LOCATED at the border of Kuala Lumpur and Selangor, Seri Kembangan has rapidly evolved into an emerging residential property investment hot spot south of Kuala Lumpur due to its strategic location, fairly affordable properties and a healthy rental market.

Located south of Kuala Lumpur, many developers have rebranded the area as KL South. Seri Kembangan is about 20km away from the Kuala Lumpur city centre and is accessible via a number of highways, such as the KL-Seremban Highway and Besraya Highway. It is also close to the Damansara-Puchong Expressway (LDP) and KL-Putrajaya Highway, among others.

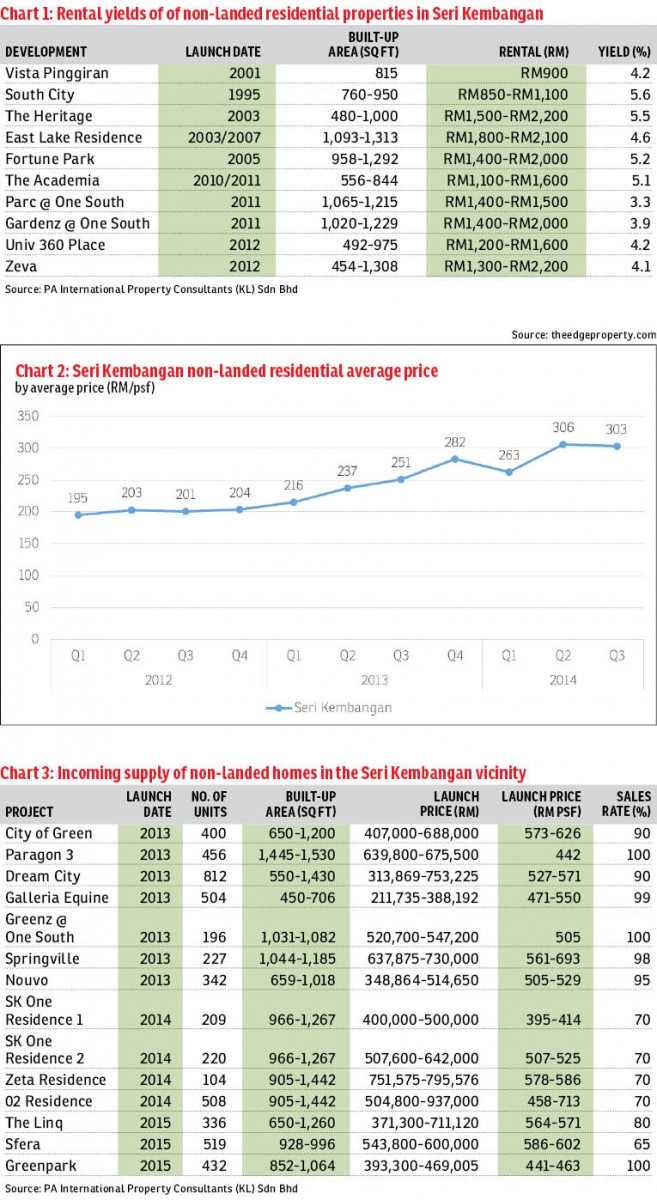

According to data collated by theedgeproperty.com, as at June 2015, asking rental yields of non-landed residences in Seri Kembangan appear to be fairly good, with indicative yields ranging between 3.7% and 6.9% per annum, mainly buoyed by the substantial student population in the area. Universities in and around Seri Kembangan include Universiti Putra Malaysia, Asia Pacific University of Technology and Innovation, Perdana University and SEGi College.

Managing director of PA International Property Consultants (KL) Sdn Bhd, Jerome Hong, tells The Edge Property that the rental market in Seri Kembangan is likely to remain healthy amid the current overall slowdown in sales.

“The rental market is likely to remain healthy, particularly for developments located near educational establishments and those within easy reach of public transport,” says Hong.

According to PA International’s research, non-landed residential developments that are popular among the student community include Vista Pinggiran, South City, East Lake Residence, Fortune Park and The Academia (see chart 1). Some older flats and low-cost apartments such as Vista Impiana are also attractive to students.

Raymond Kwong, senior negotiator of Hartamas Real Estate (KD) Sdn Bhd, concurs the rental market in Seri Kembangan is stable due to the substantial student population in the area.

“The student population supports the Seri Kembangan rental market. International students usually opt for mid-range high-rises with facilities while some students on a limited budget may go for older apartments or flats. Seri Kembangan offers many choices for both groups,” Kwong shares. “International students usually have higher accommodation budgets but we also have students who do not mind staying in a basic unit because it is cheaper,” he adds.

However, he believes the value of the older, lower-end flats and apartments offer more room for growth compared with the newer ones.

He recommends that investors on limited budgets look into older high-rise properties located close to universities and colleges as they offer good returns and value appreciation.

“Older apartments or flats have lower entry points. They could provide you stable rental income and healthy rental yield growth because the demand is always there,” says Kwong.

