THE current slowdown in the property market cycle may not be all doom and gloom, at least for Sunway Real Estate Investment Trust (SunREIT).Its CEO Datuk Jeffrey Ng Tiong Lip says the softening property prices could present bargain-hunting opportunities for Malaysian REITs.

Despite concerns over the rising number of vacant units and shrinking crowds in shopping malls, the current slowdown will not exact a heavy toll on the group, whose main asset is Sunway Pyramid and Sunway Hotel in Bandar Sunway.

His confidence hinges on the fact that SunREIT’s retail malls are located in townships, which are natural sources for shoppers.

Ng does not agree with the views of some that SunREIT is over-reliant on Bandar Sunway.

“All our assets in Bandar Sunway are horizontally integrated, from Sunway Medical Centre, Menara Sunway and Sunway Resort Hotel & Spa to Pyramid Tower East.

“Within the township, SunREIT’s assets are further horizontally integrated with the sponsor’s (parent company Sunway Group) assets such as Sunway Pinnacle, Sunway University and Monash University Sunway Campus, surrounded by a residential catchment.”

Likewise, SunREIT’s assets in Seberang Perai, Penang, and in Ipoh are located within townships.

“By virtue of the integration, be it horizontal or vertical, the most powerful synergy derived is the supply of customer footfall across these assets, as opposed to a standalone asset. The former is supported by inherent customer footfall, contributed by commercial activities across these assets,” Ng says.

“By virtue of the integration, be it horizontal or vertical, the most powerful synergy derived is the supply of customer footfall across these assets, as opposed to a standalone asset. The former is supported by inherent customer footfall, contributed by commercial activities across these assets,” Ng says.

That said, in the short term, SunREIT does not foresee robust prospects for the financial year ending June 30, 2016 (FY2016). It expects flattish distribution per unit (DPU) growth on the back of weak consumer sentiment and business

Over the past five years, SunREIT’s net property income has expanded nearly 40% to RM340.83 million in FY2015, from RM244.02 million in FY2011. Its DPU climbed to 8.73 sen per share in FY2015, from 6.58 sen in FY2011.

Meanwhile, its market capitalisation grew to RM4.53 billion, from less than RM900 million in FY2011.

For the first quarter ended Sept 30, 2015 (1QFY2016), SunREIT saw its net property income gain 4% to RM89.94 million, from RM86.49 million a year ago, backed by commendable growth from the retail and hotel segments.

However, its DPU dropped to 2.12 sen per share, from 2.28 sen in 1QFY2015.

Ng expects further expansion among REITs despite the volatile stock market conditions and softer property market cycle.

“A REIT is a strong platform for sponsors to recycle their capital and help companies to de-gear. In a tough operating environment, sponsors with stretched balance sheets may be willing to compromise on yields.

“In addition, property developers and construction companies with a sizeable completed and under-construction property investment pipeline are also potential REIT IPO candidates,” he says.

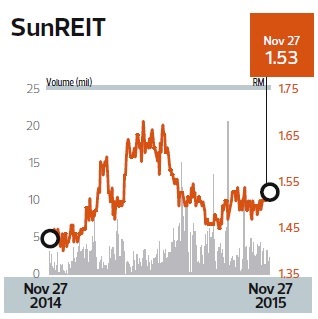

SunREIT’s share price has been hovering within a tight range of RM1.45 to RM1.55, after coming off its peak of RM1.68 in May. It closed at RM1.53 last Friday, representing a discount of 10 sen or 6.54% of analysts’ consensus target price of RM1.63.

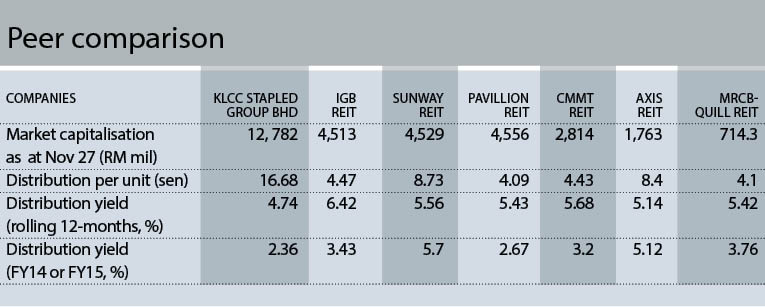

Analysts are mixed on SunREIT, with five houses calling a “buy” while six had a “neutral” recommendation, and one, a “sell”. SunREIT’s distribution yield is still reatively higher at 5.7% compared with its peers’ 2.36% to 5.12%.

