Real estate investors in Malaysia are very alert to any change in Real Property Gains Tax (RPGT), especially during October, when the national budget is tabled in parliament. That’s because RPGT could be the deciding factor in deciding whether to sell now or later. Since 2007, we have seen a gradual increase in the RPGT rate, from as low as 0% to as high as 30% as announced in Budget 2014. Thankfully or not, there’s not been any adjustment to the rate since but there’s still important stuff about RPGT you need to know.

1. How much tax do I have to pay?

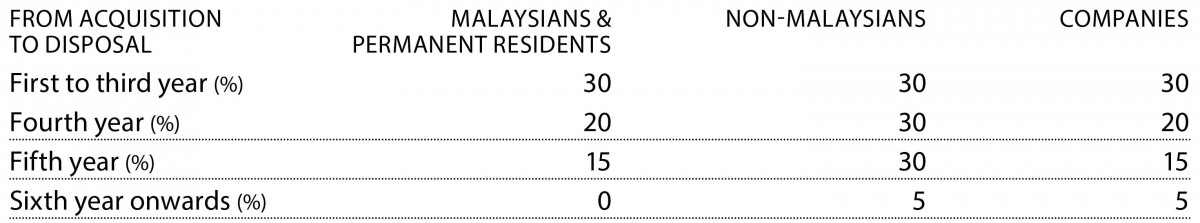

Any vendor who sells their property is required to pay RPGT. The Finance Act 2014 sets out the current prescribed tax rate as follows. (See, table)

2. What is the 3% of disposal price?

As of Jan 1, 2015, the seller or seller’s lawyer acting on behalf of the seller shall retain and pay 3% of the disposal price to the Inland Revenue Board (IRB).

This is applicable when the seller is disposing of the property within five years of signing the sale and purchase agreement. Companies and foreigners are liable to pay the 3% regardless of when they dispose of the property.

Sale and purchase agreements usually contain a clause to cater for RPGT, which states clearly that both seller and purchaser are to submit their respective Forms CKHT 1A and 2A to the IRB upon payment of the 3% retention sum within 60 days of the date of the sale and purchase agreement.

Based on Form CKHT 1A submitted by the seller, the IRB will then assess the requisite RPGT chargeable and refund the balance of the 3% retention sum (if any) to the seller.

If the seller is an individual selling the property after five years, the seller or seller’s lawyer will file Form CKHT 3 to apply to be exempted from the 3% retention sum payment.

It is worth noting that all Malaysians and permanent residents are entitled to a one-time exemption from the 3% retention sum payment when disposing of their private residential property.

There is no requirement that this entitlement must be exercised on your first-ever property disposal, thus you can decide to use the exemption for any future disposal. However, you must inform your lawyer of such an intention before the sale and purchase agreement is drafted.

3. How do I calculate chargeable gains and allowable losses?

Let’s say the price of your property has gone way up, and you now want to sell, but it’s not yet been five years since you signed the sale and purchase agreement. How does the IRB assess the RPGT chargeable gain? Or, heaven forbid, you have to sell, but the price has dropped. There are three scenarios under the RPGT regime:

a) if the disposal price exceeds the acquisition price, there is a chargeable gain;

b) if the disposal price is less than the acquisition price, there is an allowable loss; and,

c) if the disposal price is equal to the acquisition price, there is neither a chargeable gain nor allowable loss.

Thus, where there is a chargeable gain upon disposal of any real property, then RPGT is applicable according to the rates in the table above. However, in calculating chargeable gain, the seller is allowed to deduct from the chargeable amount certain expenses as follows:

a) the cost of preserving and improving the value of the property upon acquisition;

b) the cost to confirm, preserve and defend the ownership of the property; and,

c) incidental costs during the sale of the property, including legal fees, commissions to real estate agents and other expenses.

Where there is an allowable loss, tax relief is allowed to the seller for that year of assessment in an amount equal to the sum arrived at by applying the table above.

4. When can I get a refund?

If the 3% retention sum paid by the seller to IRB is in excess of the RPGT payable, then the IRB must refund the seller the excess amount. This refund may not take place instantaneously and depends on the efficiency of the seller’s IRB branch. The norm is for the seller to receive a cheque for the refunded amount in the postbox.

5. What if I calculate my payable tax wrongly?

The lawyer overseeing the sale and purchase agreement between seller and buyer will normally charge a nominal fee to file their respective CKHT forms.

While seller and purchaser can save costs by filing the forms themselves, bear in mind there is a penalty for making incorrect returns.

This can happen if you omit particulars relating to any disposal of chargeable assets; miscalculate the chargeable gains; or overstate the allowable loss.

The penalty is a fine not exceeding RM5,000, and a special penalty of double the amount of the tax which has been undercharged.

There were no adjustments to RPGT rates for Budget 2016, so investors can now better plan and calculate whether their return on investment will justify selling their property because prices are no longer appreciating as vigorously as a few years back.

Chris Tan is a lawyer, author, speaker and keen observer of real estate locally and abroad. He is founder and managing partner of Chur Associates. If you have questions for Chris Tan, please go to the Tips section of theedgeproperty.com. Disclaimer: The information here does not constitute legal advice. Please seek professional help for your specific needs.

This article first appeared in The Edge Property pullout on Nov 6, 2015, which appears every Friday with The Edge Financial Daily. Download The Edge Property pullout for free here.

TOP PICKS BY EDGEPROP

Sungai Kapar Indah Industrial Zone

Kapar, Selangor

Green Street Homes Seremban 2

Seremban, Negeri Sembilan

Taman Kemuning, Senawang

Seremban, Negeri Sembilan

Suriaman 2, Bandar Sri Sendayan

Seremban, Negeri Sembilan

Ara Sendayan @ Bandar Seri Sendayan

Seremban, Negeri Sembilan

HIJAYU 1, Bandar Sri Sendayan

Seremban, Negeri Sembilan

Bandar Springhill

Port Dickson, Negeri Sembilan

Taman Intan Perdana

Port Dickson, Negeri Sembilan