SINGAPORE (Dec 15): DBS Group Research says Frasers Hospitality Trust is in a stronger position to pursue acquisition opportunities, following its recent pre-emptive rights issue.

“We believe the increased free float post the recent rights issue should help allay investor concerns about its trading liquidity, thereby compressing FHT’s yield overtime,” says DBS lead analyst Mervin Song in a Wednesday report.

DBS is keeping Frasers Hospitality Trust at “buy” but lowering its target price to 75 Singaporean cents, from 88 cents previously. The lower target price is on the back of an increase in the number of shares post the rights issue.

FHT raised gross proceeds of S$266 million from its recently completed rights issue to fund its acquisition of Novotel Melbourne on Collins, and lowered its gearing to close to 34%, down from around 37%, to fund other acquisition opportunities.

DBS says these acquisition opportunities could come from third parties, as well as from FHT’s sponsor, Frasers Centrepoint, and its strategic partner, TCC Group.

In addition, FHT has first right of refusal on over 17 hotels and serviced residences across Asia, Australia, and Europe.

The rights issue also increased FHT’s free float by 24% to close to S$536 million.

DBS says this should increase liquidity in the stock and prospects of greater investor interest, leading to compression of FHT’s current high yield.

“In the meantime, FHT offers an attractive 7.9% yield with earnings upside from acquisitions,” Song adds.

As at 3.42pm, units of Frasers Hospitality Trust are trading half a cent higher at 65 Singaporean cents. — theedgemarkets.com.sg

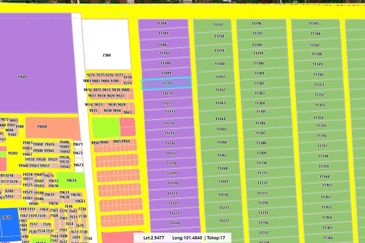

TOP PICKS BY EDGEPROP

Setia Damai

Setia Alam/Alam Nusantara, Selangor

Setia Damai

Setia Alam/Alam Nusantara, Selangor

Kawasan Perindustrian Balakong

Balakong, Selangor

Balakong Jaya Industrial Park

Balakong, Selangor

The Cove @ Horizon Hills

Iskandar Puteri (Nusajaya), Johor

Ayuman Suites Serviced Residence

Gombak, Selangor