The retail-focused REIT is now looking beyond its current asset portfolio — retail and hospitality — and intends to acquire other assets, such as warehouses and medical centres.

The retail-focused REIT is now looking beyond its current asset portfolio — retail and hospitality — and intends to acquire other assets, such as warehouses and medical centres.

“In an oversupply property market landscape amid a moderating economic environment, we expect more acquisition opportunities to prevail. However, we have tightened our investment criteria and are highly selective about third-party asset acquisition to ensure growth potential, he says.

“Our future acquisition growth will be supported by leveraging the sponsor’s completed investment properties and ongoing development. We have preliminarily identified RM2 billion to RM3 billion worth of the sponsor’s assets.”

He adds that the REIT has first right of refusal for wholly-owned assets.

To spur earnings growth, Ng says the trust fund wants assets in the triple net lease category.

Triple net lease is one where the tenant agrees to pay real estate taxes, building insurance and maintenance on the property, in addition to the usual fees expected under the agreement.

The group had last year endorsed a new strategy, which has opened up new opportunities for the REIT to look at other assets for possible acquisition.

Ng explains that medical centres, education (universities), and industrial and logistic warehouses are the ideal choices for SunREIT going forward to provide a steady income stream over the medium to long term. These “other assets” will comprise up to 15% of the trust’s total portfolio value, he adds.

“In the case of hospital and education, these are very stable master leases. It is a triple net lease and is a king card. No matter rain or shine, the money will continue to flow in without any problem.”

“Then we have another type, industrial based, whereby the capital gain is not significant like what we get from retail and hotel. This is because the rental growth is not as significant but the rental yield is about 7% to 8%, compared with 5% to 6% for retail.

“So, what I am trying to say is that so long as we balance our asset portfolio, it will boost yields and give us a chance for diversification,” he adds.

Ng says SunREIT has no plan to acquire any theme park in the near term, as the timing is not right.

“We understand that in Australia, there are some theme parks being managed by REITs. But for Sunway Lagoon, we still see heavy investment in the park to make it relevant. Hence, I think this is not the right time to think about it,” he adds.

Currently, SunREIT has 14 assets under its management comprising retail (four), hospitality (five), offices (four), and Sunway Medical Centre, with a collective property value of RM6.32 billion.

SunREIT has set a target of achieving a property value above RM7 billion by FY2017, ending June 30, and above RM10 billion by FY2020. This will be achieved through a combination of acquisitions and asset enhancement initiatives (AEI).

“We recognised that future growth will be supported largely by acquisitions as we have done extensive AEIs on our existing assets in the past five years,” Ng says.

“We have made it clear that SunREIT is a retail-focused REIT and will not allow the retail component to be diluted,” he says, adding that the retail and hotel segment will remain as the main driver of the REIT’s earnings.

Ng also reveals that the refurbishment of Sunway Putra will be completed by the end of this year. “Currently, the occupancy rate of Sunway Putra Mall is above 80% and we target to increase it to 90% by next year.

“We are confident of the potential income growth over the medium term of the newly transformed 3-in-1 mixed-use Sunway Putra, benefiting from the strong commercial and residential catchment within a 10km to 15km radius and comprehensive infrastructure connectivity.”

With all these plans in hand, SunREIT says it will continue to strive to achieve a compound annual growth rate of 5% DPU over the next five years (from FY2016 to FY2020), underpinned by growth from Sunway Putra, acquisitions and recovery in the retail and hotel segments.

This article first appeared in The Edge Malaysia on Nov 30, 2015. Subscribe here for your personal copy.