Hock Seng Lee Bhd (Feb 14, RM1.71)

Maintain buy with a trimmed target price of RM1.90: 2016 saw two sizeable job wins which lifted Hock Seng Lee Bhd’s (HSL) outstanding order book to a record RM2.2 billion. Physical construction has, however, been slow, and is expected to progress meaningfully only in 2017.

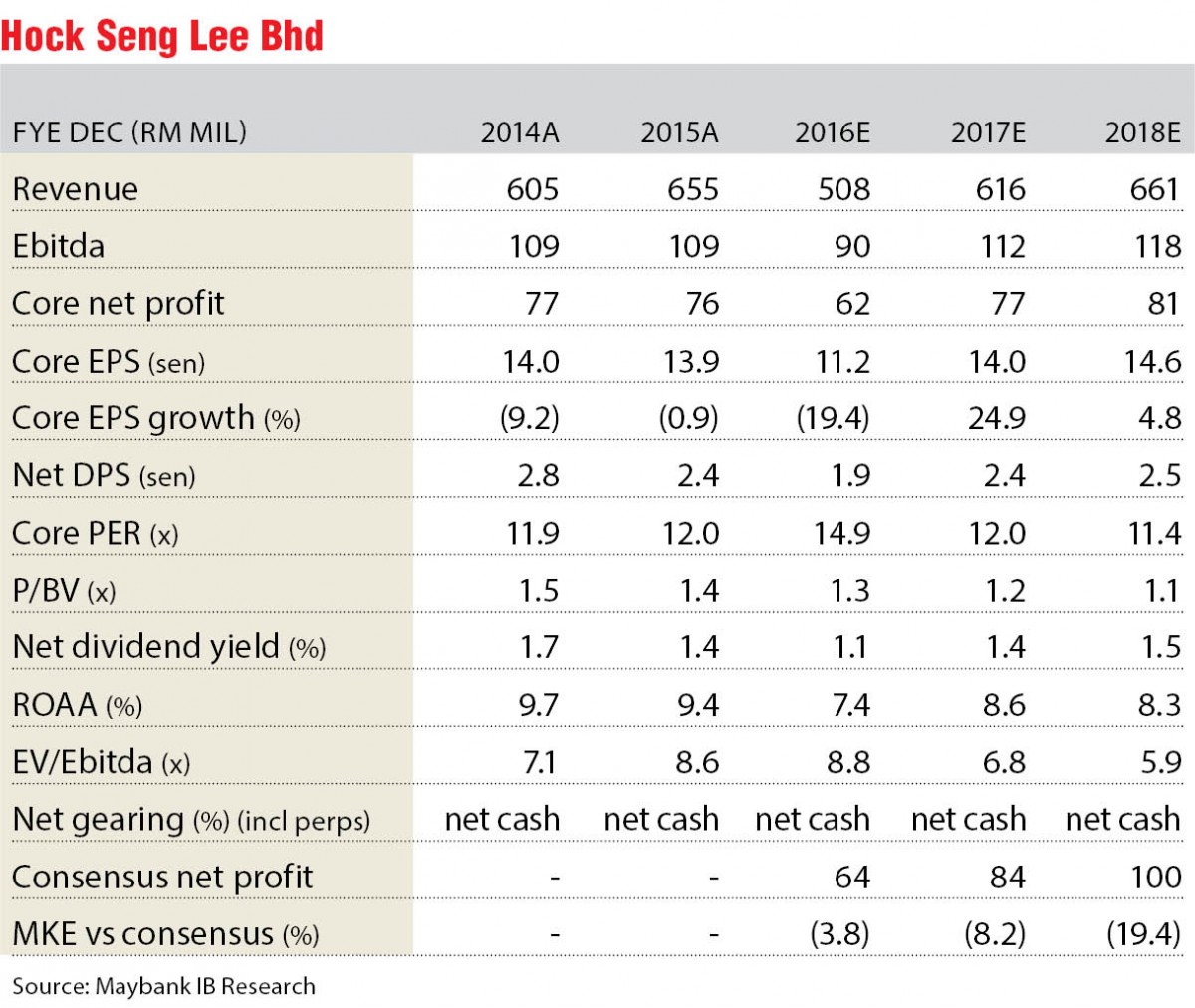

We lower our 2016/2017 net profit forecasts by 3%/13% as we push back the start of earnings contribution from these two major works to the second quarter of 2017 (2Q17). HSL’s valuations remain undemanding at 12 times 2017 price-to-earnings ratio (PER); share price declined 20% after a major job win on March 18, 2016.

Recall that a HSL-led consortium (75%-owned) clinched the Kuching Centralised Sewerage System Package 2 works worth RM750 million in March 2016, this being the second of an eight-phase project worth RM4 billion for the whole of Kuching.

Also in March 2016, a HSL-led joint venture (70%-owned) won the Pan Borneo Highway Sarawak construction (Bintangor Junction to Julau Junction, Sibu Airport to Sg Kua Bridge, including the Batang Rajang Bridge) worth RM1.71 billion. The completion dates for both jobs are 2Q22 (72 months) and 3Q20 (51 months) respectively. Physical construction have, however, yet to kick off meaningfully for both jobs due to finalisation of their contract details. These contract details are nearing finalisation.

As works on these two major jobs take off meaningfully in 2017, HSL will be kept busy. While it can afford to be more selective in tender participation for new jobs, it still keeps an eye out for new contracts to top up on its order book. With all 11 packages for the Pan Borneo Highway Sarawak having been awarded, the next major project in Sarawak is a new coastal road which could be awarded in several packages.

Our earnings model have also incorporated RM300 million of job wins in 2017 (versus RM1.9 billion wins for the nine months (9M) of 2016. Consequently, we expect net profit to rebound 25% in 2017.

Balance sheet remains strong with zero gearing and a cash balance of RM111 million (19 sen per share) at end-September 2016.

2016 has been a good year for HSL in terms of job wins with RM1.9 billion clinched in the first 9M, the two larger ones are the Kuching Centralised Sewerage System Package 2 worth RM750 million (HSL: RM563 million for a 75% stake), and the Pan Borneo Highway Sarawak (Bintangor Junction to Julau Junction, Sibu Airport to Sg Kua Bridge) worth RM1.71 billion (HSL: RM1.2 billion for 70% stake).

Consequently, HSL’s outstanding order book for construction stood at a record RM2.2 billion as at end-September 2016. Assuming a similar level of works recognition in 4Q16 versus 3Q16’s RM120 million, we estimate that HSL’s outstanding order book stood at about RM2.1 billion as at end of 2016. — Maybank IB Research, Feb 14

This article first appeared in The Edge Financial Daily, on Feb 15, 2017.

For more stories, download TheEdgeproperty.com pullout here for free.

TOP PICKS BY EDGEPROP

Queens Residences @ Queens Waterfront

Sungai Nibong, Penang

Bandar Baru Sri Damansara

Bandar Sri Damansara, Selangor

Kundang Industrial Park (Kawasan Perindustrian Kundang)

Rawang, Selangor

Suriaman 3, Bandar Sri Sendayan

Seremban, Negeri Sembilan

Taman Palma Jaya Perdana

Seremban, Negeri Sembilan

Taman Nusa Intan, Senawang

Seremban, Negeri Sembilan