According to data from theedgeproperty.com, the top five high-rises in Seri Kembangan for highest year-on-year value appreciation in 3Q2014 were all older developments, namely Megaria Orkid (+42.7% to RM148 psf), Red Ruby Aparment (+42.6% to RM207 per square foot), Perdana Selatan (+41.7% to RM257 psf), Belimbing Heights (+36.1% to RM301 psf) and Pangsapuri Vista Serdang (+34.9% to RM239 psf).

Notable capital appreciation

For those looking for units for their own stay, Kwong suggests newer projects for their better living environment, facilities and security.

“I have witnessed the changes in the property scene in Seri Kembangan. This area used to be very quiet because it is further away from Kuala Lumpur compared with Puchong and Sunway. However, when property prices in areas closer to Kuala Lumpur began to get out of reach of more people, they started looking at affordable Seri Kembangan,” Kwong notes.

Kwong estimates the current average transacted price psf for non-landed residences in Seri Kembangan at RM430 psf. “Compared with four to five years ago, there is an appreciation of 30% to 40%,” Kwong offers.

Price surge

According to theedgeproperty.com’s analysis of transactions in the 12 months to 3Q2014, the average transacted price psf for non-landed residential property in Seri Kembangan was RM303 psf, compared with RM251 psf in 3Q2013, representing a strong 20.6% year-on-year appreciation (see chart 2).

VPC Alliance (Malaysia) Sdn Bhd managing director James Wong believes the main reason for the price surge in Seri Kembangan is the improving infrastructure and accessibility in the area.

“Improvements and upgrades of the existing access to Seri Kembangan, such as the construction of the Kuala Lumpur-Putrajaya Highway (MEX), proposed Serdang-Kinrara-Putrajaya Expressway (SKIP) and proposed Mass Rapid Transit (MRT) stations, are drawing more homebuyers,” says Wong. He also attributes the strong capital appreciation to the presence of new large developments in neighbouring areas such as the proposed Bandar Malaysia development and Bukit Jalil City in Bukit Jalil.

The 486-acre Bandar Malaysia development is expected to rejuvenate and regenerate the old Sungai Besi airport area into a new, vibrant landmark in Greater Kuala Lumpur. It is expected to have an MRT Line 2 station and a High Speed Railway (HSR) transit hub connecting Singapore to Kuala Lumpur.

Meanwhile, Bukit Jalil City is a massive integrated development with residential, commercial, office and retail components on a 50-acre site in Bukit Jalil. It is well-positioned in terms of location and accessibility as it is linked to the Bukit Jalil Highway, Kesas Highway, Maju Expressway, LRT and a vast network of roads.

“Seri Kembangan offers what most buyers are looking for now (affordable housing). It is serving the mass market. Majority of the high-rise residential properties in Seri Kembangan are in the price range of RM120,000 to RM650,000,” says Wong, adding that more developers are setting foot in Seri Kembangan, considering the demand.

More incoming supply

According to PA International’s Hong, there are as many as 13 ongoing non-landed residential projects under construction in Seri Kembangan and its surrounding vicinity, launched since 2013 (see chart 3).

“These properties comprise some 5,265 units at various stages of construction. Launches of these high-rise projects reached their peak in 2013 with seven projects contributing a total of 2,937 units, followed by four projects with 1,041 units in 2014 and three projects in 2015 with 1,287 units,” Hong notes.

He says the average price of these new condominiums and serviced apartments are hovering around RM530 psf, about 27% higher than the average price psf of completed developments.

“A significant number of purchasers of these high-rise residential developments in Seri Kembangan were from the Puchong locality. Seri Kembangan has benefited as an alternative locality for buyers who can no longer afford high Puchong prices… The shift in population is heading towards the southern parts of Kuala Lumpur and Seri Kembangan is a choice that cannot be missed,” Hong shares.

Improved connectivity

However, traffic congestion in the area is the main concern for potential homebuyers.

Hong takes this as a positive sign as it indicates a population explosion in the area — which calls for more attention from the government to upgrade traffic accessibility and transport network there.

Besides highways, Hong believes the proposed Sungai Buloh–Serdang–Putrajaya MRT line will enhance the area’s access to other parts of Klang Valley which in turn will boost demand and property prices.

There are five proposed stations in Seri Kembangan located at Taman Universiti Indah, Universiti Putra Malaysia, Taman Serdang Jaya, and Serdang Raya North and South.

“With further infrastructure improvements enhancing future accessibility and connectivity, Seri Kembangan has good development potential supported by the relatively cheaper and attractive land cost (compared with Puchong),” Hong concludes.

Look at even more Seri Kembangan properties here. Also, check out the value of your property with The Edge Reference Price.

This story first appeared in The Edge Property pullout on Oct 9, 2015, which comes with The Edge Financial Daily every Friday. Download The Edge Property here for free.

TOP PICKS BY EDGEPROP

Flat Tasek 64, Bandar Baru Seri Alam

Masai, Johor

Kawasan Perindustrian Mount Austin

Johor Bahru, Johor

Palazio ( Pangsapuri Mayland Austin )

Johor Bahru, Johor

Smart Industrial Park @ SILC

Gelang Patah, Johor