018 earnings forecasts by 12% to 15% to reflect the strong performance of its assets. However, we maintain our dividend discount model-based TP of RM1.18, after lowering our dividend payout assumptions (to 95%, from 100%), as FY16’s payout rate was about 97%.

Its FY2016 core net profit of RM36 million was above our expectations, making up 116% of our earlier estimate. The revenue increase was driven by the rental income from the Komtar JBCC and 14 QSR properties acquired since the REIT’s listing date. A 3.4 sen final dividend was declared, bringing the full-year distribution per unit to six sen, suggesting a decent dividend yield of 6%. — RHB Research, Feb 16

This article first appeared in The Edge Financial Daily, on Feb 17, 2017.

For more stories, download TheEdgeProperty.com pullout here for free.

TOP PICKS BY EDGEPROP

Gateway 16, Bandar Bukit Raja

Bandar Bukit Raja, Selangor

Bandar Botanic

Bandar Botanic/Bandar Bukit Tinggi, Selangor

Horizon Residence (Dwi Mutiara)

Bukit Indah, Johor

Pan Vista, Bandar Baru Permas Jaya

Permas Jaya/Senibong, Johor

Parkfield Residences, Tropicana Heights

Kajang, Selangor