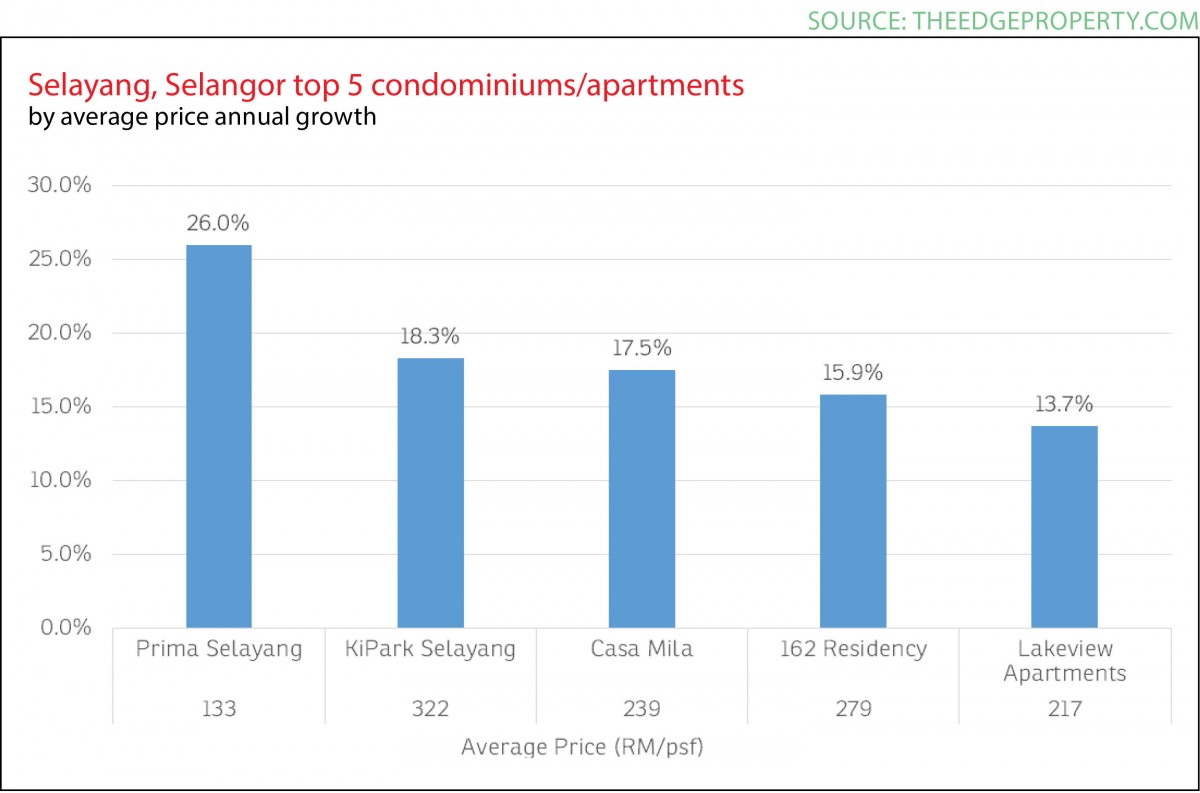

- With many new developments coming up, the local secondary market for non-landed homes has soared. Analysis of transactions by theedgeproperty.com shows average prices gained 23.5% y-o-y to RM245 per square root (psf) in 3Q2014.

- Average prices at Prima Selayang grew most, gaining 26% y-o-y to RM133 psf in the 12 months to Sept 2014. Prima Selayang is a dated, low-cost apartment in a central location. With its low starting capital value, modest gains in the average transacted price have led to higher percentage growth.

- In the mass market segment, the average price at KiPark Selayang appreciated 18.3% y-o-y to RM322 psf in the same period. With present asking prices around RM450 psf, it seems popular among buyers.

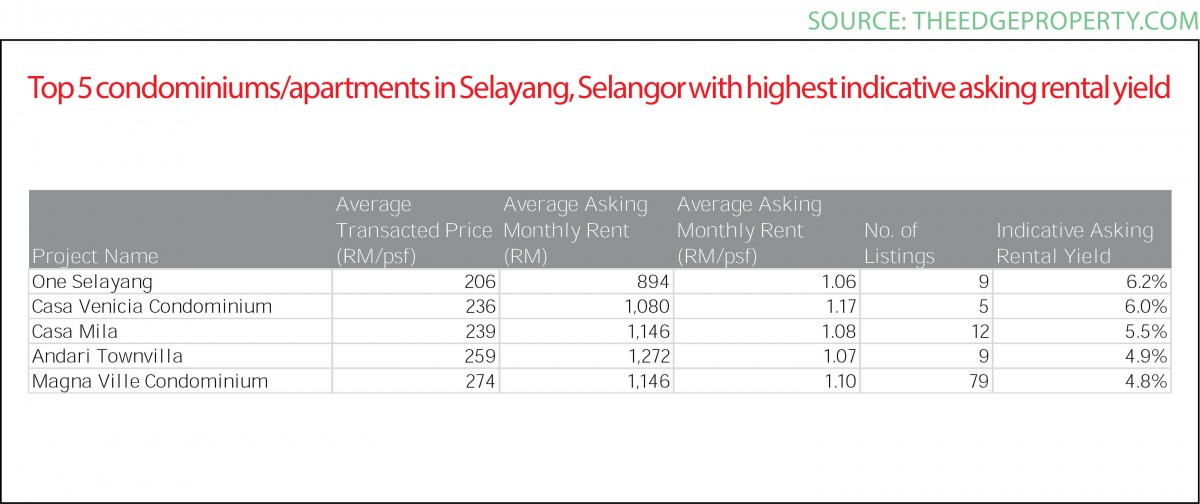

- From observation of asking rentals as at June 2015, indicative rental yields in Selayang range between 4.7% and 6.2% per annum.

- The highest yields were at One Selayang (6.2%), a mixed-use development in which 4-storeys of apartment units sit atop shops. Its rental market is driven by its location close to the medical campus of Mara University of Technology. The compact unit sizes (typically 818 sq ft) also translate into a higher proportion of rent psf.

- Decent yields can also be found at Casa Venicia (6%) and Casa Mila Condominiums (5.5%). Although fairly dated, they are well-designed and surrounded by greenery, being next to the forest reserve managed by Forest Reserve Institute Malaysia.

Click here to see recent rental transactions for KiPark, Selayang, see price comparative trends, and more.

The Analytics are based on the data available at the date of publication and may be subject to revision as and when more data is made available to us.

TOP PICKS BY EDGEPROP

Bennington Residences @ SkyArena, Setapak

Setapak, Kuala Lumpur

Ascotte Boulevard Condominium

Semenyih, Selangor

Bandar Kinrara 5

Bandar Kinrara Puchong, Selangor

The Stride Strata Office @ BBCC

Pudu, Kuala Lumpur

The MET Corporate Towers

Mont Kiara, Kuala Lumpur

The MET Corporate Towers

Mont Kiara, Kuala Lumpur

Merdeka 118 @ Warisan Merdeka 118

Kuala Lumpur, Kuala Lumpur