Pavilion REIT Oct 12 (RM1.51)

Hold, with target price of RM1.65: Having recently announced the planned acquisition of da:men USJ shopping mall for RM488 million, Pavilion REIT (PavREIT) is likely to continue its acquisition trail with the soon-to-be-completed Pavilion Extension, to which it has the right of first refusal (ROFR).

While investors may treat the asset injection news positively, PavREIT’s one-year forward yield of 5.5% implies a spread of less than 1.5% over the benchmark 10-year Malaysian Government Securities yield, which is thinner than other Malaysian REITS (M-REIT) peers. This suggests that the potential from asset injection has been priced in.

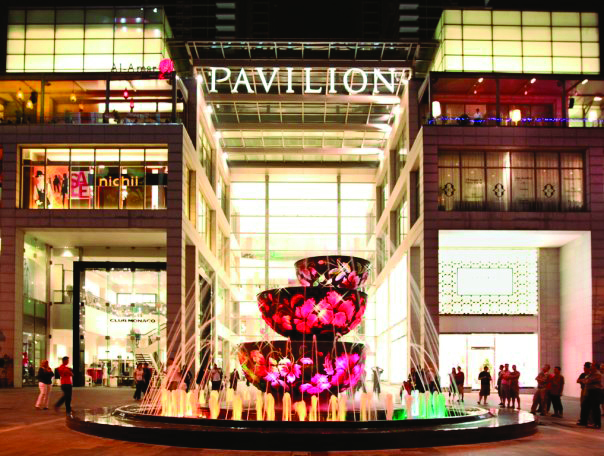

Backed by premium assets, PavREIT’s core asset is the 1.3 million sq ft net leasable area (NLA) Pavilion KL mall, located strategically in the heart of the Bukit Bintang shopping district in Kuala Lumpur.

The premium profiling and location has led to strong average rental rates of above RM20 per sq ft (psf), as well as justifies a premium valuation over other large-cap M-REITs.

The two remaining ROFR assets are the 250,000 sq ft NLA Pavilion Extension and 300,000 sq ft Fahrenheit88 mall, currently held by major shareholders of PavREIT.

Both could see valuations around or above the RM600 to RM700 million range due to their prime location near, which can support rental rates of more than RM20 psf a month.

We have imputed the Extension acquisition in financial year 2017, though forecast low initial distribution per unit accretion of lower than 1% as the asset is yet to mature. — AllianceDBS Research, Oct 12

Interested in buying a property in the Bukit Bintang area after reading this article? Click here.

This article first appeared in The Edge Financial Daily, on Oct 15, 2015.

TOP PICKS BY EDGEPROP

Taman Tun Dr Ismail

Wilayah Persekutuan Kuala Lumpur, Kuala Lumpur

Jalan Datuk Sulaiman 4

Taman Tun Dr Ismail, Kuala Lumpur

Kawasan Perindustrian Kajang Jaya

Semeyih, Selangor

Taman Tun Dr Ismail

Wilayah Persekutuan Kuala Lumpur, Kuala Lumpur

Pantai Panorama

Pantai Dalam/Kerinchi, Kuala Lumpur

Polo Park Resort Condominium @ Taman Iskandar

Johor Bahru, Johor

Taman Tasik Titiwangsa

Titiwangsa, Kuala Lumpur