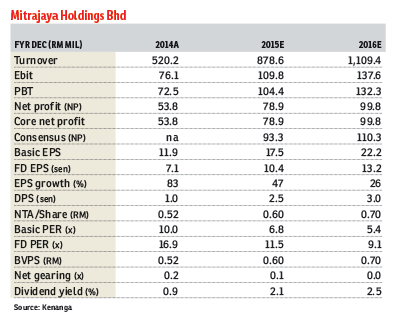

Mitrajaya Holdings Bhd (Oct 27, RM1.21)

Maintain outperform with an unchanged target price (TP) of RM1.63: On Monday, Mitrajaya Holdings Bhd (Mitrajaya) announced that its wholly-owned subsidiary, Mitrajaya Development SA Proprietary Ltd, has entered into a deed of sale with Scarlet Ribbon Properties 27 (Pte) Ltd for the acquisition of a piece of about 215 acres (87ha) freehold land in South Africa, for 40 million rand (RM12.45 million), which translates into about RM1.30 per sq ft. The acquisition is expected to be completed by 2016.

The land is located at the Western Suburbs of Pretoria, which is in close proximity to the Lansaria Airport and just north of the N14 Highway. It takes about 20 minutes’ drive from Blue Valley Golf & Country Estate via the R562 or R55 roads.

We were surprised by the acquisition as we expected the group to focus on its existing 300ha South Africa project, Blue Valley Gold & Country Estate, which the group has ventured into since 1998.

The land acquired is proposed for the development of an Eco Park Residential Estate with at least 1,600 units of medium to high density cluster/apartment homes to be built, with an estimated gross development value (GDV) of 1.6 billion rand. However, based on our conservative land cost GDV assumption of 15%, we are only expecting a GDV of RM80 million.

As of the second quarter ended June 30, 2015 (2QFY15), Mitrajaya’s net gearing stands at 0.23 times and we expect its net gearing to inch up to 0.26 times post acquisition of this parcel of land, which is still within our comfortable net gearing level of less than 0.5 times.

Based on its historical track record, we expect earnings before interest and tax (Ebit) margin of the development project to easily range between 35% and 40%, which is largely similar to its other South Africa project, Blue Valley Golf & Country Estate, which yields an average Ebit margin of 38%. While the proposed acquisition of the land is expected to be completed by 1Q16, we do not expect development on that parcel of land to take off in the near term.

We reaffirm our positive view that the construction division should be able to sustain at least for the next three years, driven by government spending on infrastructure projects and development of affordable housing projects for the next five years under the 11th Malaysia Plan.

Furthermore, the group’s current outstanding order book of RM1.55 billion provides visibility for at least two years. While its property division will be driven by its Wangsa 9 project (GDV: RM680 million) and upcoming project in Puchong Prima (GDV: RM1.5 billion) by end-2015, we expect some slowdown in the property segment, given the current drag in property sales.

However, we believe this should not impact the group significantly, given both projects’ attractive locations, which are adjacent to Light Rail Transit stations, hence providing convenience and connectivity, are strong selling points.

No change to our financial year ending Dec 31, 2015 (FY15) to FY16 earnings estimates, as we do not expect the development for this particular piece of land to take place in the near term.

Following the proposed acquisition of the South African land, we are keeping our “outperform” recommendation on Mitrajaya with unchanged TP. Our TP implies 7.3 times forward price-earnings ratio (PER), which falls at the lower end of the small- and mid-cap contractors’ forward-PER range of seven to 13 times. Given that the stock is still trading at a single-digit valuation, i.e. FY16 (estimate) PER of 5.4 times, it offers a potential total upside of 37.8%, including a dividend yield of 2.1%. — Kenanga Research, Oct 27

This article first appeared in The Edge Financial Daily, on Oct 28, 2015. Subscribe to The Edge Financial Daily here.

TOP PICKS BY EDGEPROP

HIJAYU 2 - RESORT HOMES

Seremban, Negeri Sembilan

HIJAYU 2 - RESORT HOMES

Seremban, Negeri Sembilan

PSV 1 Residences

Bandar Tasik Selatan, Kuala Lumpur

Landmark Residence 2 @ Bandar Sungai Long

Kajang, Selangor

Sunsuria 7th Avenue

Setia Alam/Alam Nusantara, Selangor