Sime Darby Bhd (June 6, RM7.59)

Maintain market perform with an unchanged target price (TP) of RM7.75: Sime Darby Bhd has announced that its wholly-owned subsidiary Sime Darby Nominees Sdn Bhd had entered into a share sale agreement (SSA) to dispose of 126 million shares and 48.8 million convertible warrants in Eastern & Oriental Bhd (E&O) representing about 10% equity interest in E&O for a cash consideration of RM342.2 million or RM2.60 per share and 30 sen per warrant. We note that post disposal, Sime Darby will continue to hold about 12.2% in E&O and will seek to continue board representation in order to continue to equity account for its holdings in E&O going forward.

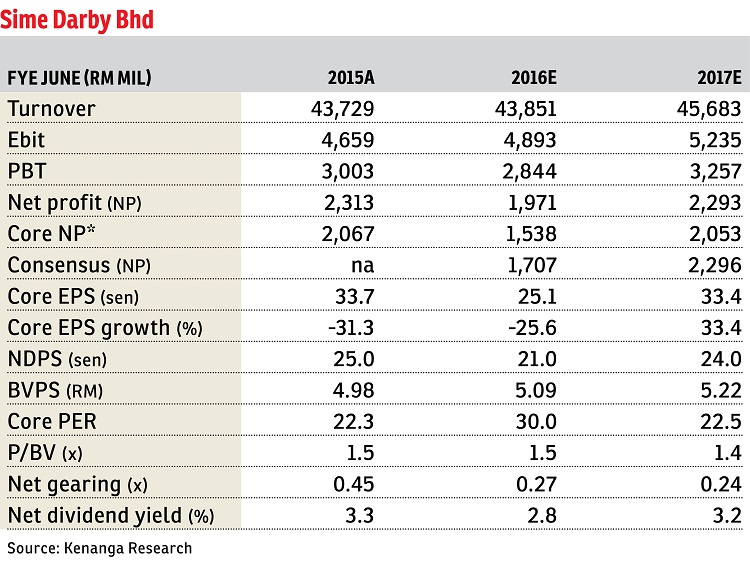

We are not surprised as we gather that the disposal is part of Sime Darby’s ongoing asset monetisation. We are “neutral” on the move, as we are expecting limited core earnings impact post disposal; only lower financial year ending June 30, 2017 estimate (FY17E) interest charges of about RM6.7 million. Note that the valuation of RM2.60 per share represents a premium of 64% to E&O’s last trading price (RM1.59) and 15% to Sime Darby’s average acquisition price per share (RM2.26). We expect the bulk of the proceeds to be seen in FY17 as Sime Darby mentioned that a 10% deposit will be paid upon execution of the SSA while the balance will be paid upon completion in three to four months. While we assume the full proceeds will be used to reduce gearing, we expect a minimal change in net gearing (FY16 to FY17E at 0.27 to 0.24 times, from 0.27 to 0.25 times previously) as the proceeds represent only 2% of FY16E total borrowings. We maintain FY16 to FY17E core net profit at RM1.54 billion to RM2.05 billion after accounting for the disposal, as the lower interest charges are not sufficiently meaningful.

However, net profit estimates are upped by 1% to 12% to RM1.97 billion to RM2.29 billion.

We expect the fourth quarter of 2016 to see earnings improvement, especially for the plantation and property segments. In the plantation sector, we expect fresh fruit bunch volume improvement against the previous quarter, coupled with better crude palm oil prices both quarter-on-quarter and year-on-year. Meanwhile, the property segment could see an improvement on the back of asset disposals.

We expect these one-offs to help Sime Darby to meet its FY16E net profit key performance indicator of RM2 billion. We maintain “market perform” and TP of RM7.75 based on sum-of parts. Our plantation TP price-earnings ratio (PER) is maintained at 24 times, in line with other big-cap planters, on unchanged FY17E earnings. Our TP implies a forward PER of 23.2 times, or about -0.8 standard deviation valuation. We believe this is fair as weak consumer sentiment and soft coal prices could depress earnings upside for the next one to two years. However, as we believe the market has priced in long-term earnings weakness, we maintain our “market perform” call. — Kenanga Research, June 6

Do not ask your BFF about the value of your home. Go to The Edge Reference Price to find out.

This article first appeared in The Edge Financial Daily, on June 7, 2016. Subscribe to The Edge Financial Daily here.